Netflix (NFLX) just reported Q1 2025, beating expectations on revenue, operating income, and earnings per share.

With paid sharing and a growing ad-supported tier, this was Netflix’s first quarter without subscriber numbers. Management now wants investors to focus on revenue, operating income, and margin expansion—not raw user additions.

With a potential US recession looming, streaming could prove surprisingly resilient. After all, staying home to binge-watch is still cheaper than going out to dinner or hitting the movies.

So, what did we learn? Let’s review.

1. Netflix Q1 FY25

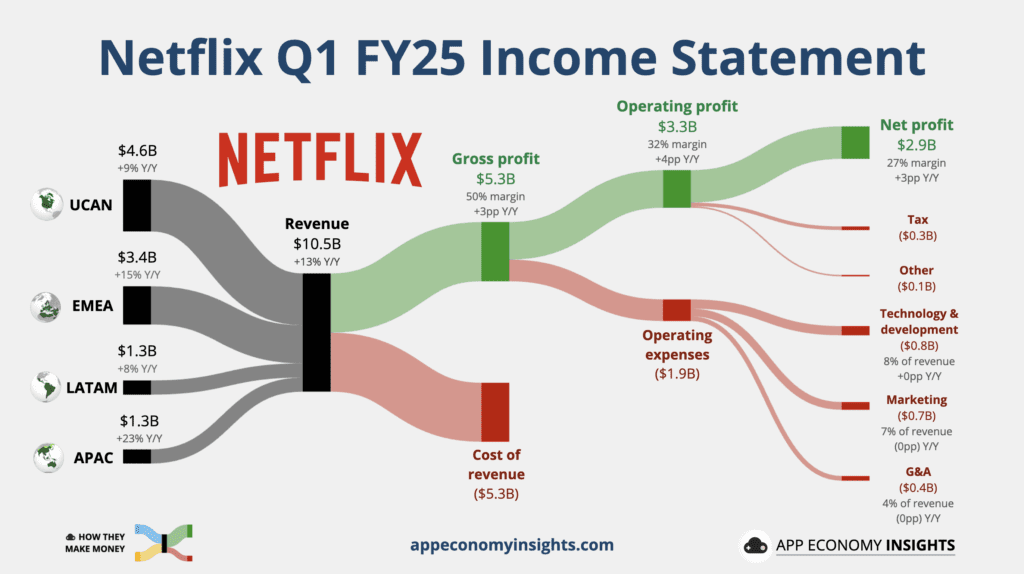

Income statement:

- Revenue +13% Y/Y to $10.5 billion ($40 million beat).

- Operating margin 32% (+4pp Y/Y).

- EPS $6.61 ($0.95 beat).

Cash flow (TTM):

- Operating cash flow: $7.9 billion (20% margin).

- Free cash flow: $7.4 billion (19% margin).

Balance sheet:

- Cash and short-term investments: $8.4 billion.

- Debt: $15.0 billion.

FY25 Guidance:

- Revenue +12%-14% Y/Y to $43.5-$44.5 billion (unchanged).

- Operating margin 29% (unchanged).

So, what to make of all this?

- Another strong quarter: Revenue, margins, and earnings all came in above guidance. Constant-currency revenue rose 16% Y/Y, and operating margin continued to expand. EPS surged 25% Y/Y, driven by healthy subscriber growth, price increases, and disciplined spending.

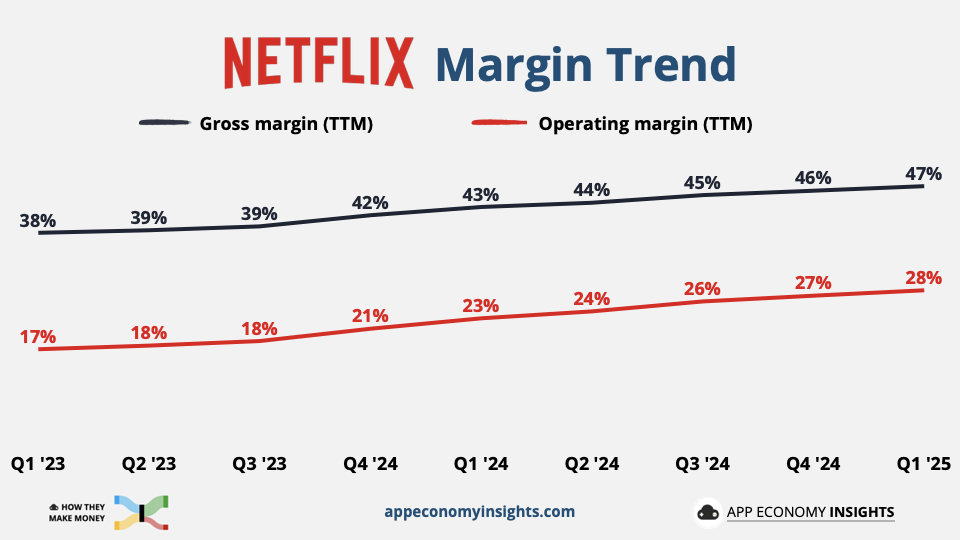

- Focus shifts from members to money: With Netflix no longer reporting subscriber counts, the spotlight is firmly on revenue and operating margin. It’s a sign of a maturing business, where pricing power, engagement, and ads are now the primary levers for growth. Margins have steadily improved in the past two years, with no near-term ceiling in sight.

- Cash machine mode: Netflix now generates billions in profit and free cash flow. Q1 alone delivered $2.7 billion FCF—fueling aggressive share buybacks and debt paydowns, while still investing in global content and ads infrastructure.

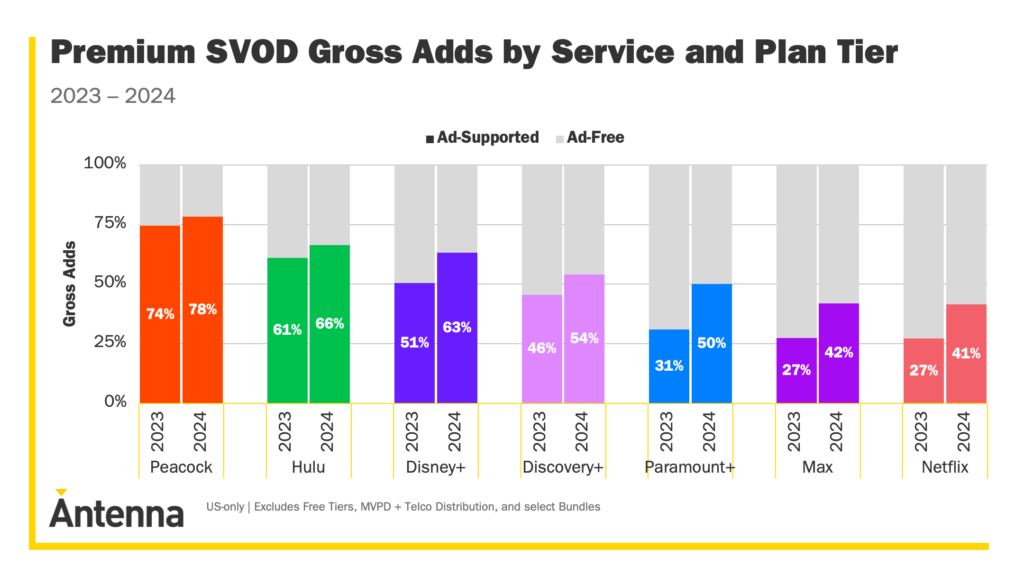

- Ad tier steps up: Netflix launched its in-house ad tech platform in the US on April 1, with global rollout coming soon. Ad revenue remains small today but is expected to double in 2025. Over half of new sign-ups in ad markets choose the ad plan, supporting long-term monetization.

- Live is gaining steam: WWE RAW is off to a strong start, consistently ranking in the Global Top 10. Netflix is doubling down with more live content—including the Taylor vs. Serrano rematch in July and a second NFL game this Christmas. These events could become powerful traffic spikes and ad vehicles.

- Content momentum holds: Q1 brought one of Netflix’s most popular English-language series ever (Adolescence) and multiple breakout films across genres and geographies. From Back in Action to Counterattack, the global slate continues to deliver hits that drive engagement and local market share.

- End of an era: Reed Hastings, who co-founded Netflix in 1997, is stepping back to become a non-executive chairman. It’s a symbolic passing of the torch after nearly three decades of leadership—first in DVDs, then streaming, and now global entertainment.

- Big picture: Netflix is executing on all fronts—revenue, profitability, and product evolution. FY25 guidance remains unchanged, but momentum is tracking toward the upper end of the range. With scalable margins, a growing ad business, and a blockbuster slate (hello Squid Game S3 in June), Netflix is pushing to make 2025 its biggest year yet.

2. Recent business highlights

$1 Trillion Target

Senior staff attending Netflix’s annual business review meeting last month spilled the beans with The Wall Street Journal.

By 2030, Netflix executives want to:

- Double revenue—from $39 billion in 2024.

- Triple operating income—from $10 billion in 2024.

Netflix aims to reach $9 billion in ad revenue by 2030, or roughly 12% of its total revenue—up from a mid-single-digit share today.

For the operating income to triple in the next six years, it must grow at a 20% CAGR, primarily fueled by 12% annual revenue growth and the operating margin expanding to 38%. This is key to Netflix’s plan: modest top-line growth, amplified into stronger bottom-line gains.

An interesting soundbite was the goal to achieve a $1 trillion valuation by 2030, from roughly $420 billion today. That implies a ~15% annual return for the stock—more than enough to beat the S&P 500.

Management expects to grow paid memberships to 410 million by 2030, with new members coming from international markets like Brazil and India.

Crowded space

March underscored just how fragmented streaming has become—with seven different platforms placing titles in Nielsen’s Top 10.

New anticipated seasons of flagship shows like Reacher, The White Lotus, and Severance drew big audiences. Even Moana 2 made waves, building on the original’s legacy as the most-streamed movie in US history.

Fragmentation may slow Netflix’s dominance in any given month—but it also raises the bar for what consistent engagement looks like. That’s where Netflix’s global scale, local production, and hit pipeline still give it a competitive edge.

Top Q1 Shows:

- Adolescence (124M views).

- The Night Agent S2 (50M views).

- Running Point (36M views).

Top Q1 Movies:

- Back in Action (146M views).

- The Life List (67M views).

- Ad Vitam (63M views).

What’s coming next?

Netflix is about to roll out new seasons of its three biggest hits by total hours watched in 2025: Squid Game S3, Stranger Things S5, and Wednesday S2.

Netflix’s growth is increasingly global, with a majority of its viewership—and new hits—coming from outside the US. It’s a positioning that may prove valuable in a geopolitically sensitive environment.

Ads at scale

Netflix expects its ad revenue to roughly double in 2025—albeit from a small base.

According to Antenna, 41% of Netflix’s new US subscriptions were ad-supported in 2024. That’s up from 36% the year before—and Netflix is catching up fast.

More importantly, 57% of new SVOD sign-ups across the industry are now ad-supported, up from 45% in 2023. The trend is clear: ad tiers are becoming the default.

3. Key quotes from the earnings call

Co-CEO Greg Peters

On the macro environment:

“Entertainment historically has been pretty resilient in tougher economic times. Netflix specifically also has been generally quite resilient, and we haven’t seen any major impacts during those tougher times.”

Netflix is positioning itself as a defensive asset amid economic uncertainty. With global reach and relatively low pricing, it’s likely to remain a budget-friendly default for millions—often one of the last expenses to be cut.

On the launch of Netflix Ads Suite:

“We launched Netflix Ads Suite in the US in April, and it enables us to improve the ad experience with better targeting, better measurement, more innovative ad formats. And then also drive more scale, and importantly, more relevance for advertisers. […] We’re seeing a nice correlation between that improvement and revenue growth.”

Netflix’s in-house ad tech is live in the US, with more countries to follow. It’s a foundational step that should unlock better monetization over time, especially as programmatic ramps globally.

On advertising engagement and growth:

“View hours per member on the ads plan is similar to the engagement that we see on our standard plan. […] We’re happy with the growth. It’s tracking well. […] We’re investing in the right areas to build long-term revenue.”

Retention and engagement on the ad tier match Netflix’s traditional offering—critical for proving ad-supported streaming works at scale. Doubling ad revenue again this year remains the target.

On global ambition and share of TV time:

“The biggest opportunity we’ve got is actually going after the roughly 80% share of TV time that neither Netflix nor YouTube have today. We think of that as a real immediate opportunity.”

Even as streaming becomes crowded, Netflix sees upside in total TV time—not just stealing share from other platforms, but converting traditional viewing habits worldwide.

Co-CEO Ted Sarandos

On the $1 trillion market cap target leak:

“We often have internal meetings and we talk about long-term aspirations, but it’s important to note this is not the same as a forecast. […] We don’t have a five-year forecast or five-year guidance.”

While the leaked $1 trillion ambition caught headlines, Sarandos clarified that it reflects internal ambition—not formal guidance. Still, it offers a glimpse into Netflix’s long-term mindset.

On content discovery and marketing efficiency:

“We are able to tell our members about a show they will love on Netflix, while they’re watching Netflix, and not go through third-party marketing to do it. […] And on social, we’ve got over a billion fans. It’s a big conversation engine.”

Netflix’s flywheel remains unique—its content finds an audience without traditional marketing spend. With 1 billion+ social media followers, discovery is built into the platform.

4. Engagement trends to watch

Engagement is the north star for Netflix—fueling word-of-mouth, long-term retention, and pricing power.

According to Nielsen, streaming accounted for 44% of US TV Time in March, up from 39% a year ago and an all-time high. That gain came directly at Cable’s expense, a segment now representing a 24% market share, down from 28% a year ago.

Netflix captured 7.9% of US TV time in March—down slightly from 8.1% a year ago. This flat market share suggests recent growth is driven more by price hikes and international expansion than deeper engagement at home.

price hikes and international expansion than deeper engagement at home.

YouTube’s momentum is hard to ignore. While Netflix’s share has held steady at around 8%, YouTube has surged to 12%, up from 10% a year ago. Total streaming time is growing, but YouTube is claiming more of it.

With less transparency into subscriber trends, market share remains one of the few forward-looking signals investors can track. If engagement flattens, it may suggest limits to how much more juice Netflix can squeeze from the US market—making international growth and ad-tier traction all the more important for the next chapter.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source: App Economy Insights

Related:

The Role of Fiscal Dominance in Monetary Policy

Authorities use high tech, called “Overwatch” to enhance border security

Why are more rich Americans opening Swiss bank accounts recently?

Gold Is at a Record High. Why It Could Climb Even Higher?

Nvidia’s CEO makes surprise visit to Beijing after US restricts chip sales to China

The Rule of 40: Your Ultimate Guide to Evaluating Software Stocks

How does the Eurodollar System Influence Global Markets?

Nvidia faces $5.5 billion charge as US restricts chip sales to China

China to now pay up to 245% tariffs on imports to US: Trump’s latest move