Following dramatic airstrikes by the US and Israel on Iranian nuclear facilities over the weekend, global markets are facing the highest geopolitical risk premium in months. Iran’s expected retaliation, the threat of closing the Strait of Hormuz, and a spike in oil prices have sent shockwaves through commodities, stocks, and crypto.

But the war clouds aren’t the only concern.

This week, investors also face a packed macro and corporate calendar—including May PCE inflation, Jerome Powell’s congressional testimony, and earnings from FedEx, Nike, and Micron. Add in fragile risk sentiment and volatile energy prices, and you get one of the most critical weeks for positioning ahead of Q3.

Let’s break it all down.

1. US–Iran Conflict: War Risk Hits Markets

The weekend’s strikes on Iran’s Fordow, Natanz, and Isfahan nuclear sites have reshaped market mood. While President Trump called the mission a “monumental obliteration,” Iran responded with missile launches—and one chilling line from its military command:

“Mr. Trump, the gambler — you may start this war, but we will be the ones to end it.”

Oil prices surged nearly 10% after Iran’s parliament approved a proposal to close the Strait of Hormuz, which handles 20% of global oil flows. Although prices have cooled back below $75, volatility is far from over.

Risk assets, particularly equities and crypto, sold off. Bitcoin dipped below $100K. Safe havens like gold and the US dollar strengthened. Traders are now bracing for further Iranian retaliation, especially if energy infrastructure or shipping routes are targeted.

2. Inflation Watch: May PCE Report on Friday

Geopolitical risks aside, Friday’s PCE data could determine the Fed’s next move. Markets are expecting core PCE to land around 2.6% YoY, slightly above target.

With tariffs and commodity shocks back in play, any upside surprise could renew fears of sticky inflation—putting pressure on rate-cut bets and growth stocks. The April print was already showing a slow descent. Now, with oil rising, Powell may tread even more carefully.

3. Powell’s Testimony: Two Days, Two Committees

Fed Chair Jerome Powell will testify before Congress on Tuesday (House) and Wednesday (Senate). The focus: inflation, rates, and the economic impact of tariffs and conflict.

Expect tough questions. Trump-aligned lawmakers may criticize the Fed for refusing to cut, while Democrats may grill Powell on recession risks. And markets will be watching every word for signs of a September pivot—or more delay.

Several other Fed speakers will also appear throughout the week, adding to the noise.

4. Corporate Earnings: Nike, FedEx, Micron in Focus

FedEx (Tuesday) will offer insight into global shipping volumes—and by extension, the health of trade and logistics. The company previously warned of slowing demand and lower profits.

Micron (Wednesday) is key for the semiconductor and AI sector. After announcing a $200B US chip investment, investors want to see how Micron positions itself amid high capex and strong AI-driven demand.

Nike (Thursday) rounds out the trio, with Wall Street watching closely after weak prior earnings. The company has flagged tariff exposure as a major concern, and is still battling margin pressure in China and North America.

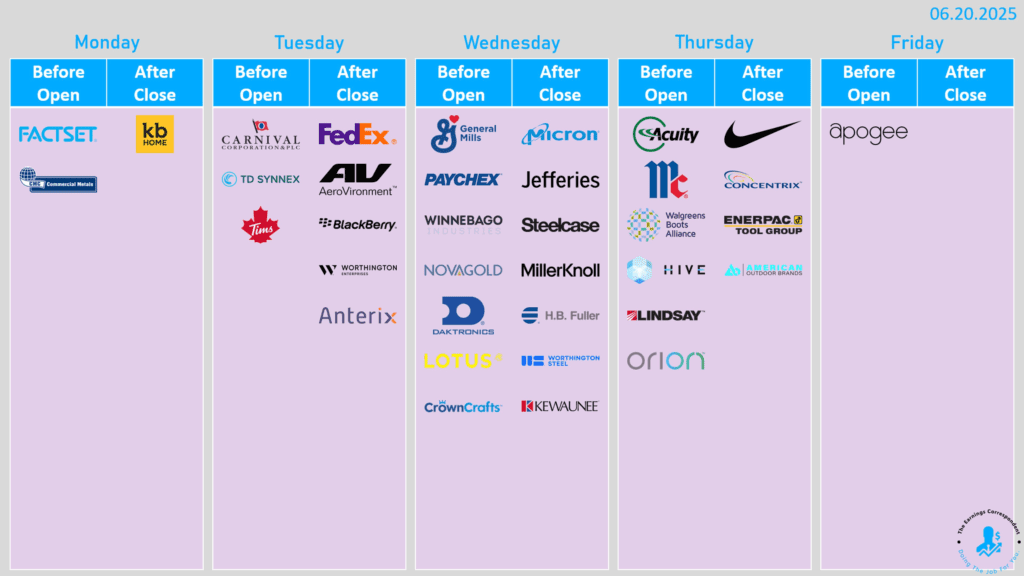

Also on watch: Carnival, Paychex, General Mills, McCormick, and Walgreens.

5. Tesla’s Robotaxi Moment (or Delay?)

Tesla is tentatively set to unveil its long-awaited robotaxi fleet in Austin this week. But delays are common—and expectations are high. Any update, rollout, or hiccup will be closely tracked by traders looking for new catalysts after recent stock stagnation.

6. Macro Calendar: Home Sales, Confidence, GDP

On the economic side, key reports include:

- Monday: Existing home sales (May), PMI flash

- Tuesday: Consumer confidence, Case-Shiller home price index

- Wednesday: New home sales

- Thursday: Q1 GDP revision, durable goods, jobless claims

- Friday: PCE inflation, consumer sentiment (final)

The real-time state of housing, consumer mood, and spending will matter more than usual, given inflation’s role in Fed policy and election-year economic framing.

What It All Means for Markets

This week is a rare overlap of war headlines, Fed narratives, inflation data, and earnings catalysts.

- Equities face headline risk from both Iran and Powell

- Bonds are caught between safe-haven inflows and rate policy uncertainty

- Oil remains the biggest wild card

- Crypto reacts sharply to any macro stress

Investors should expect higher volatility, sudden swings, and sector rotation based on news flow.

Geopolitics may drive fear, but inflation will decide rates—and earnings will show how companies are coping with it all. It’s a week where everything is in play—and no asset class is safe from surprise.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Iran–Israel–US Conflict Erupts: Nuclear Strikes, Hormuz Threats, and Global Fallout

US-Iran Conflict Escalates After Strikes on Nuclear Sites: What We Know So Far

US Hits Iran’s Nuclear Sites — Iran Strikes Back as War Escalates

Rising oil prices, inflation fears, and geopolitical volatility unsettle investors