US President Donald Trump reignited global trade tensions on Friday with a fiery declaration: a 50% tariff on all EU imports starting June 1, unless the European Union strikes a favourable deal. Delivered via his Truth Social platform, the announcement marked a dramatic escalation in the ongoing U.S.-EU trade row, blindsiding financial markets and leaving policymakers scrambling.

What Happened?

- Trump lashed out at what he called “ridiculous corporate penalties, VAT taxes, and unjustified lawsuits” imposed by the EU, accusing Brussels of engineering a $250 billion trade deficit with the U.S.

- “Our negotiations are going nowhere!” Trump wrote. “Therefore, I am recommending a straight 50% Tariff on the European Union.”

- He clarified that products manufactured within the U.S. would be exempt, in a clear attempt to pressure European firms to relocate production.

Though the post also included a 25% tariff threat against Apple over foreign-made iPhones, it was the EU-wide 50% tariff threat that sent shockwaves through financial systems across the Atlantic.

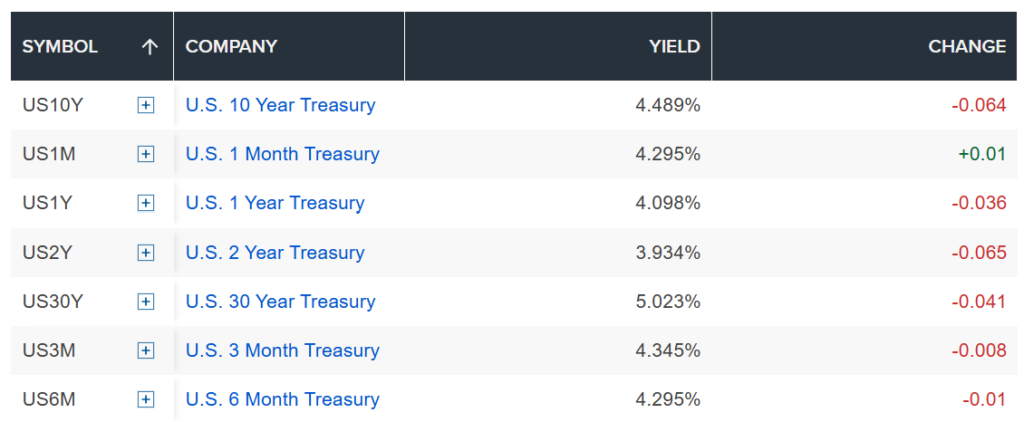

Market Fallout: Europe Trembles, US Yields Tumble

- European Stocks Crashed: Germany’s DAX plunged 2.6%, France’s CAC 40 dropped 2.8%, and the UK’s FTSE 100 fell 1.3%, wiping billions in equity value within hours.

- Currency Shock: The euro, which was up earlier in the day, reversed sharply and ended just 0.45% higher at $1.1336, despite safe-haven inflows to the yen and Swiss franc.

- Treasury Yields Sank: Fears of a global economic slowdown spurred a bond rally in the US, signalling a major shift from risk to safety.

- Oil and Commodities Retreated:

Brent crude slid over 1% to $63 per barrel, reflecting growing concern over demand destruction if a tariff war kicks off. - Trump also said in a separate post that Apple must pay a 25% tariff on iPhones made outside the U.S., sending the stock tumbling and leaving traders looking for safety in bonds.

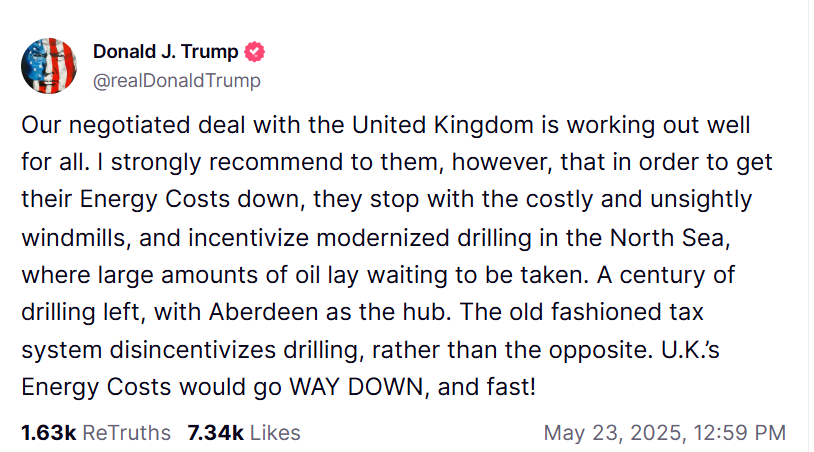

Trump’s Energy Comment to UK: More Than Side Note

Just minutes before the EU tariff threat, Trump posted this:

“I strongly recommend [the UK] stop with the costly and unsightly windmills, and incentivize modernized drilling in the North Sea… A century of oil left, with Aberdeen as the hub.”

This wasn’t random — it signalled Trump’s economic pressure campaign: rewarding countries that align with U.S. industrial policy (like fossil fuel dominance) and punishing those that embrace divergent energy or trade paths (like green energy or carbon border taxes). (Related: US-UK Trade Deal: A Big Win or Just Political Theater?)

What This Means for Europe

Economic Shock Risk

- A 50% tariff would be devastating for EU exporters, particularly in automobiles, machinery, chemicals, and luxury goods — all of which are deeply intertwined with the U.S. market.

- The EU exports roughly €450 billion ($490B) worth of goods annually to the U.S., and sectors like German autos and French cosmetics would face near-immediate disruptions.

- This could tip already fragile EU economies (Germany narrowly avoided recession earlier this year) into contraction, especially if retaliatory tariffs follow.

Trade Retaliation?

- EU Trade Commissioner Maroš Šefčovič is expected to speak with US Trade Representative Jamieson Greer soon.

While no official response has yet come from the European Commission, retaliatory measures seem likely. - The EU has a long history of swift countermeasures, as seen during the 2018 steel tariff skirmish. Expect targeted tariffs on U.S. tech, agriculture, and energy if this escalates.

Strategic and Market Implications

- Negative for the EU:

- Tariff costs could inflate consumer prices,

- strain EU-US political ties,

- and undermine eurozone growth at a critical time post-inflation.

- Mixed for the US:

- Some U.S. manufacturers may benefit short-term from reshored production or reduced competition,

- but consumers and importers will bear higher costs,

- and global supply chains could destabilize further, worsening inflation.

- Investor Sentiment Cracks: The post comes on the heels of Moody’s downgrade of U.S. debt and Trump’s “big, beautiful” tax bill, both of which had already rattled investor confidence. Friday’s tariff news flipped the focus from fiscal risk to trade war risk, with both weighing on the dollar and market outlooks.

Trump’s tariff threat is not just a negotiating tactic — it’s a warning shot in a broader battle over trade dominance, industrial policy, and economic sovereignty. For the EU, this marks a critical inflexion point: either yield to US demands or retaliate and risk deeper economic fragmentation.

Either way, markets have taken notice — and the volatility may just be beginning.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

US at risk of stagflation, Fed right to hold: Jamie Dimon

Why ‘Sell America’ is trending on Wall Street

Trump’s ‘Big, Beautiful Bill’ Moves Forward — But Sparks Backlash Over Debt and Benefit Cuts

Bloomberg Terminal Outage Disrupts Bond Auctions Across Europe

Weak 20-Year Treasury Auction Sends Yields Higher and Stocks Tumbling

Nvidia CEO Slams Biden’s AI Chip Export Curbs as a “Failure,” Backs Trump’s Reversal

White House: China Will ‘Absorb’ Tariffs — Not US Consumers

Bostic Warns on Moody’s Downgrade, Inflation Risk — Leans Toward One Cut

Nvidia Expands in China & Taiwan as US Export Rules Tighten

Earnings Calendar, Fed Speech, Housing Data: What to Watch This Week