At first glance, Trump’s new tax-and-spending mega-package looks like business as usual. But buried deep in the fine print is Section 899 — a clause that’s fast becoming one of the most controversial ideas on Capitol Hill.

Nicknamed the “revenge tax,” it gives the US Treasury power to slap an escalating tax (5%–20%) on foreign entities based in countries that impose “unfair foreign taxes” on US businesses.

What counts as unfair?

• Digital services taxes (like those used in the UK, France, and Italy)

• The Undertaxed Profits Rule (a key part of the global minimum tax deal)

• Any foreign tax that “disproportionately targets US firms”

Why Wall Street’s nervous

Section 899 came as a shock. Most analysts didn’t see it coming — and the reaction has been sharp.

“It threatens to further alienate foreign investors,” said Max Yoeli from Chatham House.

The Investment Company Institute warned it could reduce cross-border investment and ultimately harm American savers and retirement funds.

Even Ernst & Young flagged serious risks:

• Hedge funds, private equity, and trusts could face double or triple taxation

• Passive income like interest and dividends may face a 50% tax rate

• Foreign firms may avoid expanding in the US altogether

Global pushback: UK and Europe in the crosshairs

If passed, the revenge tax would apply to companies from almost all of Europe, including America’s closest trading partners. The UK, in particular, is exposed due to its digital services tax and 30% US revenue share across the FTSE 100.

Goldman Sachs says UK companies like Pearson, Experian, and Rentokil could be hit — unless they shift their stock listings or legal HQs to the US.

“This reinforces the strategic case for redomiciling in New York,” Goldman analysts noted.

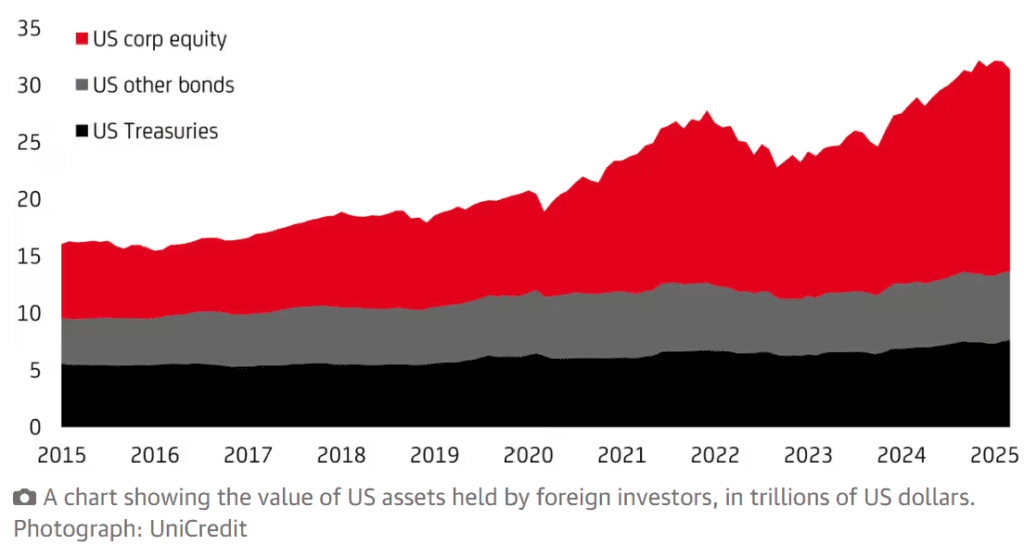

European banks like UniCredit also warned the move could harm confidence in the US dollar — especially if countries retaliate or pull investments.

Economic blowback: jobs, GDP, and US credibility at risk

According to the Global Business Alliance, Section 899 could:

• Kill 360,000 American jobs

• Shave off $55 billion per year in GDP

• Target investments that fuel US manufacturing and services

“The real victims are American workers,” said GBA CEO Jonathan Samford.

At NYU, the Tax Law Center warned the clause could backfire by encouraging tax havens, instead of discouraging them.

“It’s a political game of chicken — and US workers and consumers could pay the price,” said Director Chye-Ching Huang.

So why is it in the bill?

House Republicans say Section 899 is a negotiating tool, not a weapon — meant to pressure other countries to change their tax codes.

“If these countries withdraw these taxes and decide to behave, we will have achieved our goal,” said Rep. Jason Smith (R-Mo.), who led the effort.

The Joint Committee on Taxation estimates the measure could raise $116 billion over a decade, helping offset Trump’s other tax cuts. But analysts note it may cause long-term damage to capital inflows.

Could it become law?

The House passed Trump’s full package. The Senate is now debating it, with a decision expected before July 4. Foreign governments are watching closely — and many may retaliate if Section 899 is enacted.

Even Deutsche Bank’s FX team has weighed in, warning the US could be on the verge of turning its trade war into a capital war.

“Section 899 allows the US to weaponize foreign holdings of US assets,” they said.

What started as a clause to punish bad tax behaviour abroad may become a bigger threat to US markets than anyone expected — and investors are paying close attention.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What the Israel-Iran War Means for Oil Prices

2025 Stock Rally Isn’t Just About Magnificent 7 Anymore

Trump Says Israel Attack ‘Great for Market’ as Stocks Plunge, Oil Soars After Iran Retaliation

10 Reasons China Is Leading the Robot Race

Trump Unloads on EV Mandates, Talks Musk, Tariffs, and National Guard: Here’s What He Said

Why gold beat Euro to become world’s second-largest reserve asset

Trump-Musk Feud Last Phase: Tesla WON

Washington Starts to ‘De-Musk’: 5 Stocks Poised to Gain From the Shift