Quantum computing is still in its early stages, but it holds immense potential to transform industries such as medicine, cybersecurity, finance, and artificial intelligence (AI). With projections indicating that the global quantum computing market will surge from $1.1 billion in 2024 to $12.6 billion by 2032, investors are increasingly looking for early exposure to this high-growth sector. Two stocks—D-Wave Quantum (QBTS) and Rigetti Computing (RGTI)—have emerged as strong contenders in this evolving landscape, with Wall Street analysts giving both stocks a “Strong Buy” rating.

Quantum Computing Stock #1: D-Wave Quantum (QBTS)

Market Cap: $1.5 billion

Stock Performance: Surged 921% in 2023, significantly outperforming the broader market’s 24% gain.

52-Week Range: $0.75 – $11.41

Why D-Wave Stands Out

🔹 First Commercial Quantum Computer – Unlike other companies focused on gate-based quantum computing, D-Wave pioneered quantum annealing, a unique approach used for solving optimization problems.

🔹 Advanced Technology – The company’s Advantage Quantum Computer boasts over 5,000 qubits, making it one of the most advanced quantum systems.

🔹 Cloud Accessibility – D-Wave’s Leap platform allows businesses and researchers remote access to quantum resources, accelerating commercial adoption.

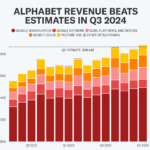

🔹 Strong Revenue Growth – In Q3 2024, total revenue reached $1.9 million, driven by a 41% increase in Quantum Computing as a Service (QCaaS) and a 66% rise in government contract revenue.

Financial Outlook

📌 Projected Fiscal 2024 Bookings: Expected to surpass $23 million, a 120% increase from 2023.

📌 Fiscal 2025 Revenue Estimate: $16.5 million, reflecting 88.1% YoY growth.

📌 EPS Projections:

✅ 2024: -$0.32 per share

✅ 2025: -$0.23 per share

Analyst Ratings

📊 6 out of 7 analysts rate QBTS a “Strong Buy”

📊 1 analyst rates it a “Moderate Buy”

📊 Average Price Target: $5.82

📊 Bullish High-End Target: $9 (Suggesting a 31% potential upside from current levels)

Quantum Computing Stock #2: Rigetti Computing (RGTI)

Market Cap: $3.4 billion

Stock Performance: Skyrocketed 1,007% over the past year.

52-Week Range: $0.66 – $21.42

Why Rigetti Stands Out

🔹 Superconducting Qubit Technology – Unlike D-Wave, which specializes in quantum annealing, Rigetti focuses on gate-based quantum computing, considered the future of universal quantum processing.

🔹 Cloud-Based Quantum Access – Rigetti’s Quantum Cloud Services (QCS) allows organizations to access quantum computing for AI, simulations, and optimization applications.

🔹 Next-Gen Quantum System – In December 2024, Rigetti launched Ankaa-3, an 84-qubit system designed to enhance quantum performance.

🔹 Key Partnerships – The Ankaa-3 system will soon be available on Amazon (AMZN) Braket and Microsoft (MSFT) Azure in early 2025.

Financial Performance

📌 Q3 2024 Revenue: $2.4 million (down from $3.1M YoY, missing estimates by $1.01M)

📌 Net Loss Per Share: Improved to -$0.08 from -$0.17 YoY

📌 Cash Reserves: $92.6 million

Upcoming Milestones (2025)

📌 Launch of a 36-qubit system – Utilizing four interconnected 9-qubit chips, targeting 99.5% median two-qubit fidelity

📌 Projected 2025 Revenue Growth: 41.5% increase after an expected 8.3% decline in 2024

📌 EPS Projections:

✅ 2024: -$0.29 per share

✅ 2025: -$0.20 per share

Analyst Ratings

📊 4 out of 5 analysts rate RGTI a “Strong Buy”

📊 1 analyst rates it a “Moderate Buy”

📊 Average Price Target: $6.10 (already surpassed)

📊 Bullish High-End Target: $12

Key Takeaways for Investors

📌 Quantum computing is still in its early stages, leading to high stock volatility but also massive growth potential.

📌 D-Wave (QBTS) focuses on quantum annealing, a specialized technology already generating revenue, making it a leader in early commercialization.

📌 Rigetti (RGTI) is betting on superconducting qubit technology, aiming to develop scalable, universal quantum computing solutions.

📌 Both companies are expanding their cloud-based quantum computing services, securing government contracts, and developing next-gen quantum systems that could drive substantial revenue in the coming years.

📌 Analysts remain bullish on both stocks, with D-Wave offering a 31% upside and Rigetti having already exceeded some targets.

Final Thought

Quantum computing is one of the most exciting and transformative fields in technology, but investing in early-stage companies requires patience and a high-risk tolerance. While D-Wave and Rigetti have shown significant stock gains, they remain unprofitable as they focus on R&D and commercialization. Long-term investors may find these stocks attractive as part of a diversified, high-growth portfolio.

Sources:

🔗 (Main) Barchart – Quantum Stocks Report

🔗 InvestorPlace – Quantum Computing Stocks

🔗 MarketWatch – Quantum Industry Outlook

🔗 Yahoo Finance – D-Wave & Rigetti Updates

Related:

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.