From an Oval‑Office pitch to rock‑star selfies in Beijing, Nvidia CEO Jensen Huang just pulled off one of the year’s most dramatic policy reversals.

A “grand bargain” in the making

After months of export‑curb turmoil, the White House told Nvidia it may restart shipments of its China‑specific H20 AI accelerator—a 180‑degree turn that analysts say could signal a broader trade compromise with Beijing.

- The sales freeze: In April, the administration barred the H20, wiping roughly $10 B from Nvidia’s 2026 pipeline and forcing a $4.5 B write down.

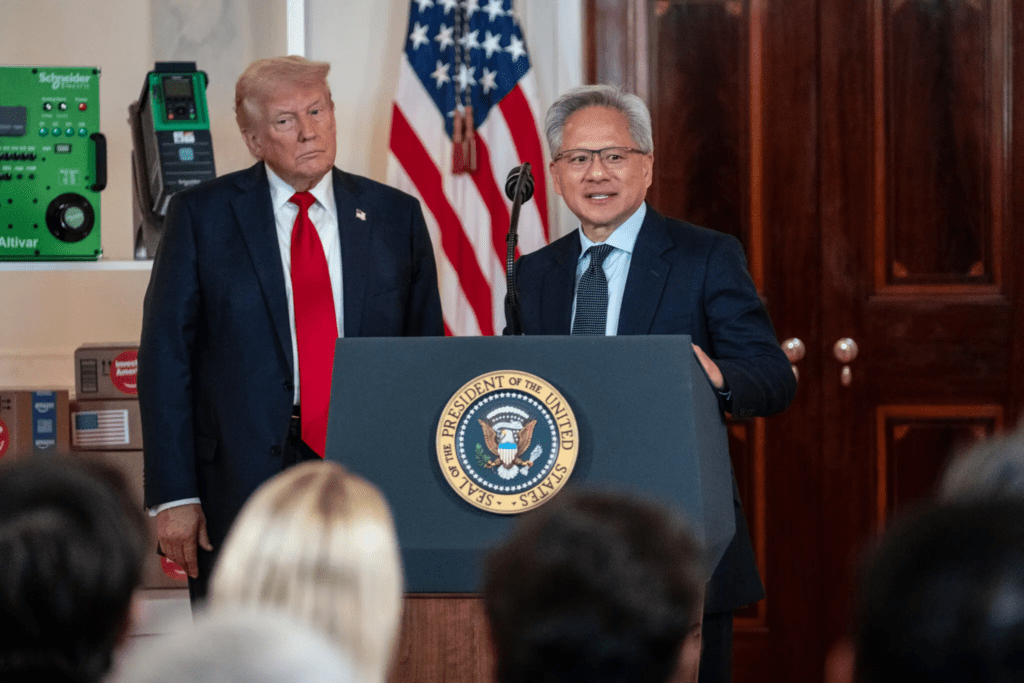

- The reversal: Last week, Jensen Huang met President Trump in the Oval Office, urging him to keep China on the “American tech stack.” Days later, Commerce Secretary Howard Lutnick said licenses would be granted to avoid ceding the market to Huawei.

How Huang Won Trump’s OK on China AI Chip Sales

A deep‐dive from The New York Times details the months‑long lobbying blitz that turned Nvidia’s China ban into a green light. Key takeaways:

- Oval‑Office pitch: Huang met Trump last week, arguing that keeping China on the “American tech stack” is the best way to blunt Huawei’s rise. Two insiders say the meeting tipped the balance.

- Back‑channel allies: White House AI adviser David Sacks—a former VC—quietly pushed to soften global chip curbs, dismantling Biden‑era limits and helping Nvidia strike monster deals in the UAE and Saudi Arabia.

- Mar‑a‑Lago dinner drama: At a $1 M‑per‑plate fundraiser in April, Commerce chief Howard Lutnick invited Huang to plead his case—only for the H20 to be blocked two weeks later, setting up the reversal saga.

- Rare‑earth sweetener: Lutnick later told CNBC the license approval was tied to China’s agreement to keep rare‑earth magnets flowing to U.S. firms—part of what some officials call a “grand bargain.”

- Huang’s strategy: Make U.S. chips the global standard, even if that means selling a “fourth‑best” product to China now and lobbying for better chips later.

The profile cements Huang’s new reputation as Silicon Valley’s chief geopolitical operator—more diplomat than engineer—while underlining how pivotal Nvidia has become to both U.S. tech dominance and Trump’s evolving trade playbook.

Huang’s charm offensive: In Beijing on Wednesday, Huang praised Chinese tech giants, called Huawei “a very great company,” and joked he wants to buy a Xiaomi EV. He told reporters the H20 “is still very competitive” and pledged to “work hard to accelerate” supply‑chain recovery, though it will “take time.”

Wall Street recalculates

Needham’s Quinn Bolton raised his price target to $200 (from $160), modelling $3 B in H20 sales per quarter and predicting the written‑down inventory will carry “near‑100 % gross margin.” Bolton sees further upside from export‑compliant Blackwell variants (B30/B40) that already have >$1 B in pre‑orders.

Insider selling continues

An SEC filing shows Huang sold another 225,000 shares—about $37 M—under a March 10b5‑1 plan, bringing 2025 disposals to 1.2 M shares (~$190 M). Board member Brooke Seawell cashed out $16 M.

What’s next

- Supply ramp: Huang says Nvidia hasn’t met with Chinese customers yet but aims to restart shipments “soon” once licenses land.

- More advanced chips: He hopes the U.S. will eventually allow products “better and better than H20” as technology moves on.

- Policy risk: Bloomberg notes Washington’s U‑turn is fueling talk of a “grand bargain” linking AI chips to rare‑earth supplies, but future licenses will still be case‑by‑case.

A deft mix of Oval‑Office lobbying, diplomatic flattery and strategic concessions has reopened the world’s second‑largest AI market to Nvidia. If shipments flow as hoped, analysts see a multi‑billion‑dollar revenue hole turning into a new growth engine—though policy whiplash and ongoing insider selling remind investors the ride will stay volatile.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches

Week Ahead (July 14 – 18): Inflation Check, Big Bank Earnings, Tech Titans

Hegseth Orders Every US Squad Armed by 2026: Defense Stocks Up

Tesla Paid for Elon’s Politics — Will the “America Party” Help or Hurt?