After the S&P 500’s best May in 35 years, investors are heading into a volatile first week of June. Jobs data, Fed speeches, and Trump’s tariff threats could shape what’s next. (More about: Where the Stock Market Stands Now After a Wild Start to the Year)

- S&P 500 rose 6% in May, its biggest May gain since 1990

- Nasdaq surged nearly 10%, while the Dow added 4%

- Tariff volatility, Fed rate talk, and labor data are now in focus

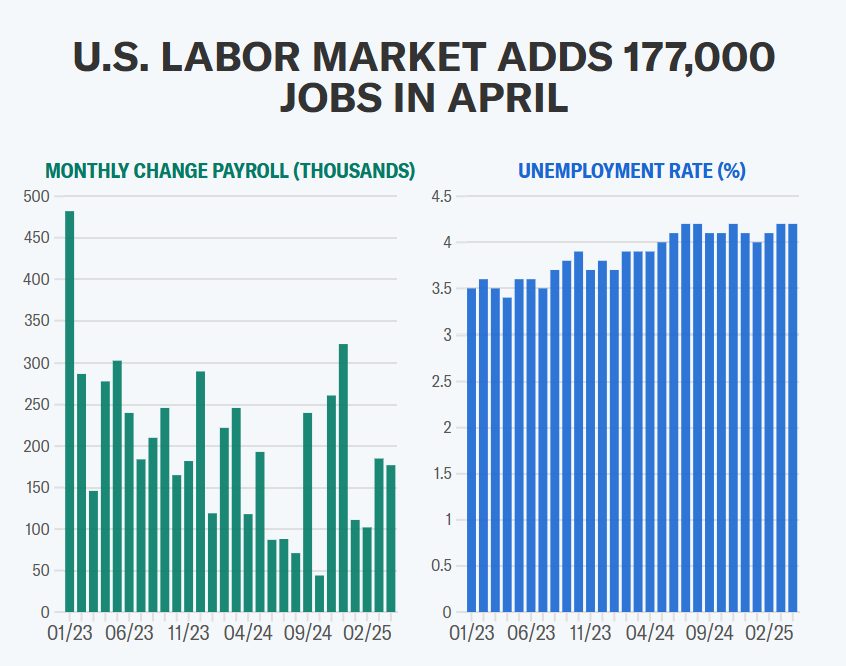

- Jobs report due Friday: 130K jobs expected, unemployment seen steady at 4.2%

Backdrop: A Wild May Sets the Stage

The S&P 500 ended May up more than 6%, buoyed by President Trump’s tariff rollback. The Nasdaq Composite led gains, up nearly 10%, fueled by continued Big Tech momentum. Still, trade policy uncertainty looms, as last week was a rollercoaster for trade policy:

- A US trade court blocked Trump’s sweeping tariffs Wednesday night

- But an appeals court reinstated them within 24 hours, reigniting uncertainty

- On Friday, Trump posted on Truth Social that China has “TOTALLY VIOLATED ITS AGREEMENT WITH US”

- Hours later, Bloomberg reported the US plans to expand tech sanctions on China, further spooking markets

This back-and-forth left Wall Street rattled. Barclays’ Ajay Rajadhyaksha noted, “Investors were hoping tariff issues would be resolved soon — but now it’s clear that uncertainty will drag on.”

Ritholtz strategist Callie Cox summed it up:

“Tariffs aren’t out of the headlines yet. After May’s rally, it makes sense to be cautious.”

All Eyes on Jobs and the Fed

The big test comes Friday, with May’s nonfarm payrolls report expected to show a slowdown to 130,000 jobs, from 177,000 in April. Unemployment is projected to hold at 4.2%.

The Fed will be front and center this week too. Chair Powell, along with regional presidents Logan, Goolsbee, Harker, and Bostic, will deliver remarks as the market watches for any hint of interest rate cuts — especially under pressure from Trump.

Earnings Still Matter: Broadcom, CrowdStrike, Lululemon Lead

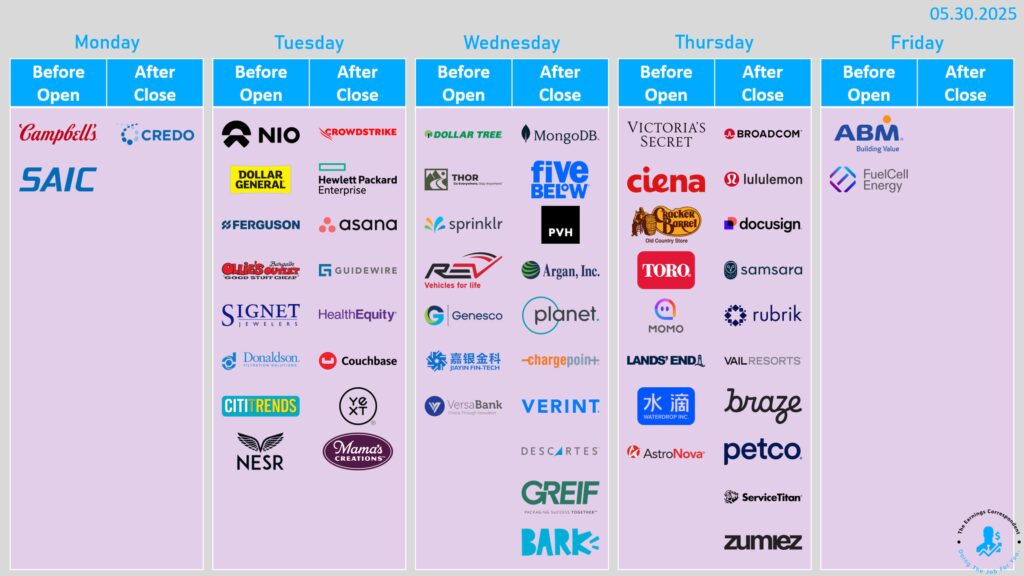

While earnings season is mostly wrapped, a few big names are still on the calendar:

- Broadcom (AVGO) will report Thursday, after Nvidia’s massive AI-fueled blowout

- CrowdStrike (CRWD) reports Tuesday, weeks after announcing layoffs

- Lululemon (LULU), Dollar General (DG), and Hewlett Packard Enterprise (HPE) are also in focus

Retail and software earnings will be key indicators of consumer demand and tech resilience as tariffs and rate uncertainty build.

| Day | Earnings Reports |

|---|---|

| Monday | Campbell’s Company (CPB) |

| Tuesday | Asana (ASAN), CrowdStrike (CRWD), Dollar General (DG), Hewlett Packard Enterprise (HPE), Nio (NIO), Ollie’s (OLLI), Signet Jewelers (SIG) |

| Wednesday | ChargePoint (CHPT), Dollar Tree (DLTR), Five Below (FIVE), MongoDB (MDB) |

| Thursday | Broadcom (AVGO), DocuSign (DOCU), Lululemon (LULU), Cracker Barrel (CBRL), Duluth Trading (DLTH), Land’s End (LE), Petco (WOOF), Rubrik (RBRK), Victoria’s Secret (VSCO) |

| Friday | No notable earnings releases |

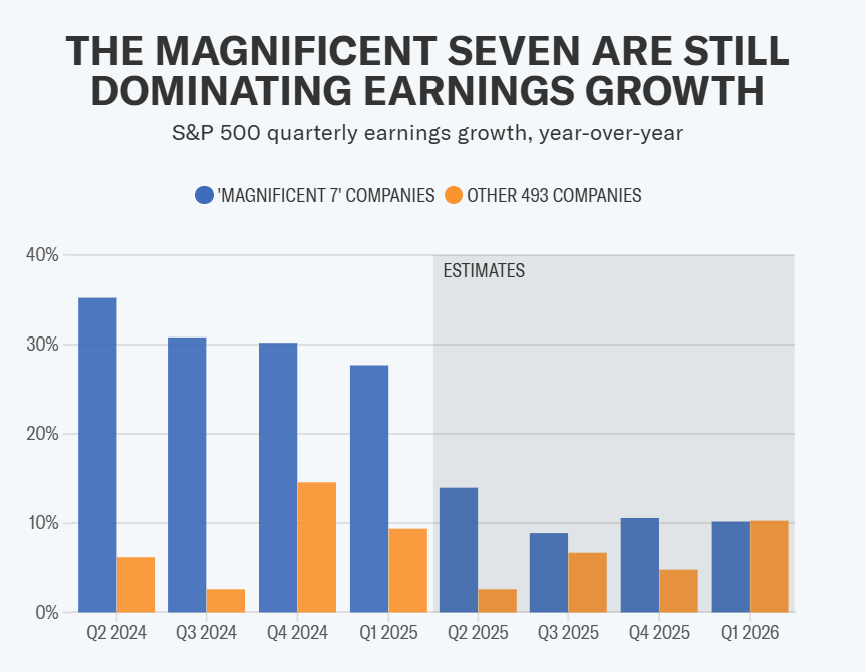

Big Picture: The Magnificent Seven Still Reign

With 98% of the S&P 500 having reported Q1 results, earnings are up 13.3%, led by the “Magnificent Seven” (AAPL, MSFT, NVDA, META, AMZN, GOOGL, TSLA), who saw 27.7% earnings growth year-over-year.

Their performance also crushed estimates by 11.7%, compared to just 4.6% for the rest of the index.

Trump vs the Fed

Trump continues to hammer the Fed on social media, demanding rate cuts. While the Fed remains cautious, tariff-induced inflation risks and still-strong labour data make their path uncertain. Powell and his colleagues’ tone this week will be crucial for market direction.

What’s Ahead This Week: Full Calendar

Check the full Weekly Market Events & Earnings table for detailed day-by-day expectations, including Fed speeches, job data, factory orders, and major corporate earnings.

| Date | Event | Details |

|---|---|---|

| Monday (June 2) | Fed Chair Powell speaks S&P & ISM Manufacturing PMI Construction spending | PMI expected at 52.3; Construction +0.3% expected |

| Tuesday (June 3) | JOLTS job openings Factory Orders Earnings: CrowdStrike, HPE, DG, NIO | Job openings expected at 7.07M; Factory Orders -3.1% expected |

| Wednesday (June 4) | ADP Employment Report ISM Services PMI Fed Beige Book Earnings: Dollar Tree, Five Below, MongoDB | ADP jobs +110K expected; Services PMI ~52 |

| Thursday (June 5) | Initial Jobless Claims Trade Deficit Nonfarm Productivity (Q1 final) Earnings: Broadcom, Lululemon, DocuSign | Productivity -0.8%; Jobless claims 240K |

| Friday (June 6) | Nonfarm Payrolls Unemployment Rate Wage Data Consumer Credit | Payrolls +130K expected; Wages +0.3% MoM, +3.7% YoY |

After a euphoric May rally, investors are now facing a trifecta of risk: job market uncertainty, aggressive trade policies, and central bank indecision. Buckle up — June might not be so kind.