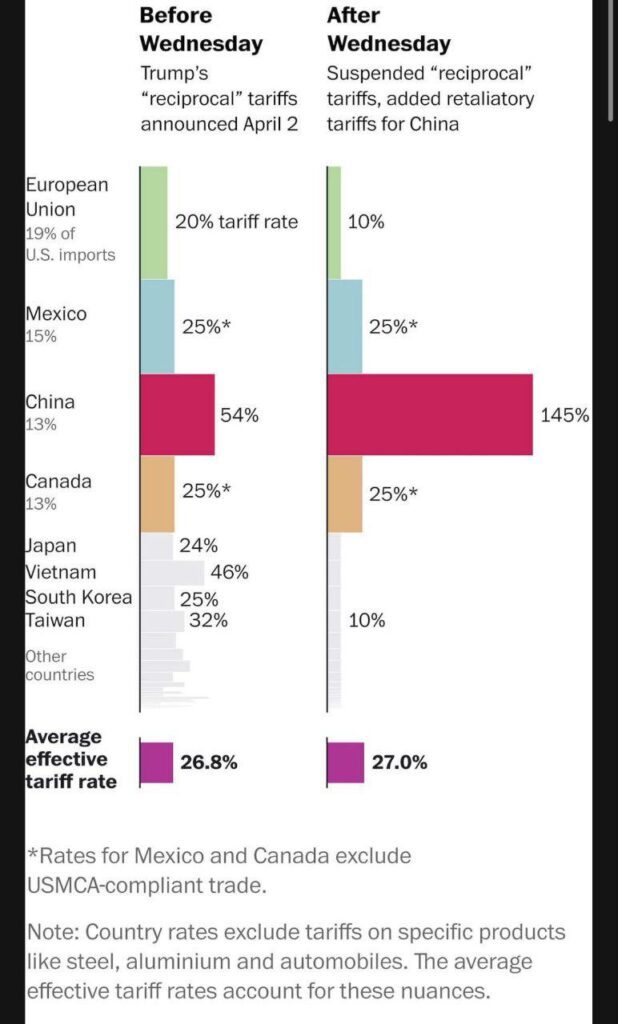

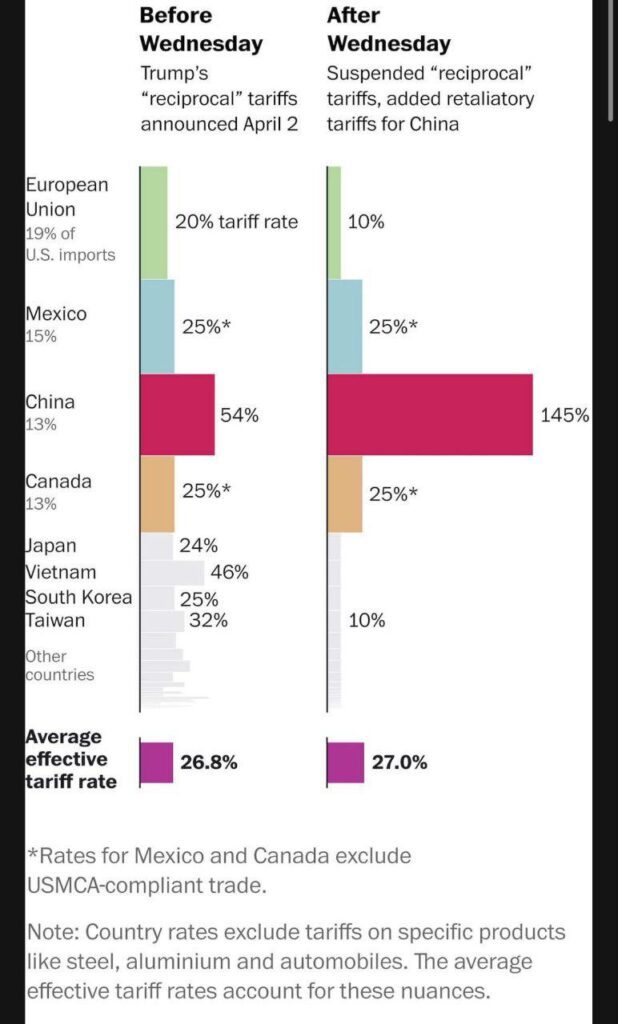

After triggering historic market turmoil with his April 2 “Liberation Day” tariffs, U.S. President Donald Trump announced a 90-day pause on most new trade duties—except for China. His goal? Negotiate 90 trade deals in 90 days.

That’s one deal per day.

Now, his administration is scrambling to reassure allies and calm financial markets still reeling from the shockwaves. But investors, analysts, and foreign diplomats aren’t convinced. Even seasoned negotiators are calling the timeline “wildly unrealistic.”

“There’s no way during this timeframe we’re doing a comprehensive agreement with any of these countries,” said Wendy Cutler, ex-U.S. Trade Representative and head of the Asia Society Policy Institute.

Trump may be touting his art of the deal, but the question looming over Wall Street and Washington is: Can he pull it off—or will this all end in more market chaos?

Who’s Steering the Ship?

Despite the 90-deal ambition, Trump’s top trade negotiator, Treasury Secretary Scott Bessent, is headed to Argentina next week—not Europe, Asia, or Canada. His absence during a critical visit from EU trade chief Maros Sefcovic has raised eyebrows.

Meanwhile, key posts in the U.S. Trade Representative’s office remain unfilled, and diplomats say messaging is mixed. There’s still no nominee for undersecretary for international affairs, a role pivotal to trade negotiations.

White House adviser Peter Navarro says “the boss is the chief negotiator,” and that Trump will personally oversee each deal.

“We’re going to run 90 deals in 90 days. It’s possible,” Navarro told Fox Business.

Markets Respond With Caution

Markets rebounded late in the week—but they’re walking on a knife’s edge. S&P 500 surged 5.7% this week, the best since 2023, but remains down 9% from April highs. Four 1,000-point Dow swings occurred in just five trading days.

Meanwhile:

- 10-year Treasury yields soared above 4.5%, their fastest rise since 2001

- The U.S. dollar plunged, hitting its lowest level since 2022

- Gold soared to a record $3,200/oz, a clear flight to safety

- Oil dropped to $61.50, as fears of a global recession weigh on demand

“Financial chaos has its cost,” said RSM’s Joe Brusuelas. “Investors are losing faith in U.S. assets.”

More about: Markets soared, crashed, and soared again — all in 5 days. Welcome to Tariff Roulette 2025

Reality Check: Can Trump Deliver?

Even Trump’s smallest previous trade win—revising auto and steel terms with South Korea—took over eight months. The USMCA took more than two years. Now, Trump is attempting to replicate that 90 times in 3 months?

Markets think not.

China, which received no tariff pause, slapped the U.S. with 125% retaliatory tariffs Friday, calling the U.S. “a joke” and refusing further tit-for-tat. And while over 70 countries have reportedly asked for meetings, actual progress remains murky.

“It’s not like there’s a sheet of paper with firm talking points,” said a diplomatic source. “Use the term ‘talks,’ not ‘negotiations.’”

What It Means for Investors

- Big Tech Relief: Smartphones, semiconductors, and consumer electronics were excluded from tariffs, sending Apple (AAPL), Nvidia (NVDA), and TSMC (TSM) higher

- Export-Heavy Stocks Stay Under Pressure: Boeing (BA), Caterpillar (CAT), and Tesla (TSLA) remain vulnerable as global demand clouds

- Retail & Transport: Walmart (WMT) and Amazon (AMZN) still face headwinds as inflation risks rise

- Safe Havens Shine: Gold miners (NEM, GOLD) and Treasury ETFs (TLT) remain strong bets as volatility persists

Trump’s 90-for-90 play might sound like a flex, but it smells more like a bluff. Financial markets have already priced in chaos—and they’re demanding receipts, not rhetoric. Unless tangible wins roll out fast, expect bond yields to stay high, stocks to wobble, and global partners to walk slowly.

For now, it’s hope vs history—and the clock is ticking.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump exempts phones, computers, chips from new tariffs

China strikes back with 125% tariffs on U.S. goods, starting April 12

Tesla stops taking new orders in China

145% Tariffs and a Global Showdown: China Rejects US “Arrogance”

EU to impose retaliatory 25% tariffs on US goods from almonds to yachts

Trump Raises Tariffs On China To 125% After Beijing’s 84% Move

China vows ‘fight to the end’ after Trump threatens extra 50% tariff

Musk made direct appeals to Trump to reverse sweeping new tariffs

Trump Opens Door to Tariff Talks—But No Pause, No Retreat, Just ‘Tough but Fair’ Deals

Bitcoin: Not so independent from the rest of the market?!…

Sources: Reuters, CNN Business