Analysts are turning bullish on oil and gas stocks again — even as prices slip and investor sentiment lags.

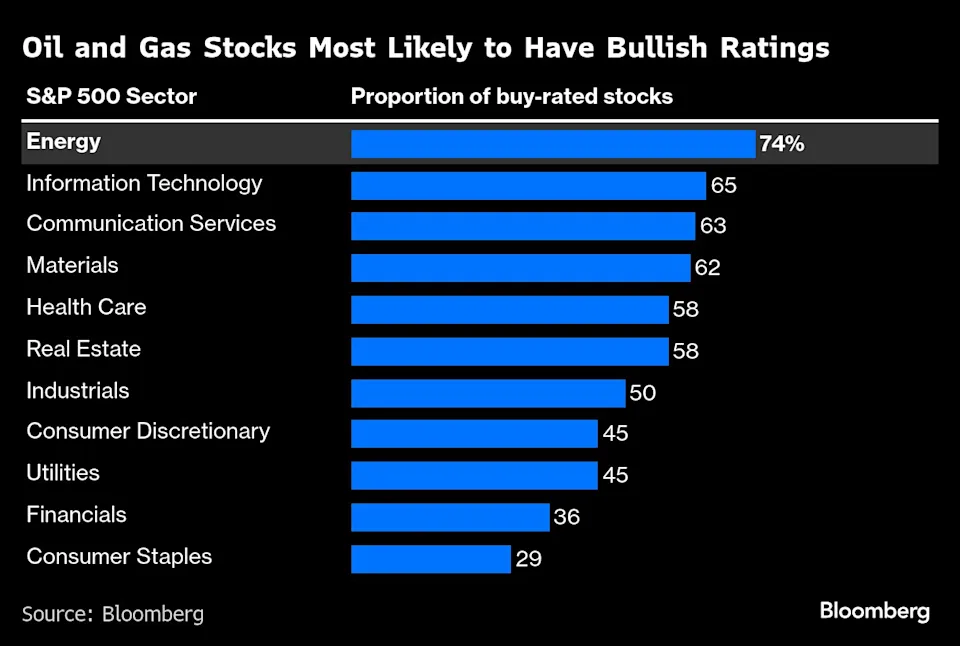

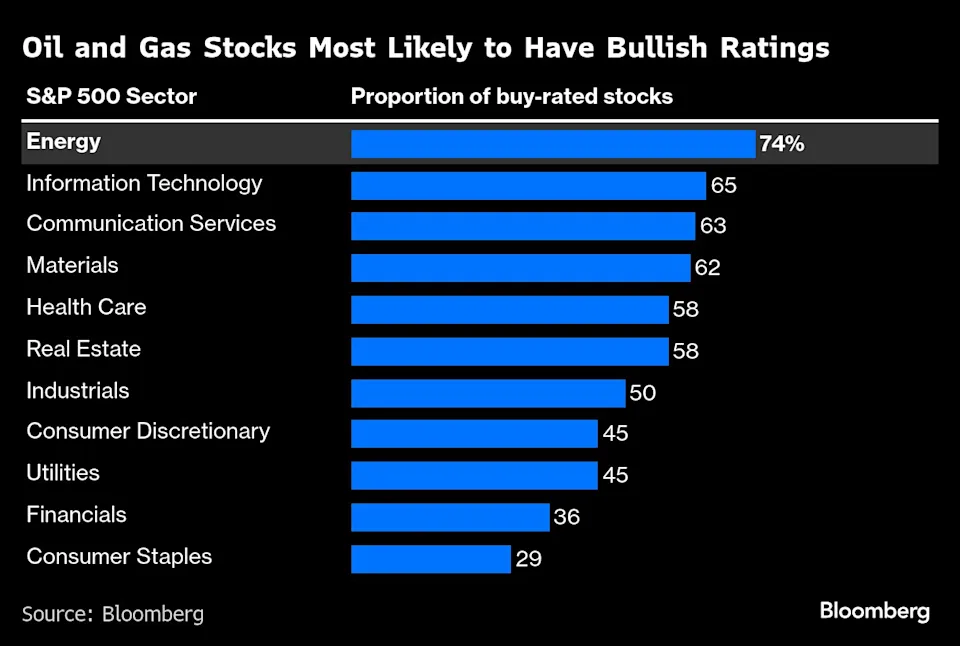

- Energy has the highest share of ‘Buy’ ratings among S&P 500 sectors

- Analysts see 16% upside, backed by low valuations and Trump’s pro-oil stance

- But falling crude prices and weak cash flow cast doubt on a near-term rebound

Wall Street is quietly warming up to the US energy sector again.

Despite being one of just three S&P 500 segments in the red this year, oil and gas stocks are getting the most buy ratings across all 11 sectors, according to Bloomberg data. About 75% of S&P 500 energy companies are rated ‘Buy’, far above the market average of roughly 50%.

Valuations Look Cheap — But So Does Momentum

The appeal? Ultra-low valuations.

“The thesis that some people have is that multiples and valuations are very, very low right now,” said Leo Mariani, analyst at Roth Capital Partners.

Energy stocks are currently the cheapest sector in the S&P 500 by price-to-earnings ratio, and Wall Street sees an average 16% upside over the next 12 months — nearly double the expected gain for the overall market.

That optimism is also being fueled by Donald Trump’s aggressive support for fossil fuels, including regulatory rollbacks and renewed calls to “drill, baby, drill.” His recent spending bill removed tax credits for renewables while offering new benefits to traditional energy producers.

The Outlook for 2026: Strong Earnings Growth

Looking further ahead, Bloomberg Intelligence forecasts that energy will lead all sectors in earnings growth in 2026, aided by Trump’s fossil-fuel-first policies and rising inflation risks. Energy stocks also offer inflation hedge potential — a trait that helped them outperform in 2022 when inflation surged.

But that’s the long game. In the short term, it’s a mixed bag.

Short-Term Risks: Weak Prices and Institutional Skepticism

- WTI crude is down about 7% YTD, hurt by Trump’s trade war fallout and OPEC+ production adjustments.

- Q2 earnings for US energy producers are expected to fall 30% QoQ, and cash flow could drop 15%, according to BMO Capital’s Phillip Jungwirth.

- Momentum is absent: energy has underperformed in 4 of the last 5 quarters.

Even bullish analysts remain cautious.

“Is there a catalyst to dramatically change that and reverse that over the next 12 months? I’m not sure,” said Mariani, noting weak institutional sentiment. His price targets for many energy names are below the Street’s consensus.

Bottom Line: Bet or Trap?

Energy is shaping up as a classic value play — cheap, unloved, but potentially profitable in a Trump-led, inflation-prone world. But with crude prices soft and investor conviction shaky, it may take more than low P/Es and presidential cheerleading to turn the sector around.

Investors will be watching Q2 earnings, Trump’s next policy moves, and global demand signals for clues on whether this bullish thesis can actually deliver.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

As the Dollar Slides, the Euro Is Picking Up Speed

Indian Bank Stocks Surge as Earnings Beat Estimates

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead