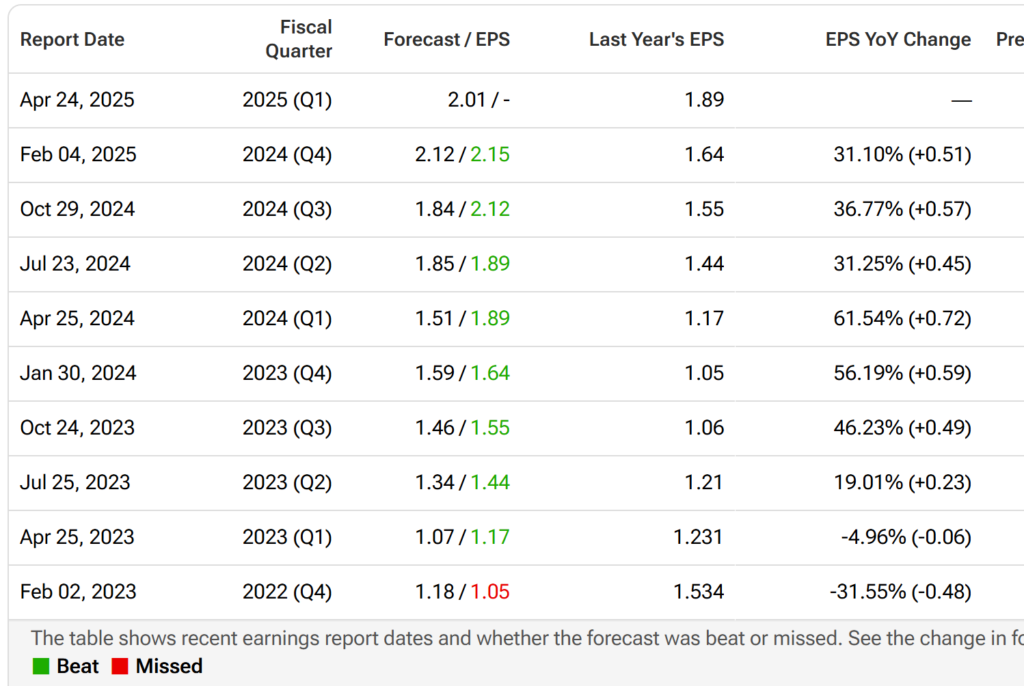

Alphabet Inc. (NASDAQ: GOOGL) is set to report its Q1 2025 earnings today, April 24, after market close. Analysts anticipate revenue of approximately $89.2 billion, marking an 11% year-over-year increase, and earnings per share (EPS) of around $2.01 to $2.02, up from $1.89 in Q1 2024

Key Predictions on Alphabet’s Q1 Performance

Revenue & EPS Growth Expected

- Revenue Projection: Analysts estimate Q1 revenue of $89.2 billion, reflecting an 11% year-over-year (YoY) increase .

- Earnings Per Share (EPS): The consensus estimate is an EPS of $2.01 to $2.02, up from $1.89 YoY .

AI-Powered Growth

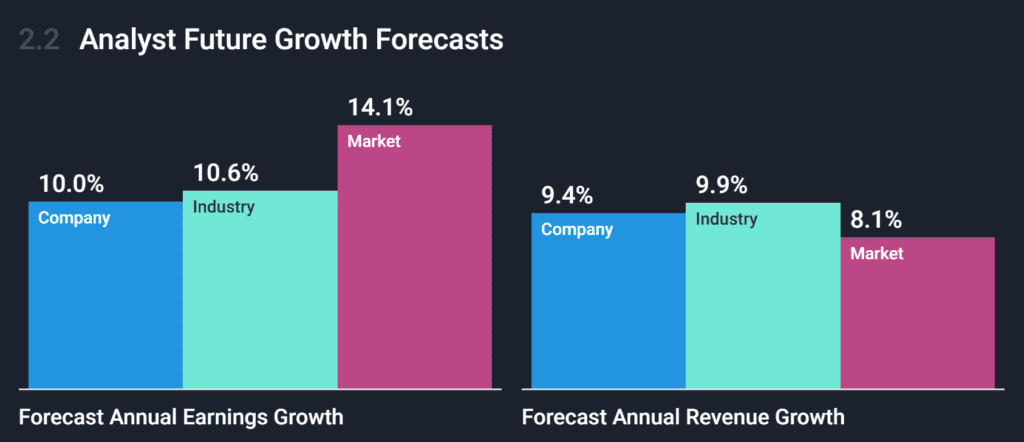

Alphabet’s AI initiatives, particularly the Gemini AI model, are expected to contribute significantly to revenue expansion. Analysts highlight the integration of AI into search, ads, and cloud services as key growth drivers .

Bullish Outlook: Continued Strength Across Key Segments

Google Cloud Growth

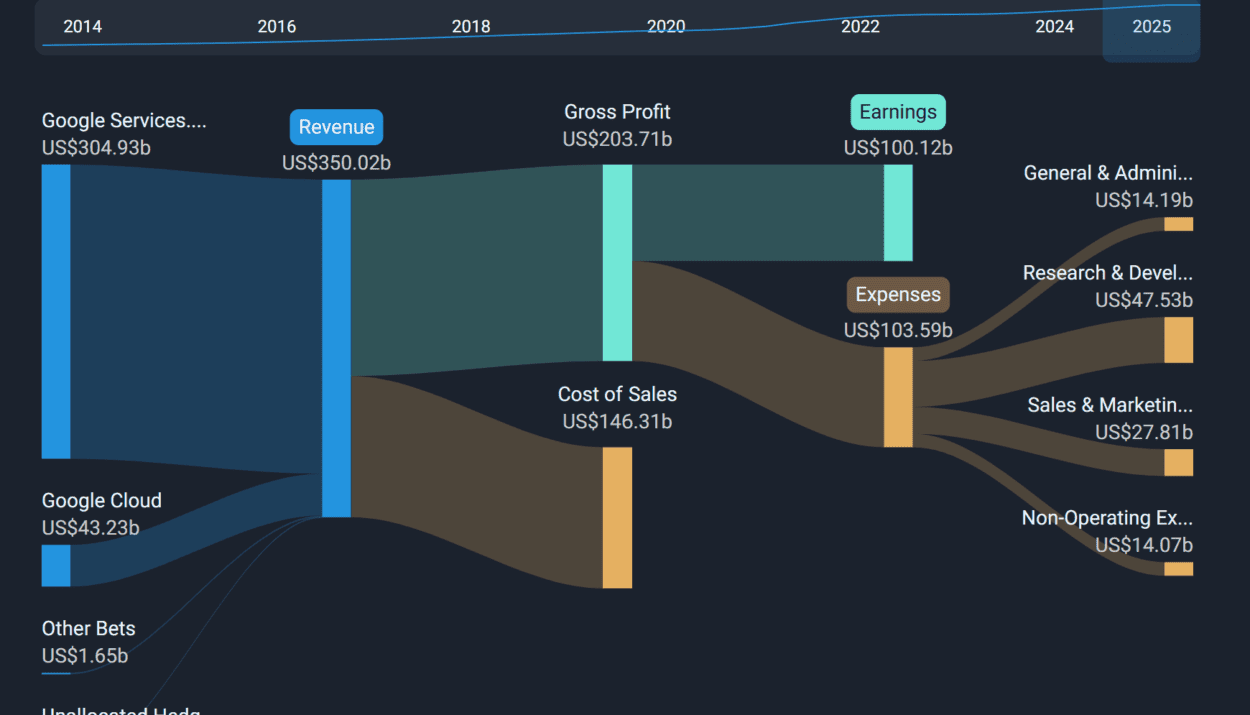

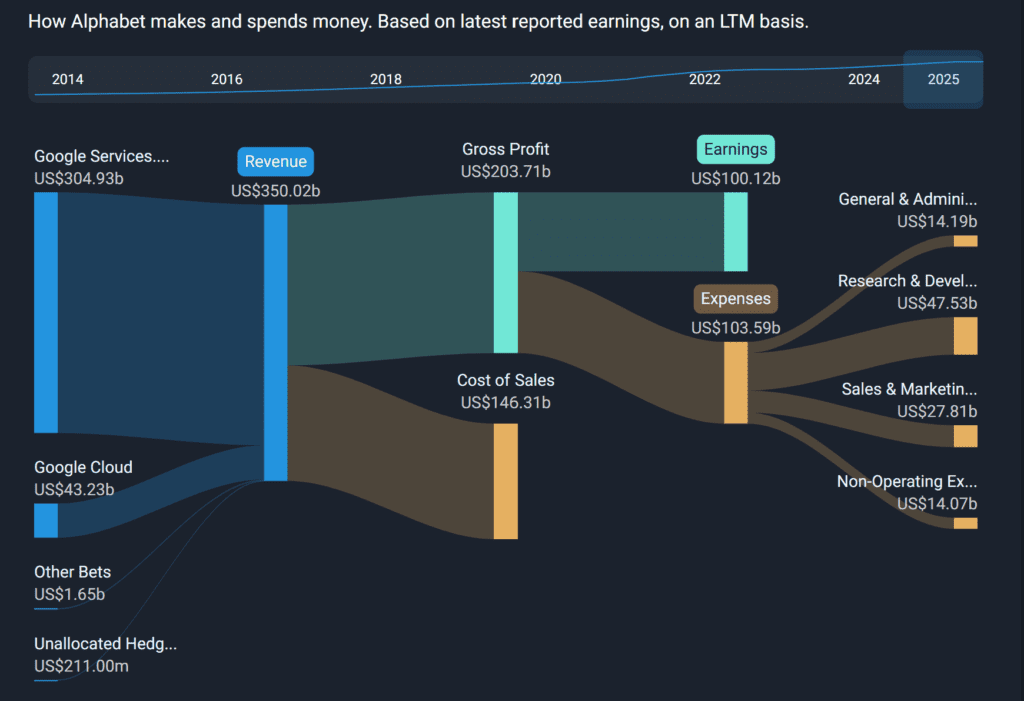

Google Cloud revenue is projected to grow 30% YoY to $12 billion, benefiting from rising AI adoption and enterprise spending .

YouTube Revenue Recovery

YouTube ad revenue is expected to rise 14% to $10.5 billion, driven by strong engagement and ad spending .

AI and Infrastructure Advancements

The introduction of Gemini 2.0 and significant progress in AI models, along with the development of new cloud regions and data centers, are anticipated to enhance Alphabet’s infrastructure capabilities .

Strong Cash Flow

Alphabet reported free cash flow of $24.8 billion in Q4 2024 and $72.8 billion for the full year 2024, indicating robust financial health .

Bearish Concerns: Regulatory & Cost Pressures

DOJ Antitrust Case

The ongoing U.S. Department of Justice lawsuit against Alphabet’s search dominance poses potential legal and regulatory risks. A recent ruling found that Google maintained illegal monopolies in online advertising, which may lead to structural changes in its ad business .

AI and Cloud Spending

While AI expansion drives growth, heavy capital expenditures (CAPEX) on AI and cloud infrastructure could impact profit margins. Alphabet exited 2024 with more demand than available cloud capacity, indicating a tight supply-demand situation .

Slowing Ad Growth

Despite the recovery, Google’s core ad business faces increasing competition from Amazon, TikTok, and Meta in the digital advertising space. Network advertising revenue of $8 billion was down 4% year-over-year .

Impact of Currency and Leap Year on Revenue

Alphabet expects a revenue headwind in Q1 2025 from foreign exchange rates and having one less day due to the leap year .

Conclusion: What to Watch for in Alphabet’s Earnings Report

Alphabet is expected to report solid revenue and earnings growth, but key areas to watch include:

- Cloud & AI Growth: The impact of Google Cloud and Gemini AI on future profitability.

- Advertising Rebound: The strength of YouTube and Search ad revenue post-pandemic.

- Regulatory & Cost Control: Updates on the DOJ case and AI investment strategy.

If Alphabet delivers above-expectation earnings and provides strong AI and cloud guidance, it could drive further stock upside. However, regulatory headwinds and rising expenses remain concerns.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: YouTube turns 20 and is on track to be the biggest media company by revenue