Global stock markets rebounded sharply to close the week on a high note after strong earnings forecasts from major tech companies eased investor concerns over the impact of Chinese AI startup DeepSeek’s disruptive model.

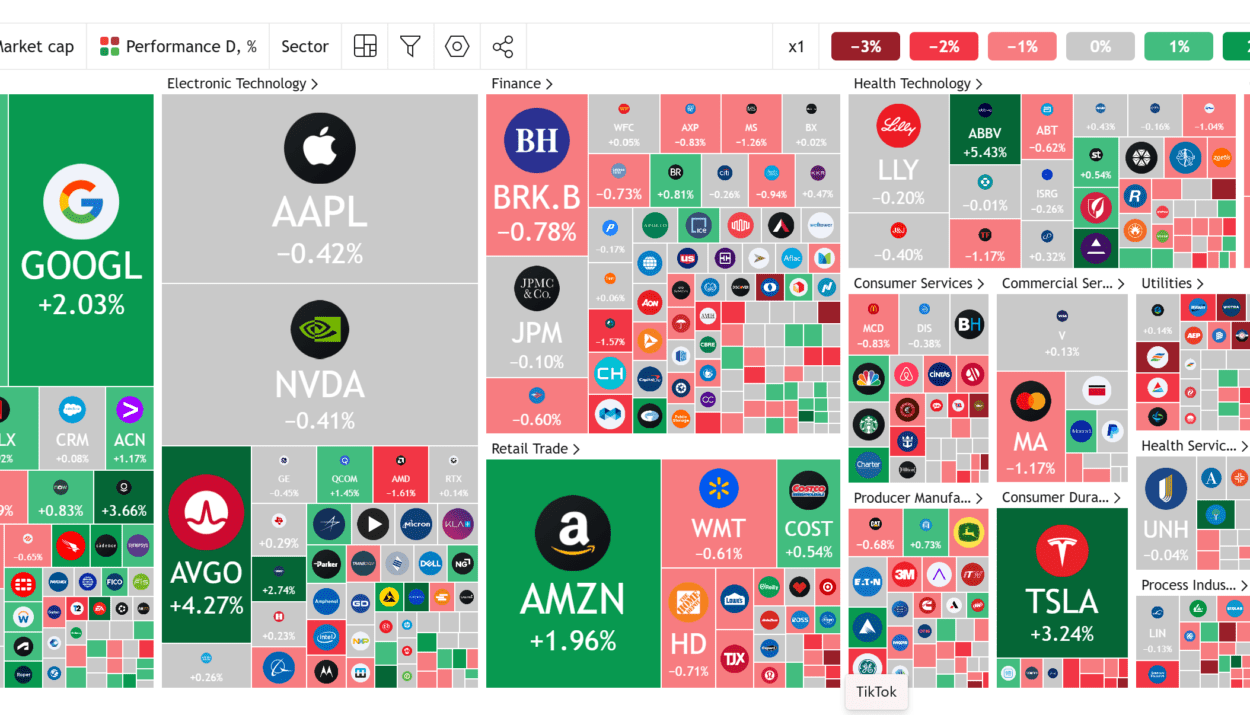

The S&P 500 erased its earlier losses from the DeepSeek-driven selloff and ended the week up 0.7%, while the Nasdaq 100 surged 1.4%, regaining momentum. Tech stocks that had been battered earlier this week bounced back, with Apple Inc. issuing a reassuring revenue forecast and Meta Platforms Inc. recording its longest winning streak since 2015. Nvidia Corp. CEO Jensen Huang was also scheduled to meet with President Donald Trump to discuss AI developments, adding to renewed optimism in the sector.

Why Stocks Rose Again After DeepSeek Shock

- Tech Earnings Boost Confidence

The market was initially rattled by fears that DeepSeek’s low-cost AI model could disrupt the profitability of U.S. tech giants. However, earnings from Apple, Meta, and Intel calmed investors by showing continued strength in demand for AI and cloud computing services. - Federal Reserve’s Inflation Gauge Provides Relief

The Fed’s preferred inflation measure came in as expected, reinforcing hopes that interest rates will remain stable. Although inflation is still above the 2% target, the market took comfort in the fact that there were no negative surprises. - Stronger Market Sentiment and Institutional Support

Despite a volatile week, major investment firms remained optimistic. Bank of America strategist Michael Hartnett suggested that U.S. tech stocks could slow down, coining the term “Lagnificent 7” as a warning about overexposure. However, investors continued to pour capital into AI-driven companies, with Nvidia and Apple leading the recovery. - Apple’s Reassuring Outlook

Apple’s holiday-quarter results were weaker than expected, particularly in China, but its revenue forecast for the current quarter was better than feared, helping boost market sentiment. - Oil and Energy Markets Stabilize

Energy giants ExxonMobil and Chevron posted mixed earnings, but Exxon’s strong production growth helped counter concerns over declining oil prices.

Market Performance Summary

- S&P 500: +0.7%

- Nasdaq 100: +1.4%

- Dow Jones: Little changed

- Magnificent Seven Index: +2%

- Bitcoin: +0.8% to $105,867

- Ethereum: +5.3% to $3,417

Key Stock and Corporate Highlights

- Apple Inc. (AAPL): Issued a reassuring forecast, boosting investor confidence.

- Nvidia Corp. (NVDA): CEO Jensen Huang scheduled to meet with President Trump, potentially discussing AI policy.

- Intel Corp. (INTC): Reported better-than-expected revenue, but warned of ongoing challenges.

- Meta Platforms Inc. (META): Extended its winning streak, bolstered by strong AI and ad revenue growth.

- Chevron (CVX) & ExxonMobil (XOM): Mixed earnings, but Exxon’s production growth provided support.

- Walgreens (WBA): Suspended its dividend after 92 years to conserve cash.

Investor Takeaways

- Tech remains the driver of the market, despite DeepSeek’s disruptive entry.

- Inflation worries are moderating, reducing the pressure on the Fed.

- Institutional investors are still betting big on AI, suggesting long-term confidence in the sector.

Conclusion

The sharp rebound in stocks signals that while DeepSeek’s rise introduced new dynamics into the AI market, the broader investment landscape remains resilient. With major tech companies reaffirming strong fundamentals, investors appear to have shaken off their initial concerns and re-focused on earnings and economic growth.

Source:

Yahoo Finance – Asian Stocks Rise as Wall Street Gains on Earnings Optimism

Related articles:

DeepSeek, AI Scaling, and the Case for Stronger US Export Controls

NVIDIA: Is the DeepSeek Sell-Off a Wake-Up Call for AI Bulls?

How DeepSeek and Ozempic Are Disrupting Decarbonization Forecasts

What Is DeepSeek and Why Is It Crashing AI Stocks?

US Investigates Whether DeepSeek Illegally Acquired Nvidia Chips via Singapore Distributors

Alibaba, releases Qwen2.5-Max, AI model that they claim is better than DeepSeek, ChatGPT, and Meta

DeepSeek shows how Trump tariffs doomed to fail

DeepSeek Causes $1 Trillion Drop in Tech Stocks

Why market panic over China’s DeepSeek is ‘overblown,’ analysts say

DeepSeek ban coming soon? White House “looking into” national security implications of it