As the global financial system adjusts to the chaos of President Donald Trump’s aggressive new trade tariffs, one major shift is drawing increasing attention: the sharp decline of the US dollar and the corresponding rise of the euro.

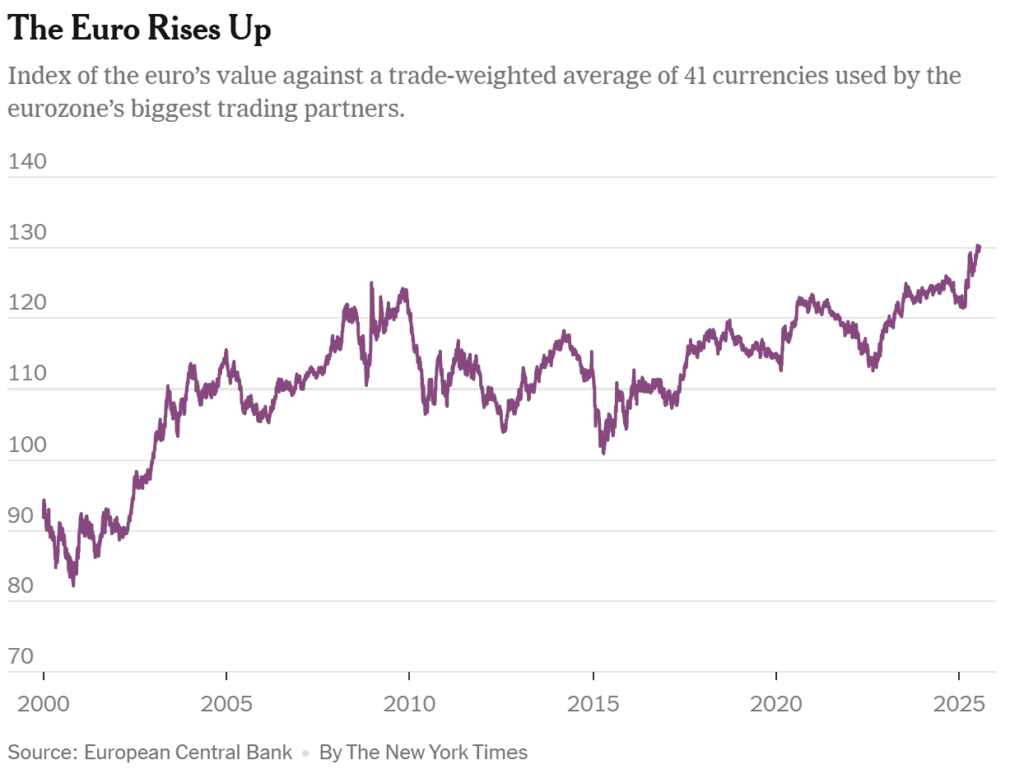

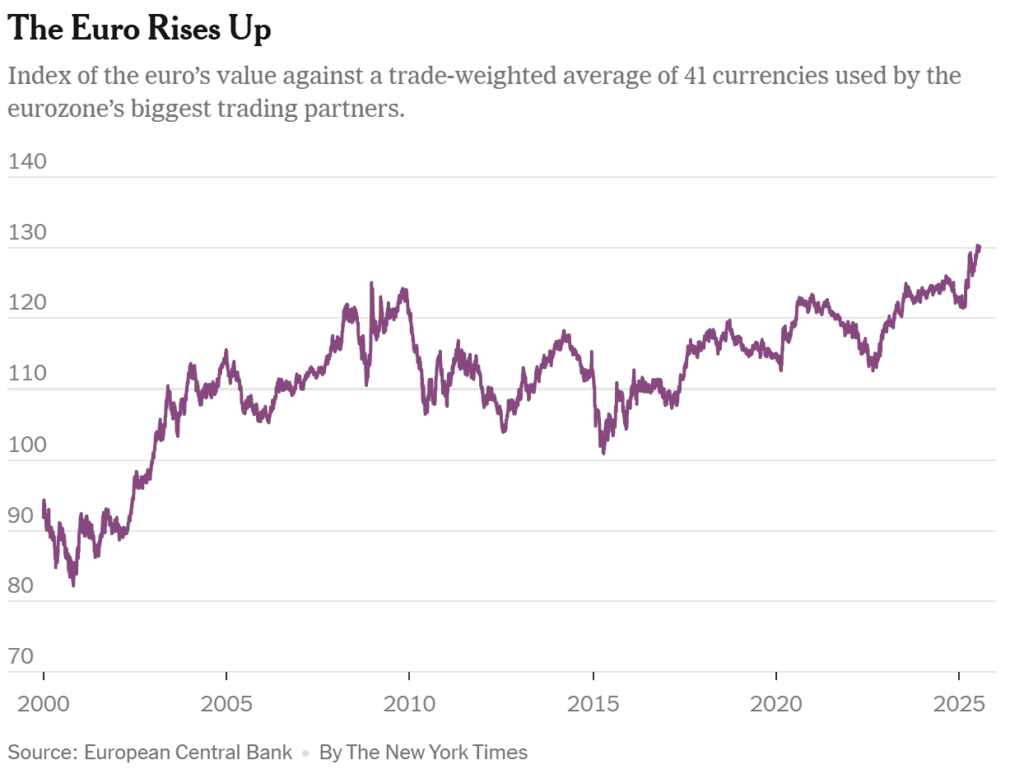

Since the beginning of 2025, the euro has surged over 11% against the dollar, reaching $1.18 — its highest level since 2021. The rally has also extended against the yen, pound, won, and Canadian dollar, suggesting the euro’s ascent is not merely a mirror of dollar weakness, but a broader sign of investor realignment.

A Flight from the Dollar

For decades, the US dollar has been the world’s undisputed reserve currency — a cornerstone of international finance and trade. But this year, as Trump’s tariffs roiled supply chains and the Federal Reserve came under political fire, cracks have begun to show.

“The dollar’s dominant role in the global financial system is no longer certain,” European Central Bank (ECB) President Christine Lagarde wrote last week, calling the moment a “profound shift in the global order.”

The dollar’s decline — down 13% year-to-date on a trade-weighted basis — has been driven by investor concern that Trump’s tariff war, now escalating with China and the EU, is destabilizing the global economy and politicizing US monetary institutions. Treasury Secretary Scott Bessent’s calls for internal Fed reviews and questions around Chair Jerome Powell’s future have only added to the uncertainty.

A Window of Opportunity for the Euro

While the euro has long been the second-most-used currency globally, it has never approached the dollar in global clout. That might now be changing. Lagarde argues that the current turmoil presents an opportunity for the euro to “gain global clout” — if the bloc can seize it.

Luis de Guindos, ECB Vice President, echoed the opportunity — and the risk. “If the euro climbs above $1.20, it becomes much more complicated,” he said, noting the economic drag a strong euro places on inflation and exports.

Indeed, the euro’s rise could become a liability. Eurozone inflation is now expected to average just 1.6% next year, well below the ECB’s 2% target. The stronger currency is pushing import prices down, tightening financial conditions even after eight ECB rate cuts in the past 12 months.

Corporate Pain: SAP, Adidas, Daimler Feel the Squeeze

Export-heavy European companies are already sounding the alarm.

- SAP, now Europe’s most valuable public company, warned that every 1¢ rise in EUR/USD cuts revenues by €30 million, unless hedged.

- Adidas cited “negative translation effects” in its overseas sales.

- Daimler, still reeling from Chinese competition and US tariffs, flagged FX volatility as a significant performance risk.

As Europe’s exports become more expensive globally, these firms face a double blow: Trump’s tariffs and an overvalued euro.

What’s Next?

Forecasts are mixed. A Bloomberg survey shows many expect the euro to hit $1.21 by early 2026. But Valentin Marinov, head of G10 FX at Crédit Agricole, believes the move is overdone and expects the euro to retreat toward $1.10 next year as rate differentials shift and recession risk looms.

Lagarde herself cautioned that a “global euro” won’t happen by default. “It must be earned,” she said, citing the need for deeper European capital markets, fiscal unity, and stronger political governance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Indian Bank Stocks Surge as Earnings Beat Estimates

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead