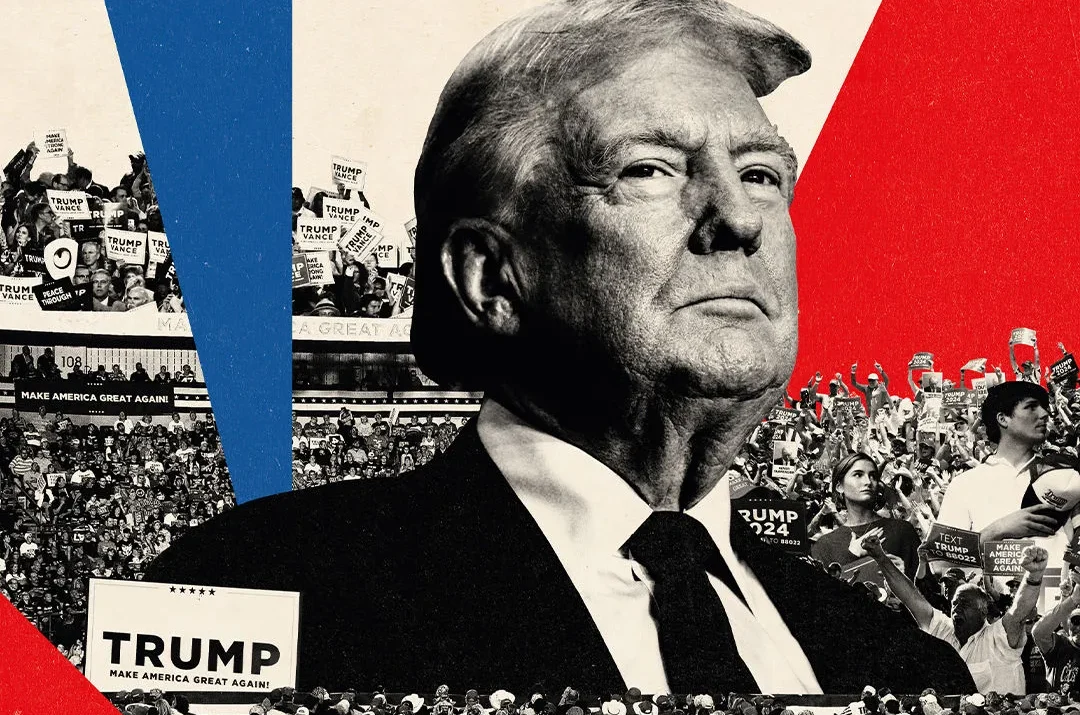

Donald Trump reelection has sparked a significant rally in the U.S. stock market, driven by investor enthusiasm for potential tax cuts and deregulation. The Dow Jones reached an all-time high, and sectors like banking and private prisons are seeing substantial gains due to anticipated policy changes under Trump. However, the bond market is showing signs of concern, with rising Treasury rates hinting at worries about the national debt and inflation.

- Stock Market Surge: Following Trump’s victory, the Dow Jones Industrial Average surpassed 44,000, and the S&P 500 recorded its third-best presidential election week since 1928.

- Sector Gains: Expectations of reduced regulations have particularly benefited big banks and private prison stocks, the latter buoyed by prospects of increased deportations.

- Crypto Enthusiasm: Cryptocurrencies are also booming, with Trump’s shift from scepticism to support further energizing the market.

- Bond Market Jitters: The bond market, however, is nervous about the potential economic impact of Trump’s policies, with Treasury rates spiking and concerns over the sustainability of tax cuts and protectionist measures.

- National Debt Worries: Trump’s proposed policies could significantly increase the national debt, with estimates suggesting an addition of $7.75 trillion over the next decade.

- Inflation Fears: Economists are worried about inflation due to Trump’s proposed tariffs and other policies that might increase prices for consumers.

While the stock market is currently thriving on the back of what is seen as a pro-business presidential agenda, the underlying concerns in the bond market about fiscal discipline and inflationary pressures suggest that the euphoria might be tempered as realities of governance and economic management set in.