Global investors are entering a high-stakes week with cautious optimism, as megacap earnings and Donald Trump’s Aug. 1 tariff deadline dominate the conversation. Futures are slightly positive, supported by last week’s record highs in the S&P 500 and Nasdaq, but traders remain on edge as policy clarity and earnings results could quickly shift market momentum.

Wall Street Opens the Week on Watch

Stock futures are treading water in early Monday trading, with investors balancing excitement over big tech earnings and concerns around escalating global trade tensions. Following a strong week for growth stocks, the market’s resilience now hinges on whether Alphabet and Tesla can deliver earnings strong enough to justify their lofty valuations.

- Dow Jones futures (YM=F): +0.10%

- S&P 500 futures (ES=F): +0.13%

- Nasdaq 100 futures (NQ=F): +0.21%

Tariff Countdown Intensifies

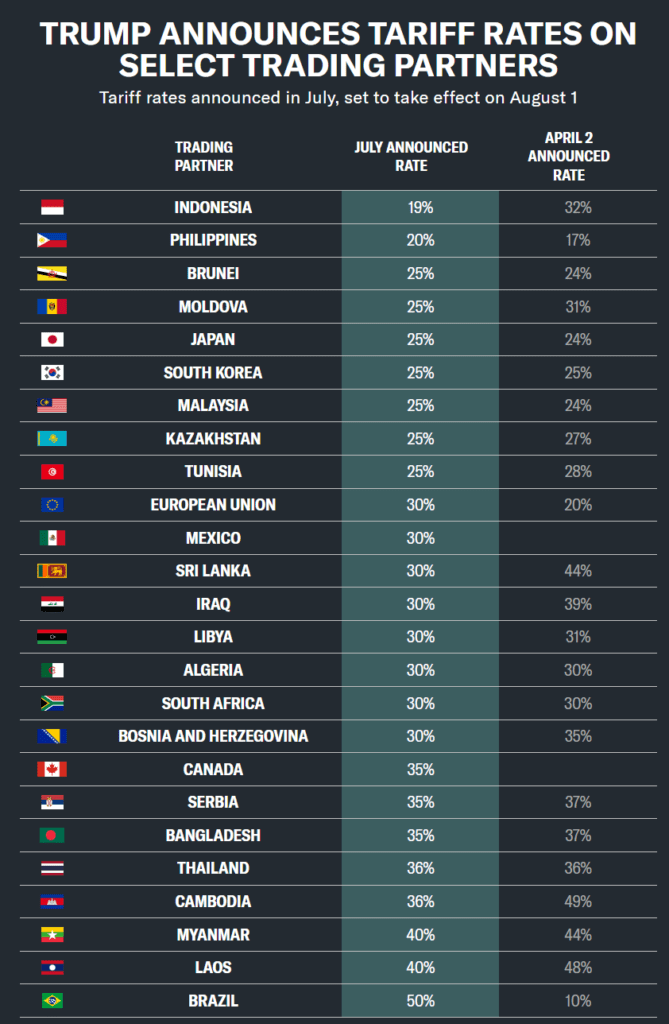

The looming Aug. 1 deadline for Trump’s sweeping new tariffs is rattling trade partners and corporate planners alike. While the White House insists it’s a hard deadline, Commerce Secretary Howard Lutnick says talks can continue even after tariffs kick in. Trump is reportedly pushing for aggressive blanket tariffs on EU imports, raising fears of a full-scale trade war.

- Aug. 1 tariff rate: Up to 30% on EU and Mexico, 35% on Canada, 50% on Brazil

- Trump’s current demand to EU: Minimum 15%-20% blanket tariffs

- Commerce Secretary Lutnick: “They’ll start paying Aug. 1 — we’ll still talk after”

- Lutnick says he’s confident a US–EU trade deal will be reached before the Aug. 1 tariff deadline — but warns duties will start either way.

- EU response: Preparing countermeasures and seeking leverage via talks with China

Big Week for Tech Earnings

Earnings season shifts into high gear this week, starting with Alphabet and Tesla on Wednesday — the first of the Magnificent Seven to report. With tech stocks driving the market’s gains, this week’s reports could make or break the current rally. Analysts expect these giants to post strong growth, contrasting with weaker performance across the broader index.

- Monday earnings: Verizon (VZ), Domino’s Pizza (DPZ), Cleveland-Cliffs (CLF)

- Wednesday earnings: Alphabet (GOOG), Tesla (TSLA)

- FactSet data:

- 59 S&P 500 firms have reported so far

- 86% have beaten earnings expectations

- Forecasted Q2 EPS growth:

- Magnificent Seven: +14%

- Rest of S&P 500: +3.4%

More about: What to Watch This Week: Earnings Tsunami Meets Tariff and Fed Cross‑Currents

Global Markets Snapshot

Global equities are mixed as investors weigh the fallout from Japan’s upper-house elections, China-EU diplomacy, and growing concerns over the US’s tariff trajectory. With Japan’s markets closed for Marine Day, volumes in Asia were light, while European markets opened slightly lower.

| Market | Level | Move |

|---|---|---|

| 🇺🇸 S&P 500 (futures) | 6,343.00 | +0.13% |

| 🇺🇸 Nasdaq 100 (futures) | — | +0.21% |

| 🇺🇸 Dow (futures) | — | +0.10% |

| 🇪🇺 Euro Stoxx 50 (fut.) | — | -0.08% |

| 🇯🇵 Nikkei 225 | Closed (holiday) | — |

| 🇨🇳 Shanghai Composite | 2,936.22 | -0.46% |

| 🇰🇷 KOSPI | 2,803.90 | -0.12% |

| 🇦🇺 ASX 200 | 7,769.20 | -0.28% |

| 🇮🇳 Sensex | 80,184.85 | +0.22% |

Commodities — Oil & Precious Metals

Oil prices remain tight but slightly up, reflecting ongoing geopolitical friction—especially new sanctions on Russia—balanced by healthy global supply.

- Brent crude is trading around $69.38/barrel, up about $0.10 (0.14%) on the day

- WTI crude sits near $67.50/barrel, climbing $0.16 (0.24%)

- Markets expect Brent to stay range-bound between $64–70, with six-week trading patterns reflecting tight movement

Analyst outlook:

- Goldman Sachs projects Brent average $66 in H2 2025

- Morgan Stanley sees prices easing to $60 by early next year

- Gold, a traditional safe haven, is holding steady near $3,352.50/oz, up ~$1 (0.04%) from Friday

- Silver is also stable, trading around $38.22/oz, up 0.1%

Forecast: Technical momentum suggests a bullish setup with potential upside toward $3,865/oz if gold clears resistance near $3,575

Crypto Brief — Bitcoin & Ethereum

Crypto markets are trading higher after last week’s sluggishness:

- Bitcoin: $118,330 (+0.4%), range [$116,776–$118,790]

- Ethereum: $3,771.57 (+3.6%), range [$3,642–$3,814]

Crypto remains sensitive to macroeconomic trends, including inflation, interest rate hints, and trade policy risks.

TSMC Breaks $1 Trillion

TSMC (Taiwan Semiconductor) became the first Asian stock since PetroChina in 2007 to hit a $1 trillion valuation, fueled by AI-driven demand and rising chip prices. Shares have surged nearly 50% since April, with investors betting TSMC will dominate the next generation of AI manufacturing.

- TSMC forecast: +30% revenue growth this year

- Goldman Sachs: “AI customers show no signs of slowing”

- JPMorgan: Higher wafer prices and strong demand could offset currency pressure

What’s Next?

Monday is light on macro data, but key earnings and trade developments are expected to roll in throughout the week. The big question: can markets extend gains, or will tariffs and tech disappointments bring a reversal?

Today’s watchlist:

- 10:00 AM ET: June Leading Economic Index (US)

- Earnings: Verizon, Domino’s Pizza, Cleveland-Cliffs

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Indian Bank Stocks Surge as Earnings Beat Estimates

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches