Another CEO is speaking out against naked short selling. This time, Power Nickel CEO Terry Lynch is sounding the alarm, warning that market manipulation is threatening junior mining companies.

At the Vancouver Resource Investment Conference, Lynch didn’t hold back, calling for awareness and action against what he describes as a predatory market practice that’s artificially driving down stock prices.

Just yesterday, I shared GameStop (GME) naked short-selling speculations after Schwab’s price glitch, which alerted investors that GME had hit $40,000 per share—far above its actual price of $27 at the time. This led to renewed speculation that GME’s real price might be suppressed due to naked short selling. (Full story here)

Now, another company is raising the same concerns—this time from inside the mining industry.

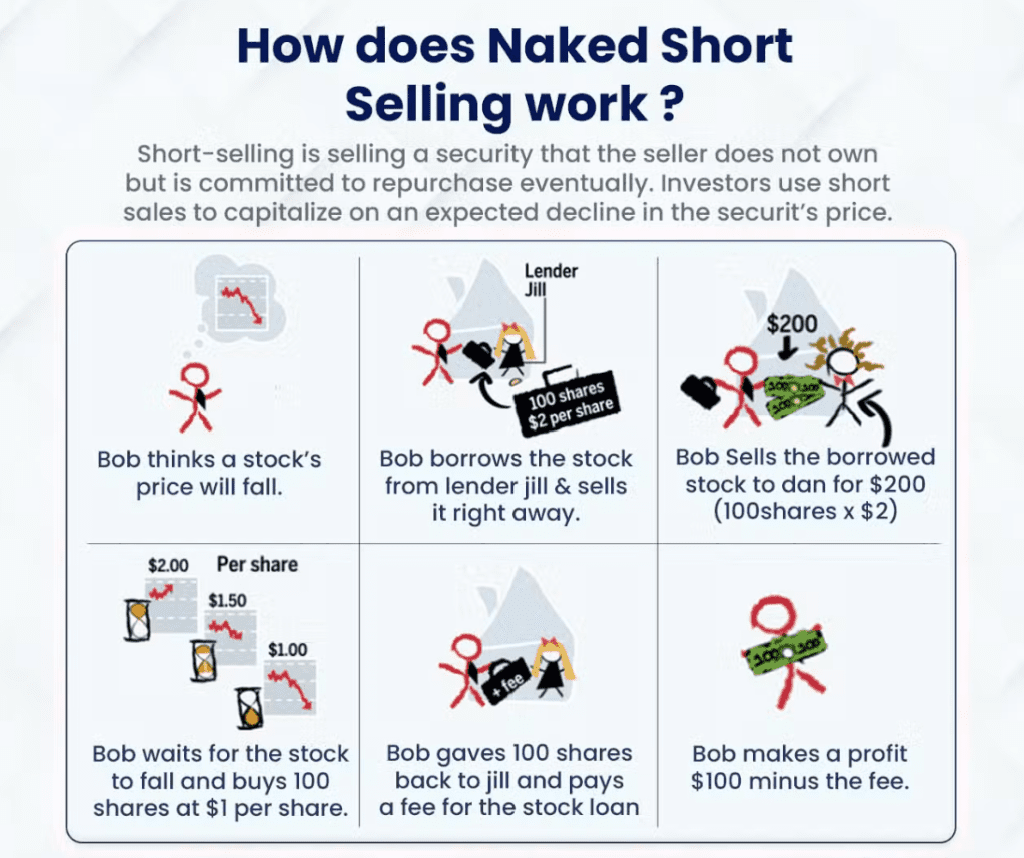

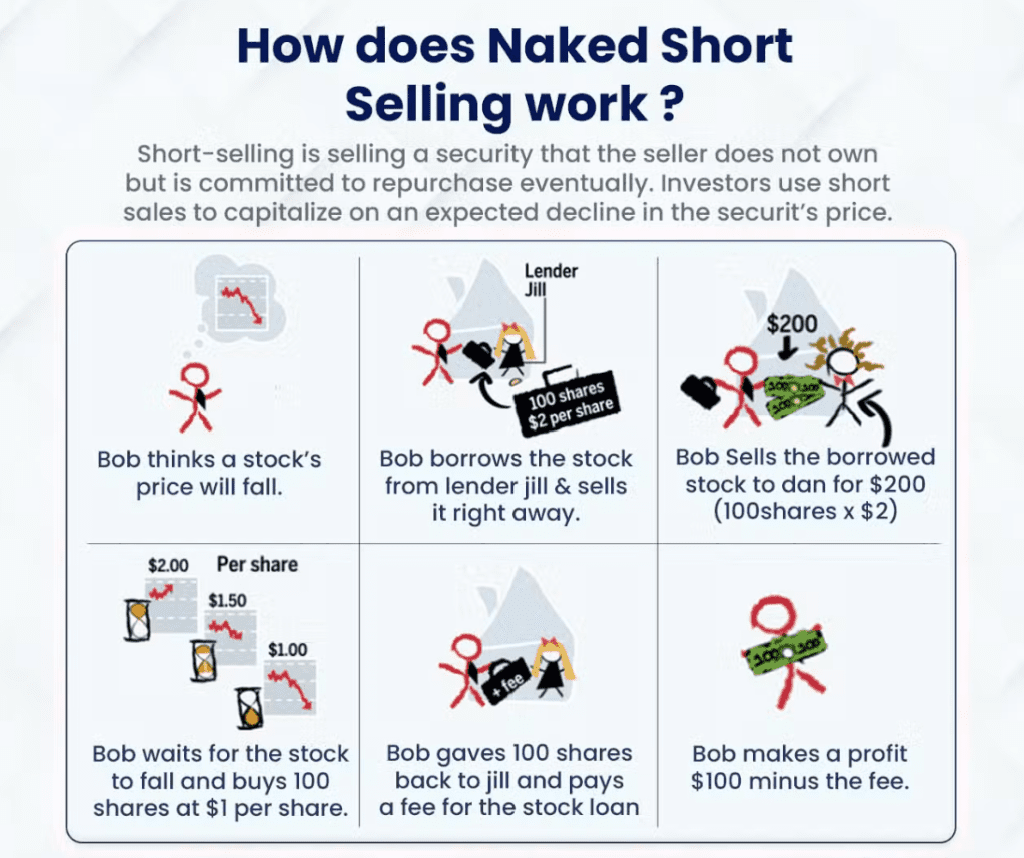

Naked short selling involves selling shares without ensuring their availability for delivery, leading to artificial stock price suppression.

What’s Happening?

🔹 Lynch’s concern: Suspicious trading patterns in Power Nickel’s stock led him to investigate potential manipulation.

🔹 What he found: His firm filed a complaint in December 2023 detailing significant and persistent position imbalances, which he believes are signs of naked short selling suppressing stock prices.

🔹 Why it matters: Naked short selling creates an artificial oversupply of shares, leading to lower prices and eroding investor confidence.

This echoes the GameStop saga, where retail investors suspected naked shorts were suppressing the real stock value—and recent events only add more fuel to the fire.

A History of Market Manipulation

📉 Naked short selling has long been dismissed by mainstream media, often labeling retail investors as “conspiracy theorists.”

⚠️ The 2021 meme stock frenzy changed that—GameStop ($GME) and AMC ($AMC) traders exposed major flaws in the system, revealing how short sellers may be manipulating markets.

🔍 Even the SEC’s actions raise concerns—the agency recently denied a FOIA request for GameStop FTD (failed-to-deliver) data, citing “foreseeable harm.”

This lack of transparency fuels speculation about who benefits from these practices—and why regulators won’t release critical data.

Why It’s a Bigger Problem

💰 Lynch warns that naked shorting isn’t just a meme stock issue—it’s crippling junior mining companies, making it harder for them to raise capital and grow.

🚨 It’s not just speculation anymore—his firm officially filed a complaint demanding an investigation into potential illegal short selling.

⚡ This issue isn’t going away—more CEOs and investors are waking up to just how deep this problem goes.

Will Anything Change?

✅ Bullish Case:

- More CEOs speaking out could pressure regulators to take action.

- Retail investors are more aware than ever—they won’t ignore manipulation anymore.

- If regulators investigate and enforce stricter rules, companies targeted by short sellers could see price recoveries.

❌ Bearish Risks:

- Regulators have historically ignored or downplayed naked short selling concerns.

- Hedge funds and institutions benefit from these tactics, making meaningful change difficult.

- Without enforcement, market manipulation may continue unchecked.

One thing is clear: The fight against naked short selling is far from over.

As more CEOs step up and retail investors keep exposing market manipulation, this issue will only gain more attention.

Related:

Key Events to Watch in This Week & Their Market Impact

Earnings Calendar for This Week: Stocks to Watch and Forecast

Trump’s Auto Tariffs: Will Auto Stocks Crash or Rally?

Car Tariffs May Start on April 2, What It Means for Stock Market

Trump’s Auto Tariffs: What It Means for Tesla Stock

The stock market just won’t crack. Bulls say it’s time for a breakout to new highs

Schwab reports GME stock price above $40,000 in latest glitch: Naked short-selling manipulation?

Javier Milei just DESTROYED market: Are meme coins officially DEAD?