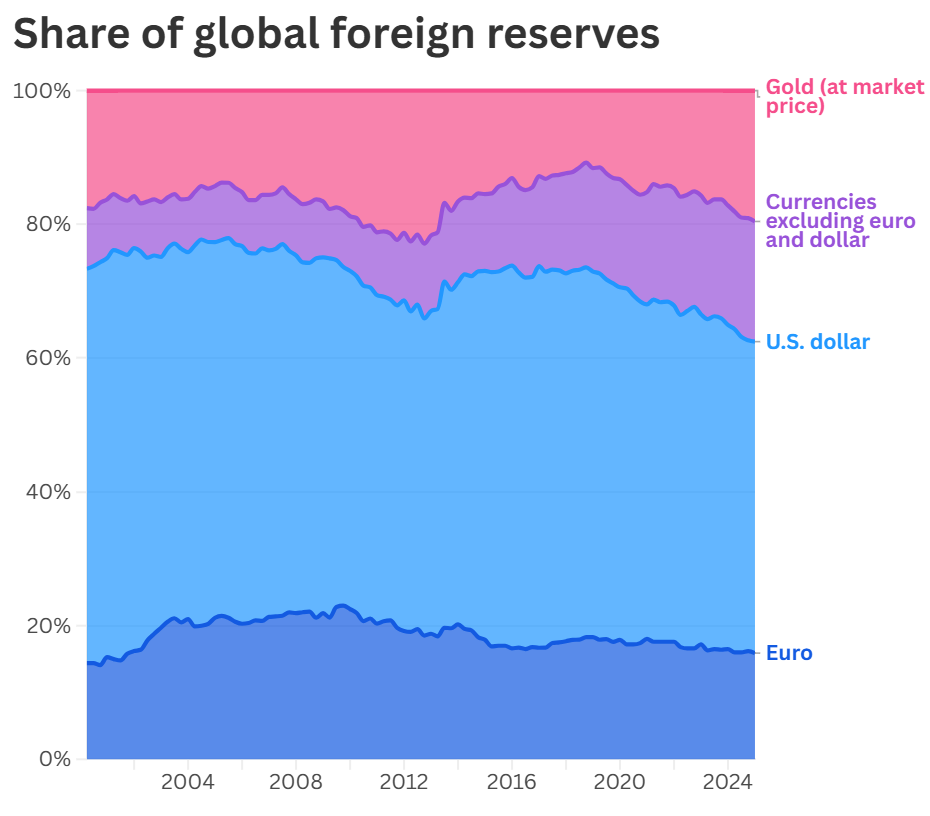

Driven by geopolitical turmoil, inflation fears, and long-term distrust in fiat systems, gold has officially overtaken the euro in 2024 as the second most significant global reserve asset — trailing only the US dollar. But central banks may be nearing their appetite’s peak.

Rise of Gold: From Hedge to Heavyweight

Gold now makes up 20% of global foreign exchange reserves, up from an average of 16.5% in 2023, according to the European Central Bank (ECB). In contrast, the euro’s share has slipped to 16%, solidifying gold’s position as the world’s second-largest reserve asset by market value, behind the US dollar (which holds steady at 46–47%).

This shift marks a historic reversal and places gold at reserve levels not seen since the Bretton Woods era.

“Gold reserves held by central banks stand at levels close to those last seen in the 1960s,” the ECB reported.

The turning point began in 2022, following Russia’s full-scale invasion of Ukraine, which sparked a renewed rush into “safe haven” assets. Paired with high inflation, interest rate hikes, and rising fears of financial sanctions, gold quickly became a strategic reserve for nations navigating turbulent geopolitics.

Why Central Banks Bought So Much Gold

According to surveys conducted by the World Gold Council and ECB, central banks gave three main reasons for accumulating gold:

- Long-term store of value and inflation hedge

- Strong performance during crises

- Portfolio diversification

Additionally, one in four central banks in emerging or developing economies cited fears of future sanctions and “monetary realignment” as major motives — especially China, India, and Turkey, which together added over 600 tonnes of gold to their reserves since 2021.

ECB data also indicates that countries aligned geopolitically with China and Russia have sharply increased their gold holdings since Q4 2021.

Appetite Wanes: Are Central Banks Nearing the Limit?

While 2024 marked record-breaking central bank gold purchases, analysts warn this momentum may not last.

- Gold demand from central banks jumped to 20% of global total (double the 2010s average)

- But Q1 2025 showed a 33% drop in central bank gold buying (World Gold Council data via ING)

- Chinese buying also slowed notably in recent months

“Institutions have played a key role in the gold rally and will probably continue buying gold — but at a slower pace,” said Hamad Hussain, economist at Capital Economics.

Still, the long-term trend favors gold, especially amid persistent geopolitical risk, trade fragmentation, and concerns about the US dollar’s dominance.

“Uncertainty is the new normal. Gold offers stability,” said Janet Mui, CFA, of RBC Brewin Dolphin.

Price Volatility Remains — But So Does Demand

Gold has seen a surge in price, hitting $3,380/oz in June 2025, before dipping slightly on market volatility and shifting US tariff policy. A soft US CPI print this week helped boost gold again, as rate cut hopes resurfaced.

Spot gold is currently trading around $3,360, with US gold futures up over 1%. The weaker US dollar index has also contributed to making gold cheaper for global buyers.

Silver Joining the Rally?

While gold takes the headlines, silver is quietly surging too. Inflows into silver ETFs are nearing historical highs, as investors bet on industrial demand, green tech applications, and a lagging catch-up to gold’s rally.

USD Still King — But For How Long?

Despite gold’s rise, the US dollar still accounts for nearly half of global reserves. But its declining trust as a safe haven is pushing central banks toward greater diversification, including not just gold but also other currencies and digital assets.

“As the US turns inward on trade, it makes sense for others to hedge with alternatives,” said Mui.

Gold’s rise to No. 2 is historic — but whether it maintains that spot depends on:

- Central bank buying trends in 2025–2026

- Global inflation and rate outlook

- Further geopolitical shocks

- US fiscal policy and dollar strength

For now, gold sits at the top of its modern era — a timeless asset that has once again proven its relevance in the age of currency wars and global fragmentation.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump-Musk Feud Last Phase: Tesla WON

Washington Starts to ‘De-Musk’: 5 Stocks Poised to Gain From the Shift

Trump says relationship with Musk is over and threatens him

Elon Musk Empire Under Fire: What Trump’s Revenge Could Mean for Tesla and SpaceX

“You Mean Man Who Lost His Mind?” — Trump Slams Door on Musk

Timeline of Elon Musk and Donald Trump “Break Up”

Why Trump Can’t Just Quit Elon Musk — Even After Their Public Breakup