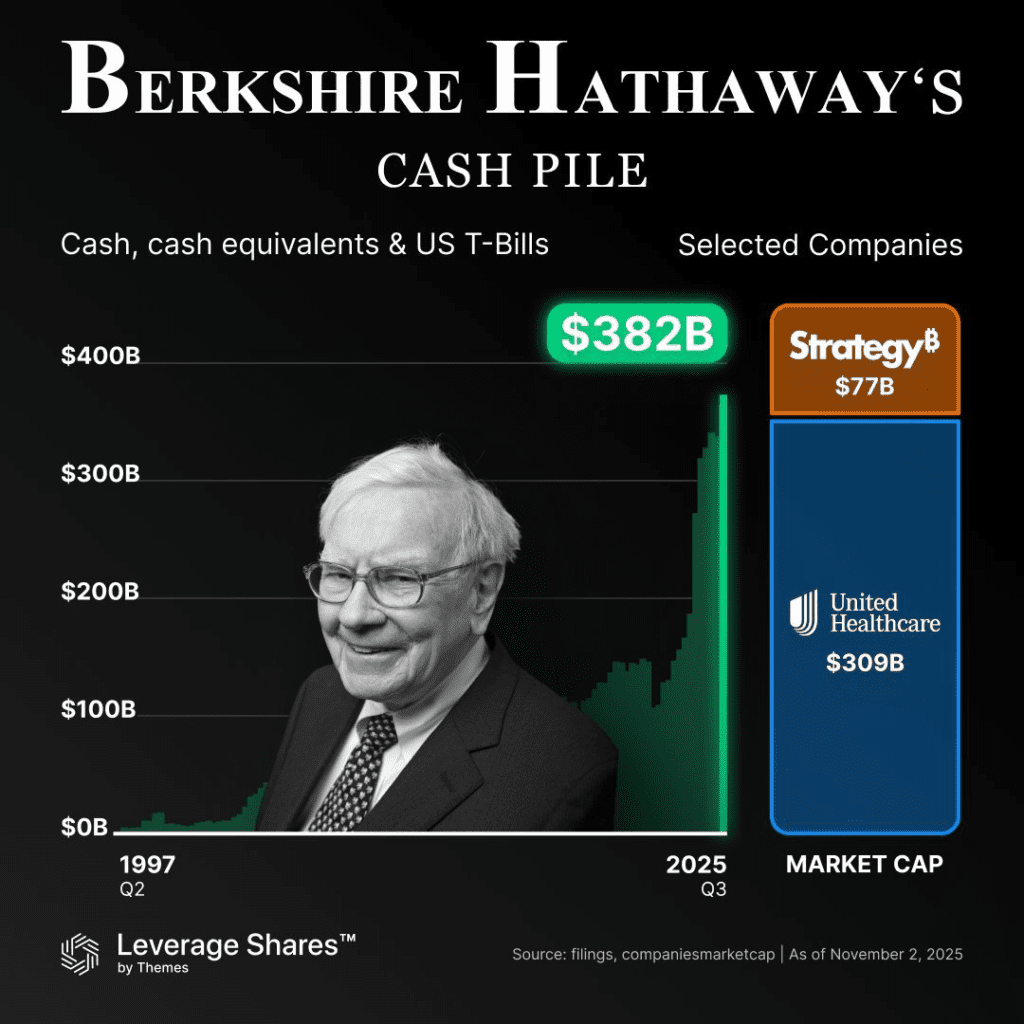

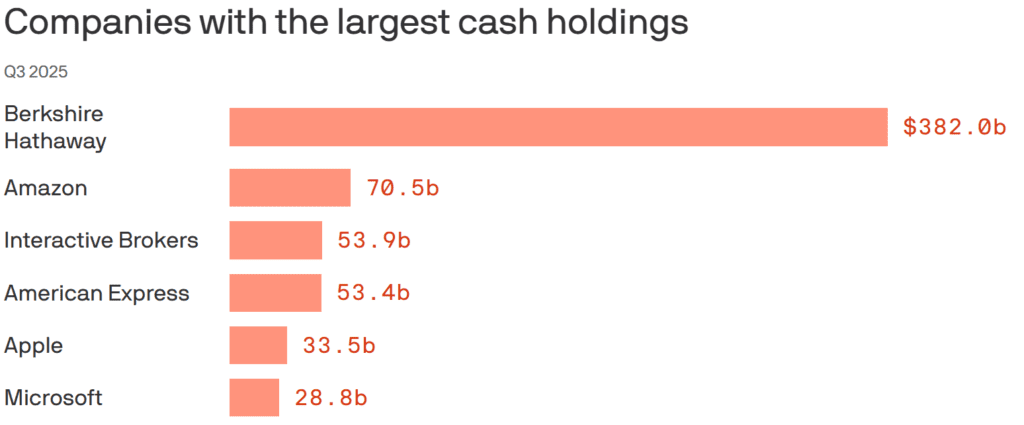

Warren Buffett’s Berkshire Hathaway has amassed a record $382 billion in cash, more than the combined reserves of Apple, Microsoft, and Alphabet, giving incoming CEO Greg Abel unprecedented financial firepower when he takes over in 2026.

Berkshire’s third-quarter earnings surged 34% year-over-year to $13.5 billion, driven by a 200% rise in insurance underwriting income. Yet, Buffett continues to sell more stocks than he buys, unloading $12.5 billion in equities while purchasing just $6.4 billion, marking his 12th straight quarter as a net seller.

Analysts see Buffett’s caution as a warning sign. With T-bills yielding above 5%, Berkshire is opting for safety while Big Tech piles on debt to fund the AI spending boom. “Buffett is obviously put off by current market valuations,” said Jonathan Owen of TwentyFour Asset Management.

Despite the massive liquidity, Berkshire has not repurchased its own shares for five straight quarters — signaling Buffett may be bracing for a market downturn or economic slowdown before deploying cash.

Even as he steps down as CEO this year, Buffett’s philosophy remains clear: long-term bets on quality. Berkshire’s two never-sold holdings, American Express (AXP) and Coca-Cola (KO), remain portfolio cornerstones.

Both stocks delivered solid Q3 results — AXP with 19% EPS growth, and KO with robust 11% gains in 2025, reflecting Buffett’s enduring belief in enduring brands and steady dividends.

While Wall Street chases the AI boom, Buffett is hoarding cash — waiting patiently for value to return. As one analyst put it: “In a market obsessed with spending, Berkshire’s edge is that it doesn’t have to.”