Minutes after President Trump announced 25% tariffs on the EU, the S&P 500 erased $500+ BILLION of market cap. Meanwhile, Bitcoin just broke below $84,000 for the first time since November 11th.

What’s next?

At around 12:30 PM ET, President Trump began answering questions about tariffs.

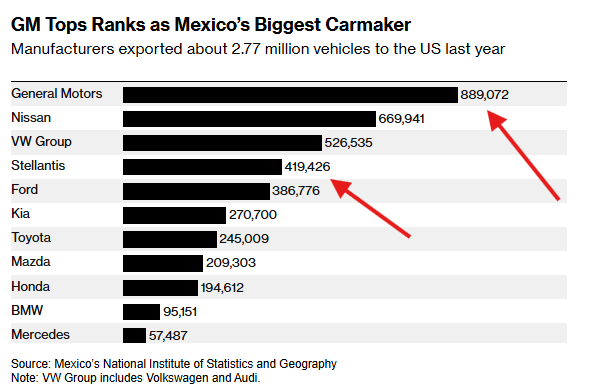

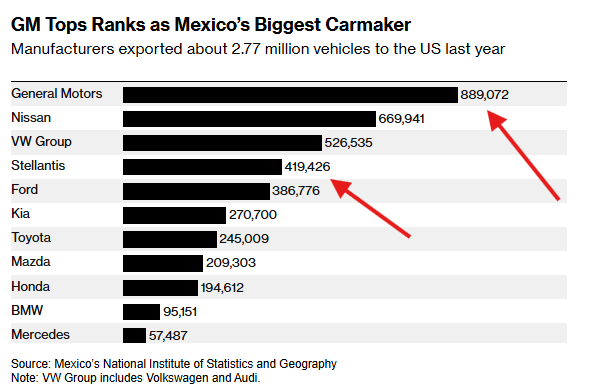

He said 25% tariffs will be announced “very soon” and that the EU “was formed to screw the US.” He mentioned that the tariffs would be applied “generally” and specifically called out car imports.

He recently said that the tariffs on Mexico and Canada are still set to begin in April. Trump said that the tariffs would begin April 2nd, instead of April 1st.

Previously, markets had hoped that the deal Trump made with Canada and Mexico would last indefinitely.

This means we are now set to see:

1. 25% tariffs on Canada

2. 25% tariffs on Mexico

3. 25% tariffs on the EU

4. 10% tariffs on China

5. (Potential) 100% tariffs on BRICS

Markets are now pricing-in a rebound in inflation as prices on many goods are expected to rise. For example, a 25% tariff on Canada and Mexico raises costs for US automakers.

This tariff would add ~$3,000 to the price of some of the ~16 million cars sold in the US each year.

Food costs are set to rise as well, with Mexico supplying over 60% of fresh produce to the US.

Here is a chart of US inflation expectations since the trade war headlines began.

One year inflation expectations are up from ~2.7% to ~4.3% and could easily DOUBLE from their lows. We could see an average tariff rate of 20%+ in the US, the highest rate in 30 years.

What’s interesting is the SHARP divergence between Gold and Bitcoin since the trade war began.

While Gold is up +10%, Bitcoin is down -10%, even though Bitcoin is historically viewed as a “hedge” against uncertainty. If there’s enough interest, we can make a thread on this.

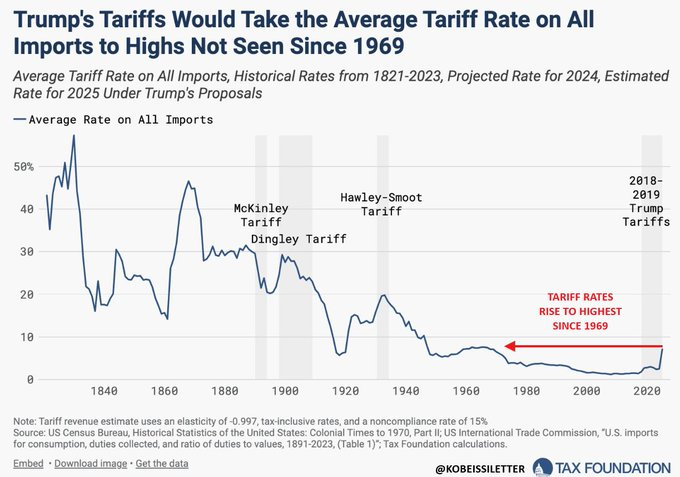

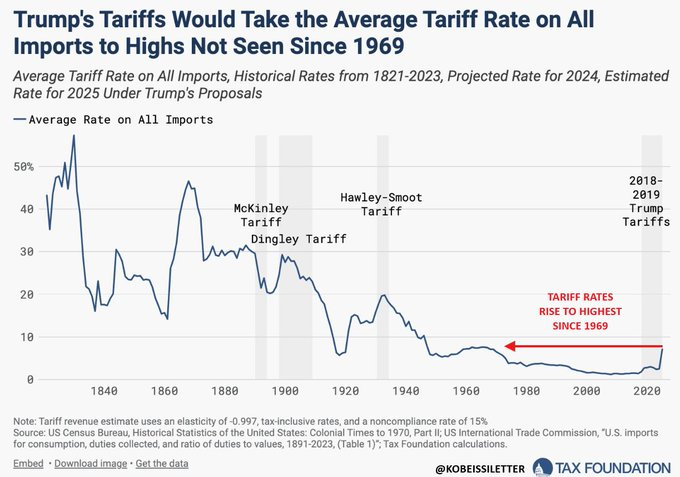

President Trump’s tariffs are set to raise US tariff rates to their highest since 1969. The 10% tariff on China builds on already EXISTING tariffs, some of which are from the last Trump trade war.

When you factor in EU tariffs, we could see the highest rate since the 1940s.

What’s even more telling is the Volatility Index, $VIX.

Even as the S&P 500 has traded near or at all time highs this month, the $VIX has been rising. It’s now up over +30% since February 14th and continues to rise.

Volatility is here to stay.

Looking ahead, the question becomes will President Trump make another deal?

As we saw with Canada and Mexico, Trump could make a deal in the lead up to tariff implementation. We continue to believe that tariffs on EU allies, in particularly, are more or less posturing.

As we saw following the initial announcement of the US-Mexico trade deal, 2-year inflation breakevens fell sharply. We expect to see a similar reaction when Trump reaches another deal with Mexico/Canada/EU.

We do NOT believe that these tariffs are intended to last for years.

Overall, we believe risky assets will continue to see increased volatility into Q2 2025. With Bitcoin in a bear market and the S&P 500 down -4% from its high, we are trading it.

Volatility is the new normal.

Source: TKL

Related:

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors

How Will Tesla Be Affected by 25% EU Tariffs?

Trump vows to slap 25% tariffs on EU and claims bloc was ‘formed to screw US’

Amazon Unveils Ocelot: A Game-Changer for Quantum Computing?

Covid and a Reminder about Long Term Investing

Understanding the Fed’s Rate Decisions: High or Low Interest Rates?

3 Value Stocks that are Backed by the World’s Largest Activist Hedge Fund

Is $MSTR “forced liquidation” possible and what happens if Bitcoin falls?

Why Nvidia’s earnings are important to the entire US stock market

Daily Market Brief: Stocks Struggle, Bitcoin Drops & Earnings Highlights

Trade War and Market Panic: Are Short-Term Dips Long-Term Opportunities?

The Market Begins a New Trading Trend: Contrarian Trump Trades

Hedge Funds Loaded Up AI Stocks at the Fastest Pace Since 2021