The US stock market continued its sharp selloff Thursday, as fears over an escalating global trade war weighed heavily on investor sentiment. Major indexes closed at their lowest points of the year, with the S&P 500 officially entering correction territory amid intensifying backlash to President Donald Trump’s sweeping tariffs.

- The S&P 500 dropped 1.4%, marking its lowest close of 2025 and sliding into a market correction, now down 10.1% from its record high less than a month ago.

- The Dow Jones Industrial Average plummeted 537 points, also hitting a new year-to-date low.

- The Nasdaq Composite slid nearly 2%, as tech stocks bore the brunt of the selloff, bringing it to its lowest level of the year.

- The selloff, which began last week, deepened after Trump’s 25% tariffs on steel and aluminum imports took effect Wednesday, prompting retaliatory tariffs from Canada, China, and the European Union.

- President Trump escalated tensions further Thursday by threatening a 200% tariff on wines, champagne, and other alcohol imports from the EU.

- Tesla shares dropped 3%, closing at $240.68, and are now down 40% year-to-date, despite Wednesday’s brief rebound.

- Industrials, agriculture, and automotive stocks are also under pressure, as tariffs increase costs and squeeze margins.

Why Are Markets Falling?

The intensifying trade war is fueling investor uncertainty. Trump’s tariff on metals has triggered billions in retaliatory tariffs:

- Canada imposed tariffs on $21 billion of U.S. goods, including steel, aluminum, and even electricity imports.

- The European Union plans to introduce counter-tariffs in April, while China has already slapped 15% tariffs on U.S. agricultural exports like wheat, corn, and cotton.

These tit-for-tat measures raise concerns about slowing global trade, higher costs for businesses and consumers, and potential supply chain disruptions.

What Is a Market Correction?

A correction happens when a stock index falls 10% or more from its most recent peak. The S&P 500’s decline comes just weeks after hitting a record high of 6,144.15 in February.

Jeff Buchbinder of LPL Financial notes that corrections are common, but the speed and cause of this drop — a major geopolitical trade clash — have investors on edge.

Economic Concerns Grow:

Economists warn that a prolonged trade war could hurt GDP growth, drive up inflation, and delay Federal Reserve interest rate cuts that markets had hoped for later this year.

Higher tariffs can raise prices for raw materials like steel and aluminum, impacting manufacturing, construction, and automotive industries, while retaliatory tariffs could reduce U.S. exports.

Will This Correction Lead to a Bear Market?

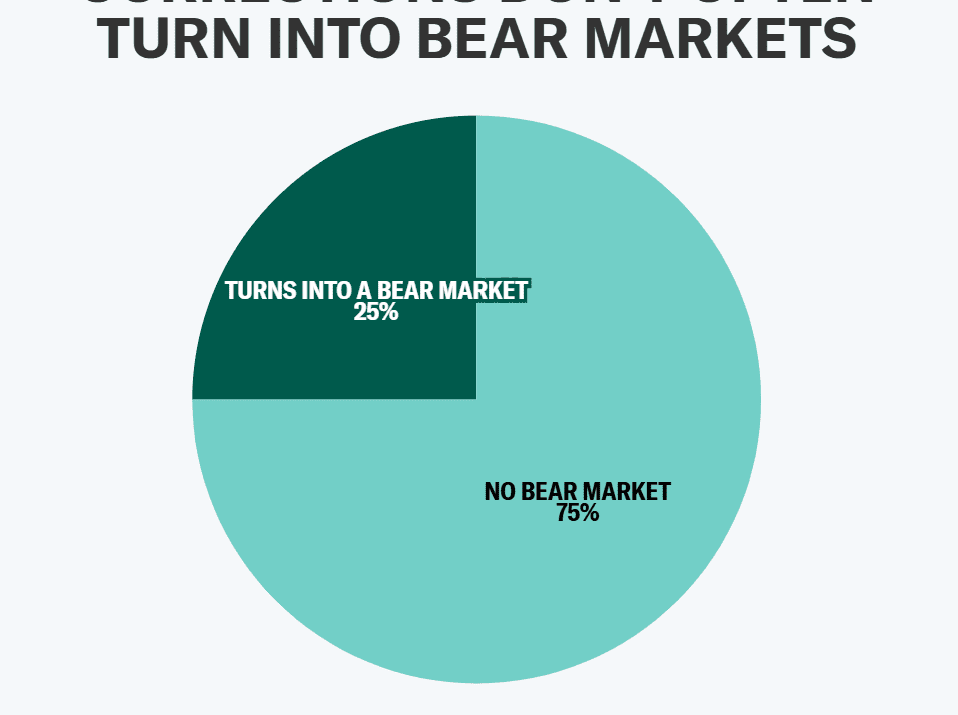

According to Ryan Detrick, chief market strategist at Carson Group, corrections are common, but they rarely turn into bear markets.

- Since World War II, there have been 48 corrections, and only 12 (25%) became bear markets.

- “We may be in a correction, but we don’t see a bear market coming,” Detrick told Yahoo Finance. “Choppiness is normal in post-election years.”

Strategists Remain Cautious but See Fundamentals Intact

- Yardeni Research lowered its 2025 S&P 500 year-end target from 7,000 to 6,400.

- Despite this cut, earnings expectations remain strong, according to Eric Wallerstein of Yardeni Research. The revised target is due to valuation concerns, not deteriorating fundamentals.

- Liz Young Thomas, head of investment strategy at SoFi, noted that the recent selloff has been driven purely by sentiment, not by falling earnings forecasts.

What’s Next?

With threats escalating on both sides, markets are bracing for more volatility. If no trade agreements are reached soon, analysts fear this correction could turn into a deeper market downturn.

For investors: Stay alert. Markets are highly sensitive to tariff developments, and any progress or escalation could trigger sharp moves in stocks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

US Government Shutdown: What It Means for Stock Market

The world is rearming at a pace not seen the since end of World War II

What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN

Donald Trump’s Tesla Sales Script Note Is Going Viral

CPI inflation data cools in February, easing investor fears about health of US economy

Chinese AI team wins global award for replacing Nvidia GPU with industrial chip

Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory

Internal Ripple Emails Expose Anti-Bitcoin Smear Campaign

Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?

Nasdaq 100 Crashes After Dimon & Buffett Sell-Off: What Did They Know?

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app