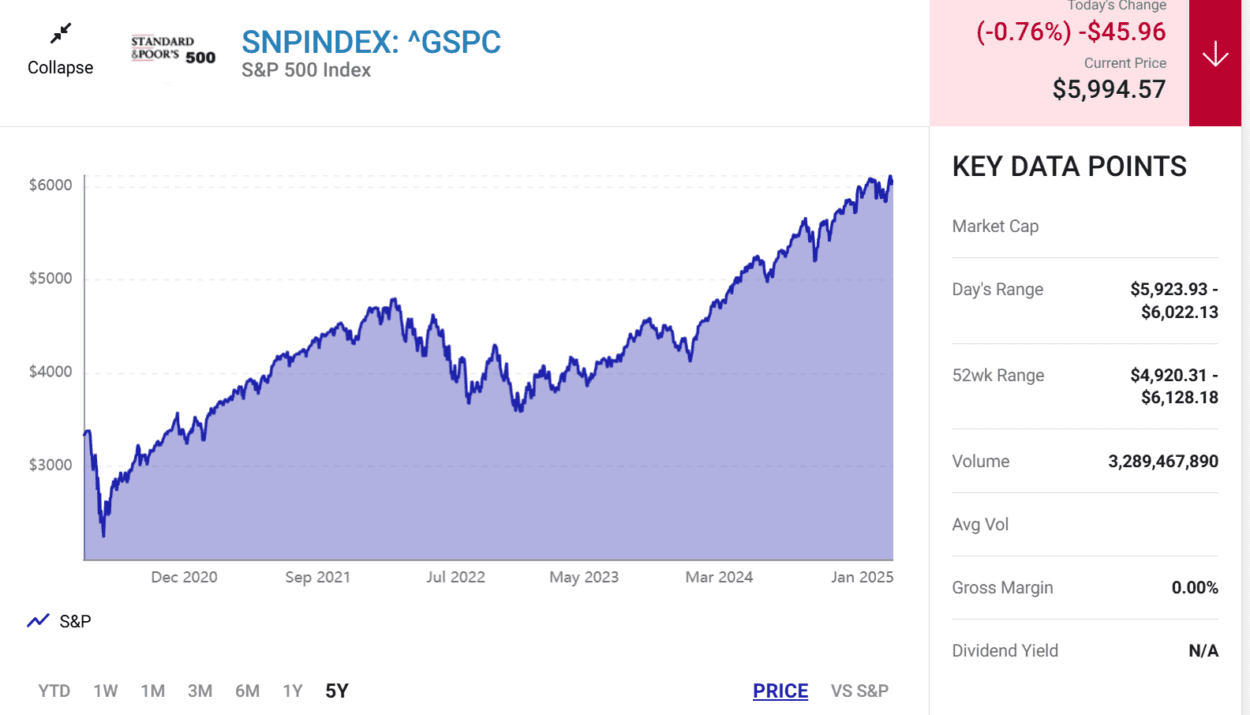

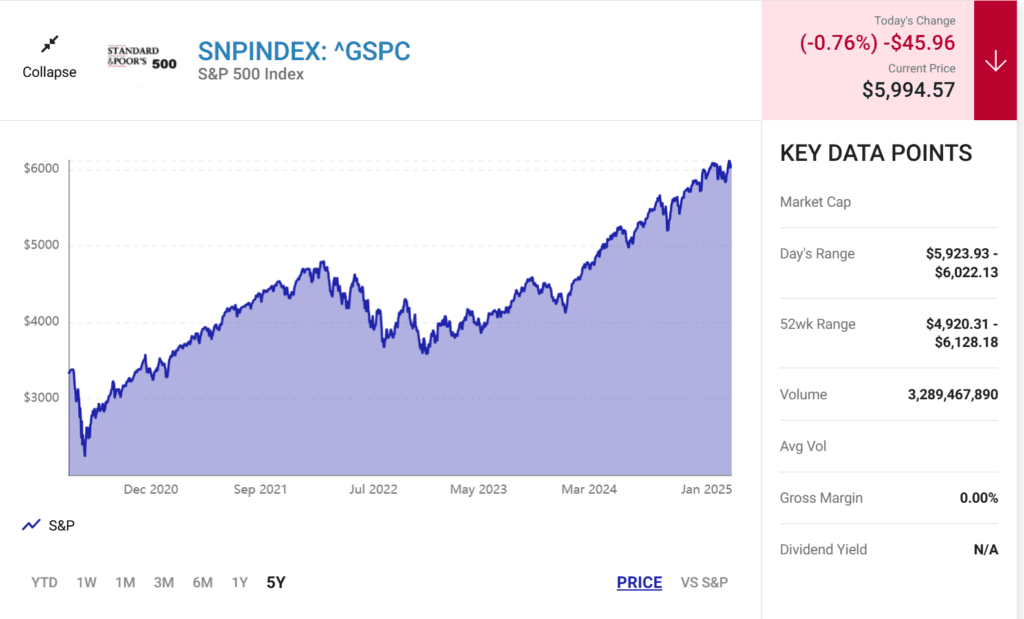

Warren Buffett, the legendary CEO of Berkshire Hathaway (BRK.A, BRK.B), has built a reputation as one of the greatest investors of all time. With a 19.8% compound annual growth rate in Berkshire’s stock price since 1965—far outpacing the S&P 500—Buffett’s investment decisions are closely followed by Wall Street.

Now, a significant shift in his strategy has raised concerns about stock market valuations. As Buffett’s cash pile swells to a record $325 billion, some analysts believe this could indicate that the stock market is overheated and due for lower returns.

1. Buffett’s Massive Stock Sales

In 2024, Berkshire Hathaway sold $133 billion worth of stock, compared to just $6 billion in purchases. Key sales included large stakes in Apple (AAPL) and Bank of America (BAC)—two of Buffett’s biggest holdings. This selling spree was significantly higher than in previous years, leading to a surge in Berkshire’s cash reserves, which more than doubled from $168 billion at the end of 2023 to $325 billion by September 2024.

Buffett has cited concerns over potential capital gains tax increases as one reason for the sales. However, analysts suspect that his decision to offload stocks and hold onto cash may indicate a lack of attractive investment opportunities in an expensive market.

2. A Stock Market Warning?

Buffett’s latest moves could be a sign that he believes stock valuations are too high. The Cyclically Adjusted Price-to-Earnings (CAPE) ratio, a widely used valuation metric, currently stands at 37.9—one of the highest levels in history.

For context:

- November 1999: The CAPE ratio hit 44.2, and the S&P 500 lost 10% annually over the next five years.

- January 2009: The CAPE ratio was 13.3, and the S&P 500 surged 128% over the next five years.

- Current CAPE (Feb 2025): 37.9, which is 120% higher than the historical average of 17.2.

Historically, a high CAPE ratio has correlated with weaker future stock returns, making Buffett’s cautionary stance even more noteworthy.

3. Market Liquidity and M2 Money Supply

While Buffett’s bearish stance suggests caution, some experts argue that stock prices could remain elevated due to excess liquidity in the system. The M2 money supply across the U.S., Europe, China, and Japan has doubled in the past 14 years, fueling asset prices.

Additionally, the rise of passive investing has created an environment where investors continue buying stocks regardless of valuation. This structural shift in the market could keep valuations high, even if Buffett and others are cautious.

Final Thoughts: Should Investors Follow Buffett’s Lead?

Buffett’s massive stock sales and growing cash position signal that he sees limited opportunities in the current market. The historically high CAPE ratio supports the argument that future returns could be subdued or negative.

However, the global liquidity environment and the dominance of passive investing might sustain the stock market rally longer than expected. While taking clues from Buffett is always wise, investors should maintain a long-term focus, staying diversified and avoiding market timing.

For those who believe in Buffett’s cautious approach, holding more cash and looking for undervalued opportunities might be a prudent move. But for those who think the market will remain strong, continuing to invest consistently may still be the best strategy.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet

Has a new era begun? Investors have never been so optimistic…