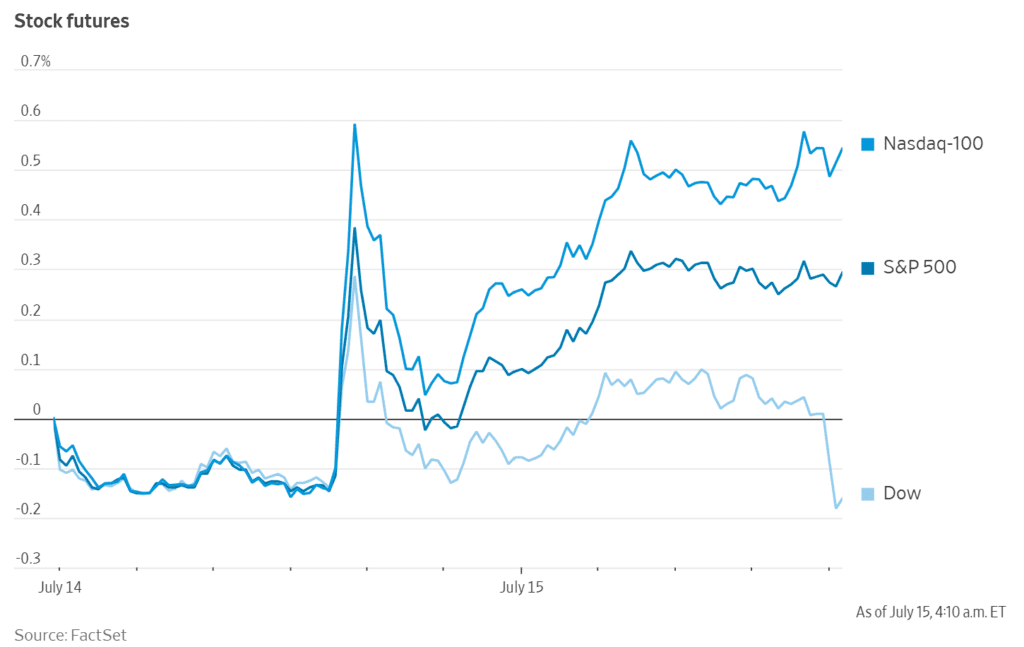

US equity futures edged higher overnight, shrugging off another burst of tariff rhetoric from President Donald Trump as investors positioned for two potential market movers: a June inflation print that should show the first real bite from import levies, and a volley of results from the nation’s biggest banks that will set the tone for second‑quarter earnings.

The early green tint followed a muted Monday cash session in which stocks recovered after Trump told reporters his 30 % tariff letters to the European Union and Mexico were merely “the start of negotiations.” Even so, the president doubled down on a threat to slap 100 % “secondary” tariffs on Russia—and on countries that continue buying its oil—if Moscow fails to strike a cease‑fire deal within 50 days. The White House later clarified the pledge would combine duties on Russian goods with financial sanctions on their buyers.

Futures Snapshot

| Contract (Sep) | Level | Chg % |

|---|---|---|

| S&P 500 | 6,325 | +0.3 % |

| Nasdaq‑100 | 17,676 | +0.5 % |

| Dow Jones | 39,991 | flat |

| 10‑yr Treasury yield | 4.43 % | +2 bp |

| DXY dollar index | 103.20 | ‑0.1 % |

| Gold (Aug) | $3,370 oz | +0.3 % |

| Bitcoin | $121,200 | ‑1 % |

Inflation in Focus

Economists expect the Consumer Price Index to rise 0.3 % month‑over‑month and 2.4 % year‑over‑year, up from 2.1 % in May. Core CPI is seen at 3 %. A hotter‑than‑expected reading could reinforce the Federal Reserve’s reluctance to cut interest rates at its July 31 meeting, though futures still price a 60 % chance of a reduction in September.

Trump, who has repeatedly called for “rocket‑fuel” stimulus, escalated his criticism Monday: “We have no inflation — rates should be below 1 %. Powell’s a knucklehead.” The remarks came as Fed Chair Jerome Powell asked the central bank’s inspector general to review cost overruns on a $2.5 billion headquarters renovation, an issue Trump allies have seized upon while exploring whether the president can fire Powell before his term ends next May.

Banks Kick Off Earnings

JPMorgan Chase, Citigroup and Wells Fargo will report before the opening bell, followed by BlackRock, State Street and Bank of New York Mellon. Consensus now calls for S&P 500 profits to grow 5.8 % in Q2, down from 10 % before the April launch of Trump’s trade war. Analysts say the lowered bar could help companies beat estimates, but revenue commentary will be scrutinized for any hint that tariffs are curbing demand or fattening costs.

“Guidance matters more than the headline EPS number,” said Jay Hatfield of Infrastructure Capital Advisors. “If the banks sound upbeat on loan growth and credit quality, investors will breathe easier.”

Tech Tailwind from Nvidia

Global sentiment got a lift after Nvidia secured US approval to resume shipping its pared‑down H20 artificial‑intelligence chips to China. Asian semiconductor stocks rallied, and Nasdaq 100 futures gained 0.5 %. The news underscored Washington’s balancing act of restricting Beijing’s access to cutting‑edge AI hardware while avoiding a full‑blown supply‑chain rupture.

Pentagon Spends Big on AI

Separately, the Department of Defense said it will award contracts worth “up to $200 million each” to OpenAI, Elon Musk’s xAI, Alphabet’s Google and Anthropic to accelerate the adoption of generative AI across military and government systems. The move follows Defense Secretary Pete Hegseth’s directive last week to “unleash” drone innovation by slashing red tape and treating small unmanned systems as “consumables, not durable assets.”

Dollar Drift Hits Europe Inc.

Across the Atlantic, the euro’s 13 % surge versus the dollar this year is emerging as an earnings headwind. Bloomberg calculations show currency translation could shave several percentage points from large‑cap European profit growth; the Stoxx 600 technology sub‑index nonetheless led Tuesday’s modest advance.

Commodity & Energy Rundown

- Oil: WTI slipped below $83 as traders judged Trump’s Russia threat unlikely to dent near‑term crude flows to India or China.

- Gas: European TTF futures dipped to €35/MWh amid similar skepticism.

- Gold: Up for a second day after Monday’s dip; analysts say the metal could retest April’s record if tariff talks stall.

- LNG: Venture Global began producing from Phase 2 of its Plaquemines export plant, giving the private firm greater exposure to spot prices.

Notable Stock Movers (pre‑market)

- Meta Platforms +0.9 % — Zuckerberg promises “hundreds of billions” in AI compute, unveils 5 GW “Hyperion” cluster for 2027.

- Waters (WAT) ‑11 % — to merge with BD’s diagnostics unit in a $17.5 bn Reverse Morris Trust.

- Mastercard (MA) +1.2 % — Seaport Global upgrades to Buy, PT $616.

- Rocket Lab (RKLB) +4.5 % — Citi lifts PT to $50 on long‑term Neutron launch revenue.

- Open‑AI siblings: Microsoft, Alphabet, Palantir firmer on Pentagon AI contracts.

- Chinese lithium miners (Tianqi, Ganfeng) sank up to 11 % in Hong Kong after profit warnings.

Today’s Key Events (all times ET)

- 08:30 – US CPI / Core CPI

- 08:30 – Canada CPI

- Pre‑mkt – Earnings: JPM, C, WFC, BLK, BK, STT

- 09:00 – Fed Govs. Bowman, Logan speak

- 12:00 – Trump meets EU officials on tariffs (tentative)

- 14:00 – India‑US trade‑deal working session (source)

- After‑mkt – IBM, United Airlines, UnitedHealth Group deliver results Wednesday.

Markets have grown conditioned to tariff headlines, but today’s data and bank commentary will reveal whether the real‑world cost is finally finding its way into prices and profits. A tame CPI and resilient bank guidance could extend the rally that just delivered another record Nasdaq close. A surprise spike in inflation or gloomier tone from JPMorgan & Co. would test the market’s summer calm — and give the Fed yet another dilemma as political pressure mounts.