GameStop Corp. (NYSE: GME) is scheduled to release its fourth-quarter fiscal year 2024 earnings today, March 25, 2025, after market close. As a prominent video game retailer, GameStop’s earnings report is highly anticipated by investors, analysts, and the broader retail sector, especially given the company’s recent stock volatility and strategic shifts.

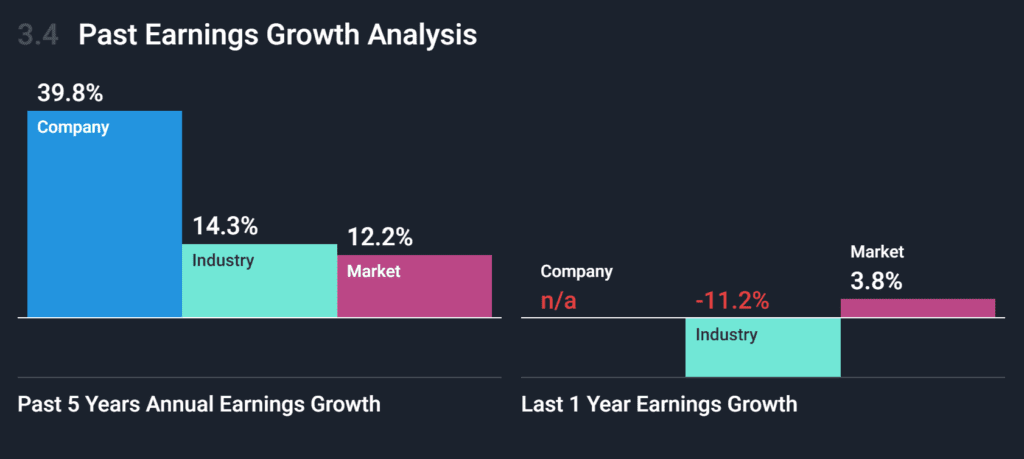

Over the past year, GameStop’s stock has experienced significant fluctuations, influenced by retail investor interest and broader market dynamics. The stock has risen approximately 69% over the past year but has declined 18% year-to-date in 2025.

Key Predictions for GameStop’s Q4 Performance

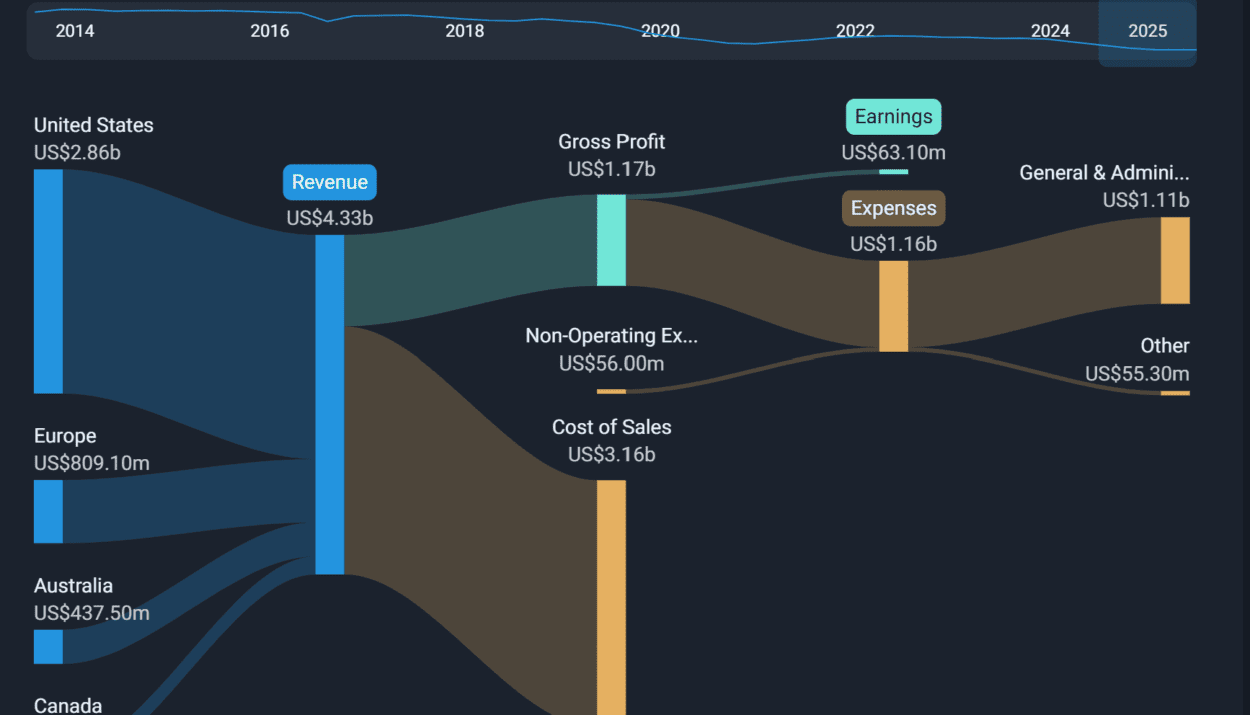

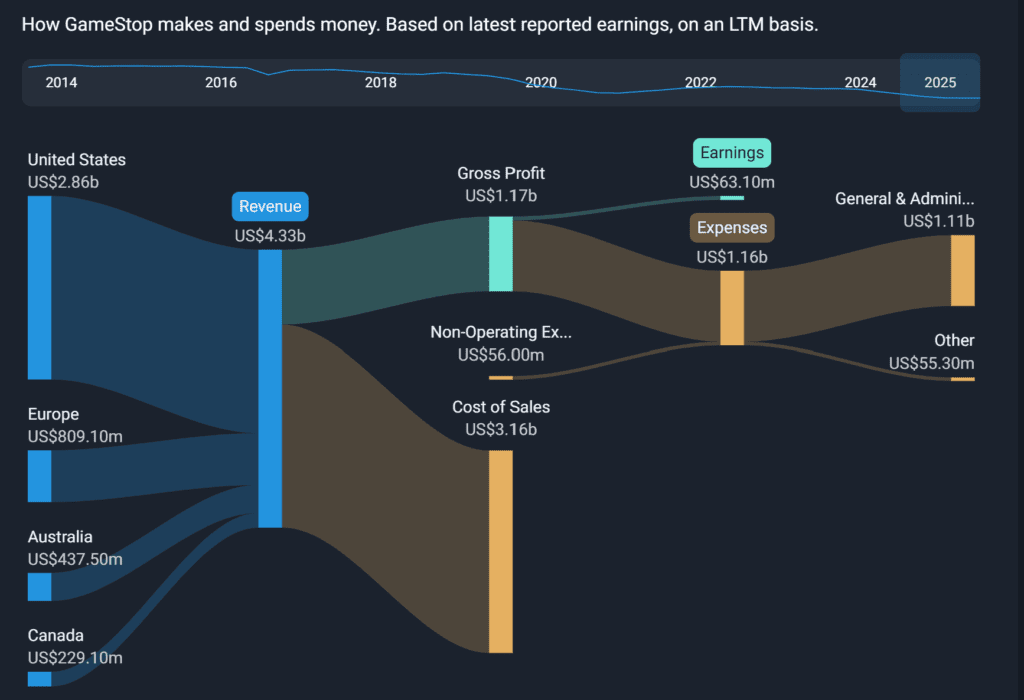

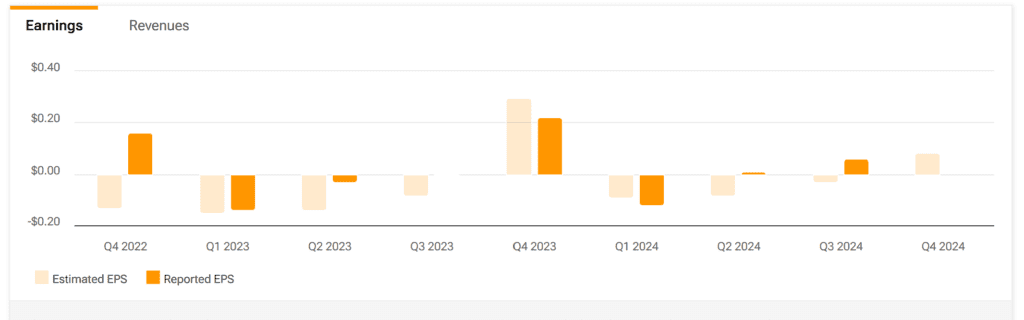

- Revenue and Earnings Expectations Analysts anticipate a decline in both revenue and earnings for the quarter:

- Revenue Estimate: $1.48 billion, a decrease of approximately 18% year-over-year. Earnings Per Share (EPS) Estimate: $0.08, down from $0.22 in the same quarter last year.

- Analyst Ratings and Price Targets The consensus among analysts is bearish:

- Average Rating: Sell. Average Target Price: $10.00, suggesting a potential downside from current levels.

- Strategic Considerations and Market Speculation Investors are keenly watching for updates on GameStop’s strategic initiatives:

- Cryptocurrency Investments: Speculation has arisen regarding GameStop’s potential investment in Bitcoin, following CEO Ryan Cohen’s interactions with prominent figures in the cryptocurrency space. Any confirmation or denial of such investments could significantly impact investor sentiment.

- Cost-Saving Measures: The company’s efforts to streamline operations, including potential store closures and asset optimization, are expected to be discussed, providing insights into future profitability strategies.

Market Reaction and Volatility

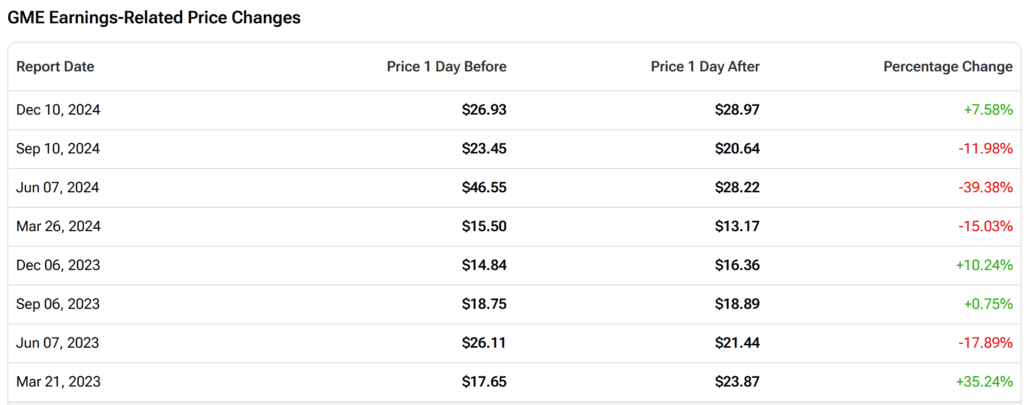

Given the high level of interest and the stock’s history of volatility, significant price movements could occur post-earnings:

- Implied Volatility: Options markets are pricing in a potential 10% move in the stock price following the earnings release.

- Technical Levels: Key resistance levels to watch are $29 and $32, with support levels at $22 and $20, which could come into play depending on the earnings outcome and guidance provided.

Final Take: Caution Advised

While GameStop remains a focal point for retail investors, the upcoming earnings report is expected to reflect the challenges facing its traditional business model. Analysts recommend caution, emphasizing the need for a clear strategic direction to navigate the evolving retail and gaming landscape.

Investors should closely monitor the earnings release and subsequent management commentary to assess GameStop’s plans for adaptation and growth in a rapidly changing market environment.

Disclosure: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with a financial advisor before making investment decisions.

Related: How Roaring Kitty’s wealth went from $53,000 to nearly $300 million – could one day top $1 billion