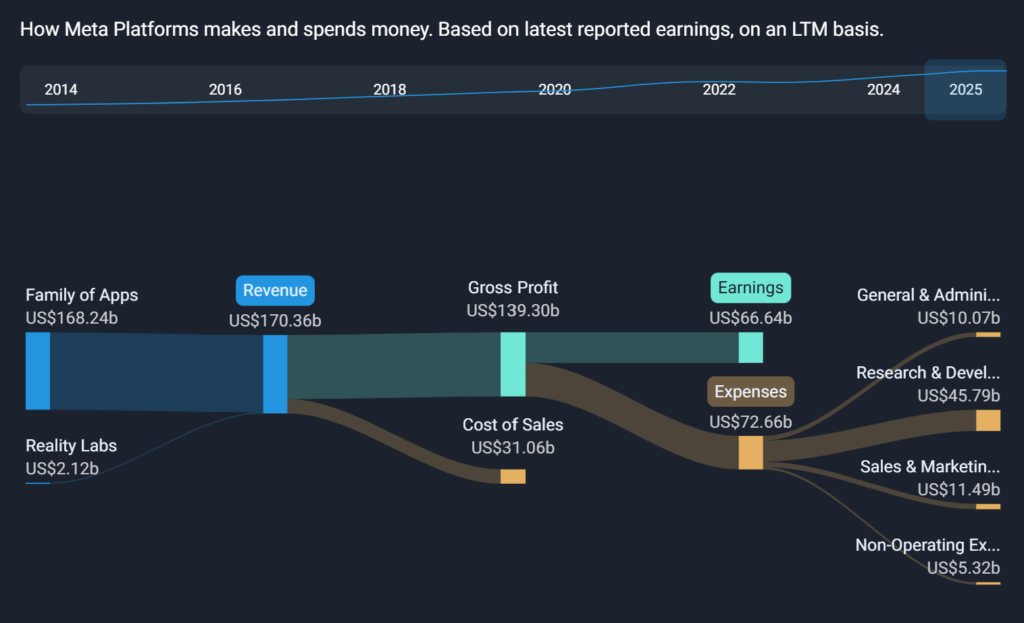

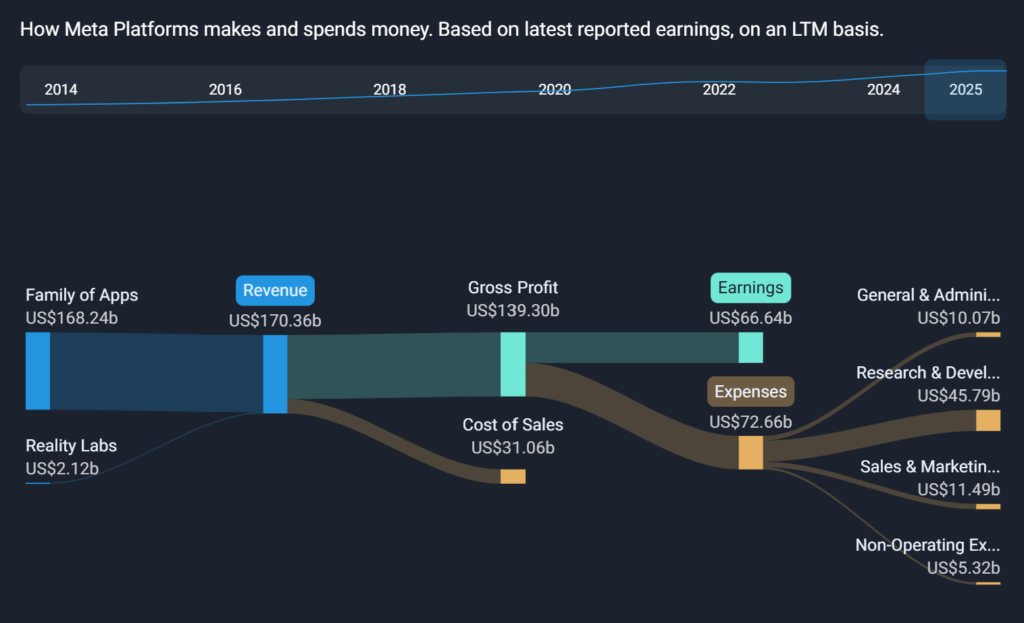

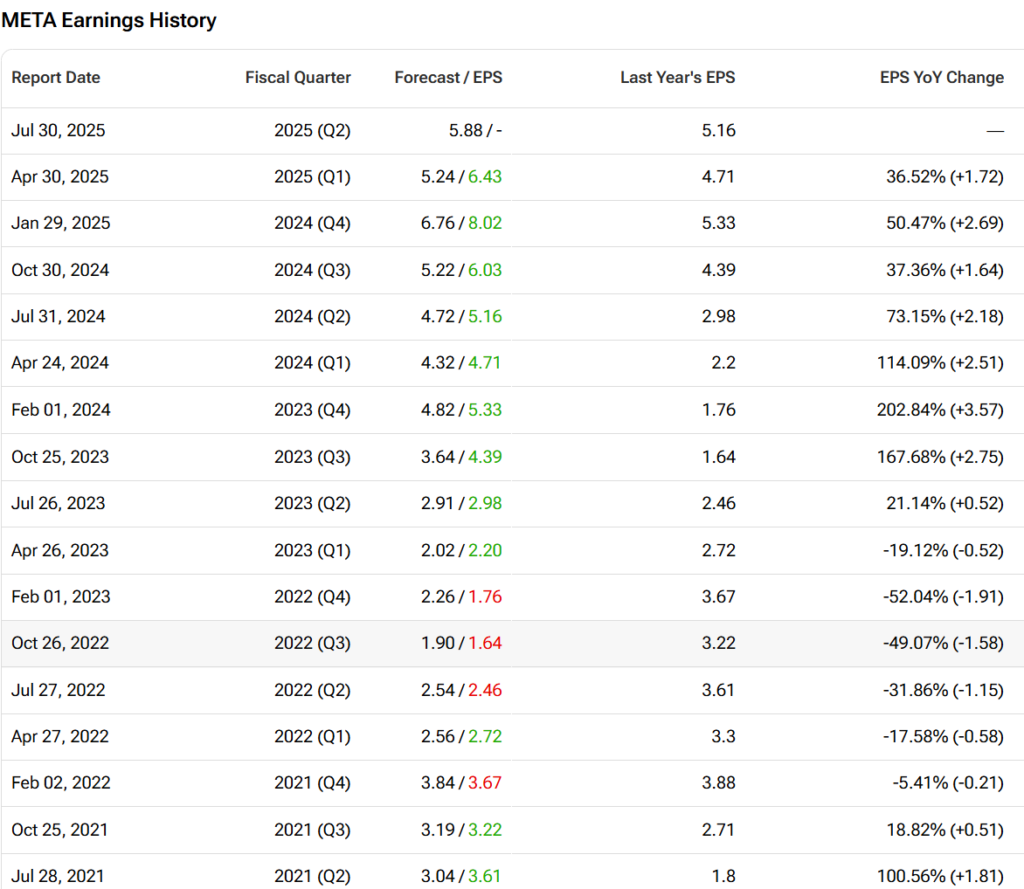

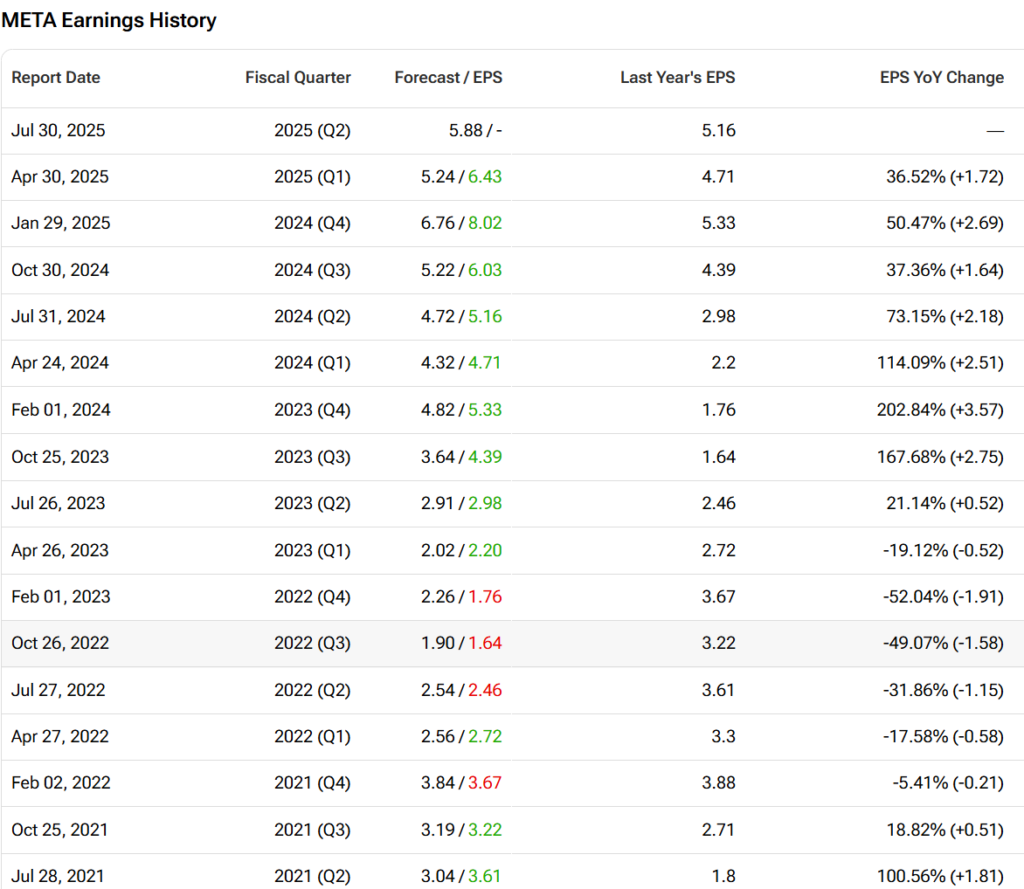

Meta Platforms (NASDAQ: META) will report its second-quarter earnings after market close on Tuesday, July 30. Analysts expect strong year-over-year revenue and earnings growth, fueled by robust advertising demand, AI-driven monetization, and expanding user engagement. However, high capital expenditures and persistent losses in Reality Labs remain concerns for investors.

Expected Q2 2025 Results

- Revenue: $44.5B to $44.8B (+14–15% YoY)

- Earnings Per Share (EPS): $5.83 to $5.89 (+13–15% YoY)

- Operating Margin: Expected around 38%–40%, flat YoY

- Net Income: Estimated $15–16B, vs. $13.5B in Q2 2024

Key Factors to Watch

1. Advertising Strength and Pricing Recovery

Advertising still makes up ~98% of Meta’s revenue. Analysts expect ~$44B in Q2 ad revenue, with ad impressions up ~6.9% and average ad price recovering ~+7.5% YoY. AI-curated feeds and tools like Advantage+ have helped boost Reels monetization, while Click-to-Message ads on WhatsApp continue expanding.

2. AI Investment and Monetization Signals

Meta’s 2025 capex guidance of $64B–$72B, largely for AI infrastructure, is a central focus. Wall Street wants to see how these investments in in-house chips, AI supercomputers, and new hires (Meta Superintelligence Labs) are driving measurable improvements in ad efficiency, user engagement, and future monetization potential.

3. Reality Labs Losses and Strategic Updates

Reality Labs is expected to post a Q2 loss of -$4.8B to -$5.3B, with revenue stagnant at ~$380M. With full-year losses possibly nearing $20B, investors will look for any signs of cost discipline or traction in areas like smart glasses, where Ray-Ban Stories have tripled sales YoY from a small base.

4. Regulatory Headwinds

Meta faces continued scrutiny, particularly from Europe’s Digital Markets Act. A €200M fine and opt-out ad changes could pressure conversion rates in the EU. Investors await any commentary on revenue impacts and possible Q3 headwinds from regulatory compliance or advertiser pullbacks.

Analyst Sentiment and Stock Performance

Meta remains a Wall Street favorite. Out of 70+ analysts, more than 90% rate META a “Buy,” with average price targets between $750–$760. Several top firms — including BofA ($775 PT) and Canaccord ($850 PT) — cite Meta’s dominant AI positioning, improving ad business, and margin resilience.

Despite trading near all-time highs, the stock is up 22% year-to-date and 50% over the past 12 months. Technical support lies near $648, with resistance around $728. A post-earnings breakout could push the stock into uncharted territory, but high expectations may limit upside unless Meta significantly beats.

Bullish Case for Meta

- Ad Revenue Rebound: With pricing and impressions rising, Meta’s ad machine is humming again. Q1 saw +16% YoY revenue growth and a 23% EPS beat.

- AI Powerhouse: Meta’s AI investments are already showing ROI in ad conversions (+5% Reels CTR) and user engagement. The Llama ecosystem and Superintelligence Labs team position Meta as an AI leader.

- WhatsApp Monetization Potential: Business messaging on WhatsApp is growing rapidly. Analysts see $30B–$40B long-term revenue potential here.

- Reels Monetization Catch-Up: Reels is now generating a $10B+ run rate. Better conversion and ad tools are closing the monetization gap with Stories.

- Financial Strength: With nearly $60B in cash and 40% margins, Meta can afford to invest while returning value via $40B+ in annual buybacks.

- Insider Confidence: Insider buying (~$19M in recent months) and Zuckerberg’s continued majority voting control signal internal conviction.

Bearish Case for Meta

- Soaring Costs and Margin Pressure: Capex and opex continue to rise. Q1’s operating margin dipped to 37% from 40% YoY — further compression in Q2 could worry investors.

- Reality Labs Drag: With $5B+ quarterly losses and little revenue, Reality Labs remains a major financial overhang.

- Regulatory Risks: New EU ad rules have sharply cut conversions in early tests. Additional fines and restrictions could weigh on future revenue.

- User Saturation: DAU growth is slowing in North America and Europe. Any engagement decline, especially among younger users, may spook markets.

- Competitive Threats: TikTok, Amazon Ads, and Apple’s privacy changes pose ongoing risks to Meta’s core ad business.

- Valuation Risk: META trades at ~28x forward earnings. A miss or cautious guide could trigger a sharp pullback given stretched multiples.

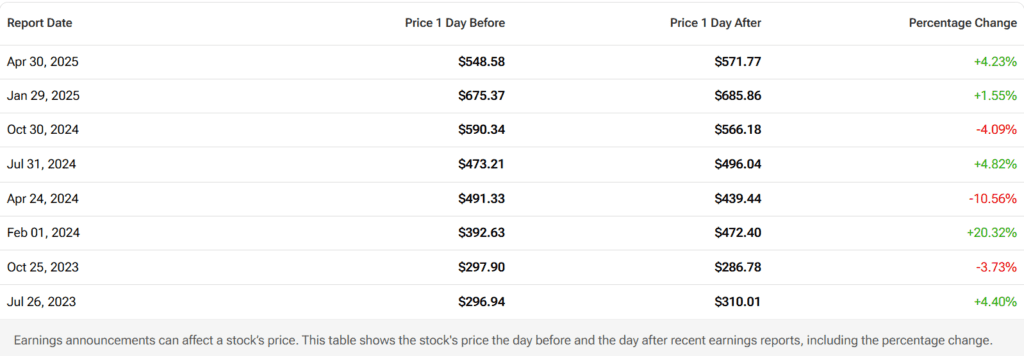

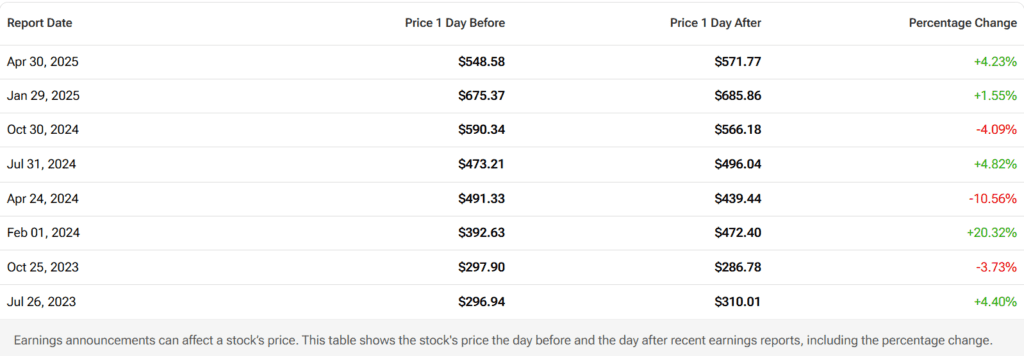

How Will META React Post-Earnings?

Historically, Meta has a 50/50 track record of post-earnings moves. A beat often leads to a +6–8% pop, while a miss sees ~4–5% downside. Given elevated expectations and crowded positioning, Meta likely needs both a top/bottom-line beat and bullish guidance to sustain its rally.

Traders will also closely watch Q3 guidance, commentary on ad demand, and any early signs of monetization from new AI and WhatsApp tools.

Conclusion

Meta’s Q2 2025 earnings come at a critical moment. The company has reasserted dominance in digital ads, rolled out next-gen AI tools, and kept margins high despite rising costs. But now the bar is higher. Investors want proof that Meta’s massive spending — on AI, infrastructure, and the metaverse — is translating into durable revenue streams.

If Meta delivers another clean beat, outlines clear monetization strategies for WhatsApp and AI tools, and keeps costs in check, the stock may break to new highs. However, any stumble — particularly on margins, Reality Labs, or forward guidance — could quickly dampen the bullish momentum.

As always, execution is everything. And with Meta’s stock priced for perfection, the Q2 print could set the tone for the rest of 2025.

Sources: Investors Business Daily (IBD); Investopedia – Preview; Investopedia – Price Levels; IG; Quartz; Barron’s; Zacks; MarketBeat – Earnings Calendar; MarketBeat – Originals; AInvest – Insider Sales & Implications; AInvest – Assessing Insider Selling; Meta Investor Relations – Home; Meta IR – Q1 2025 Transcript; Nasdaq (Zacks) – Preview Roundup; Seeking Alpha; Yahoo Finance; TipRanks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Trade War Reshaped: US–EU Deal Finalized, China Truce Extension Likely

Global Markets Kick Off Tuesday With Cautious Optimism: Market Wrap

Market Is Euphoric Again — and Everyone Knows It

Wall Street Keeps Breaking Records, But Big Tests Are Looming

Tariff Shock Incoming: Trump’s August 1 Deadline to Hike Prices on Food, Clothing, and Cars

Hottest Business Strategy This Summer Is Buying Crypto

Accidental King of Meme Stocks: How a Canadian Hedge Fund Manager Sparked 2025’s Retail Rebellion