It’s shaping up to be a week that markets and policymakers can’t afford to ignore. With key inflation data just ahead of the Fed’s policy decision, a flurry of tech events set to rock sentiment, and diplomatic activity ramping up amid global tensions, both economic and geopolitical forces are in play. Volatility is expected, and the tone of the week could redefine expectations for rate policy and global stability.

What to watch this week:

1. Inflation in Focus Ahead of Fed

The U.S. August Consumer Price Index (CPI)—due to be released on Thursday, is the final major data point before the Fed meets on September 16–17. Economists forecast a 0.3% monthly increase, bringing the annual inflation rate to 2.9%. Core CPI is expected to match July’s 3.1% rise. A mild CPI print could open the door to a 50 basis-point rate cut, while a hotter-than-expected result could temper market optimism.

2. Tech Spotlight: iPhone 17 & Investor Presentations

Tech will set the tone this week. Apple unveils the iPhone 17 Tuesday, including a thin “Air” model and upgraded Pro versions—an event that always ripples across suppliers and rivals. At the same time, the Goldman Sachs Tech Conference is offering Wall Street a direct line into AI spending trends.

Goldman Sachs Tech Conference:

- Monday: Presentations by Nvidia and AMD

- Tuesday: Meta and Broadcom

- Wednesday: Microsoft

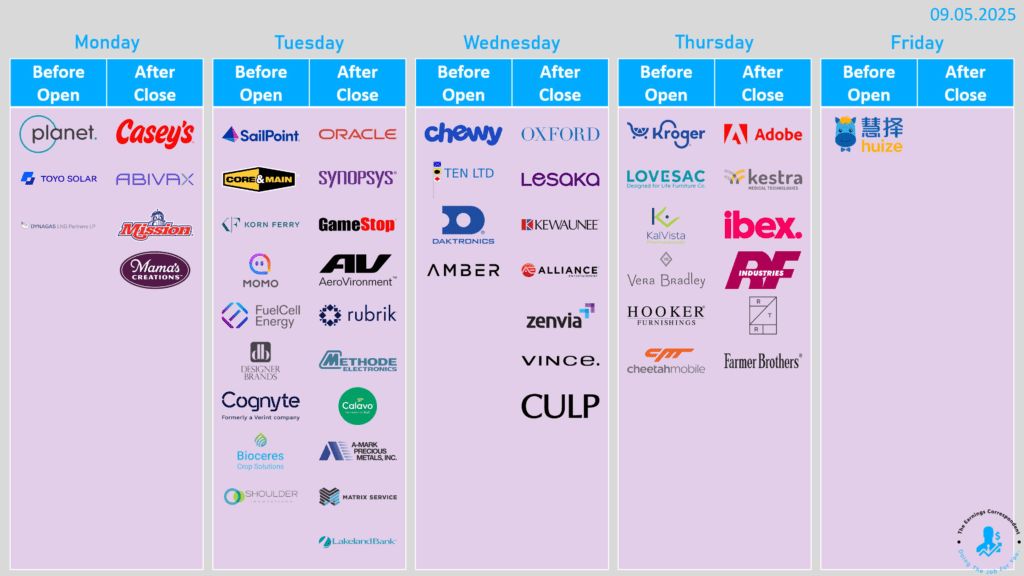

3. Earnings: Cloud, AI, and Meme Stocks

This week’s earnings calendar is light but important. Oracle reports Tuesday, with investors focused on cloud momentum and AI deal flow. Adobe and Kroger on Thursday will give fresh reads on consumer spending and whether Adobe’s AI tools are gaining traction. Meanwhile, GameStop reports Tuesday, testing whether the meme stock still has staying power amid shaky fundamentals.

| Day | Before Open | After Close |

|---|---|---|

| Monday | Planet Labs (PL), Toyo Solar, Dynagas LNG Partners LP (DLNG), Mission Produce (AVO), Mama’s Creations (MAMA) | Casey’s General Stores (CASY), Abivax (ABVX) |

| Tuesday | SailPoint (SAIL), Core & Main (CNM), Korn Ferry (KFY), Momo (MOMO), FuelCell Energy (FCEL), Designer Brands (DBI), Cognyte Software (CGNT), Bioceres Crop Solutions (BIOX), Shoulder Innovations, Lakeland Bancorp (LBAI) | Oracle (ORCL), Synopsys (SNPS), GameStop (GME), AeroVironment (AVAV), Rubrik (RBRK), Methode Electronics (MEI), Calavo Growers (CVGW), A-Mark Precious Metals (AMRK), Matrix Service Company (MTRX) |

| Wednesday | Chewy (CHWY), TEN Ltd (TEN), Daktronics (DAKT), Amber Enterprises, Alliance Entertainment (AENT) | Oxford Industries (OXM), Lesaka Technologies (LSAK), Kewaunee Scientific (KEQU), Zenvia Inc. (ZENV), Vince Holding (VNCE), Culp Inc. (CULP) |

| Thursday | Kroger (KR), Lovesac (LOVE), KalVista Pharmaceuticals (KALV), Vera Bradley (VRA), Hooker Furnishings (HOFT) | Adobe (ADBE), Kestra Medical Technologies, Ibex Limited (IBEX), RF Industries (RFIL), Rent the Runway (RENT), Cheetah Mobile (CMCM), Farmer Brothers (FARM) |

| Friday | Huize Holding (HUIZ) | — |

4. Geopolitical Watch: Europe in Washington, Trump to Speak to Putin

President Trump announced European leaders will visit the U.S. on Monday and Tuesday to address the Ukraine conflict, and he also plans to speak with Putin shortly. This could influence defense policy, sanctions, and risk appetite across global markets.

5. Strategic Market Considerations

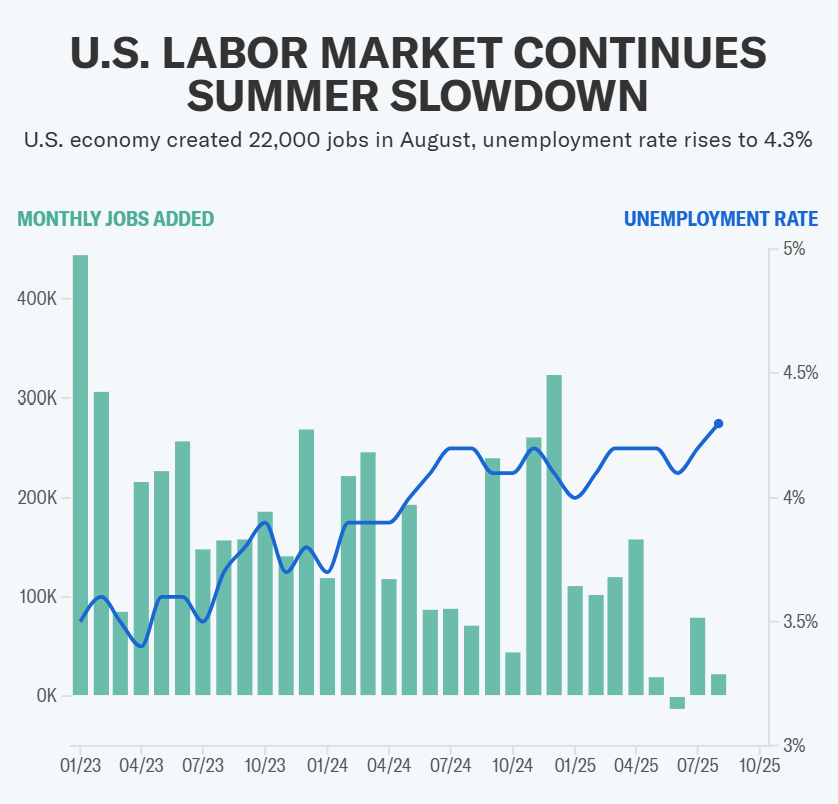

Despite weak job data, markets still expect a rate cut—with a 25 bp move nearly fully priced in. Some are even betting on 50 bp.

Elevated equity valuations mean even minor surprises—like persistent inflation or geopolitical shocks—could ripple across markets.

Event Calendar: This Week at a Glance

| Day | Economic Events | Earnings / Events |

|---|---|---|

| Mon | Consumer Credit (July) | Nvidia, AMD speak at Goldman conference |

| Tue | NFIB Small Business (August) | Apple iPhone 17 launch; Oracle; Meta, Broadcom speak at Goldman |

| Wed | PPI (Aug); Wholesale Inventories (July) | Microsoft speaks at Goldman; Chewy earnings |

| Thu | CPI & Core CPI (Aug); Jobless Claims; Fed Budget | Adobe; Kroger earning reports |

| Fri | Univ. of Michigan Sentiment (Sept Preliminary) | — |

Weekly Highlights

| Theme | Why It Matters |

|---|---|

| Inflation & Fed Policy | CPI sets tone for potential July monetary easing |

| Tech & Earnings Pulse | Signals from Apple, cloud giants, and AI players will guide sentiment |

| Diplomatic Moves | Europe & Putin talks could shift geopolitical risk outlook |

| Market Sentiment | Valuations high, expect sharp responses to data and headlines |

This is a critical juncture for markets—data, diplomacy, and big tech will all be on centre stage.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility