Markets struggled to find direction Tuesday as President Trump delivered his firmest-yet-but-maybe-not-really warning that his sweeping new tariffs will take effect August 1, with no extensions. Investors, weary from months of reversals, stood still as they awaited either a deal frenzy or another about-face.

- S&P 500 eked out a 0.02% gain, while the Nasdaq rose just 0.03%. The Dow slipped 0.13%, continuing a cautious week after Monday’s steep losses.

- Trump reaffirmed that letters sent to 14 countries imposing 25%–40% tariffs were “final.” But as Forbes noted, this marks at least the 28th time he’s changed course since April’s “Liberation Day” tariff rollout. Wall Street’s nickname? “TACO Trump” – Trump Always Chickens Out.

- Traders are torn between two outcomes: one where negotiations lead to vague victories, or another last-minute extension masked as ‘firm diplomacy.’

Amazon Feels the Tariff Pinch

Amazon shares dropped around 2% on the launch day of Prime Day, as concerns mounted that tariffs would drive up product prices. Adobe estimates US retailers will bring in $23.8 billion in sales during the four-day event, but a growing share of Gen Z shoppers say they’ll skip the sale due to cost pressures.

Global Trade Tension Rises

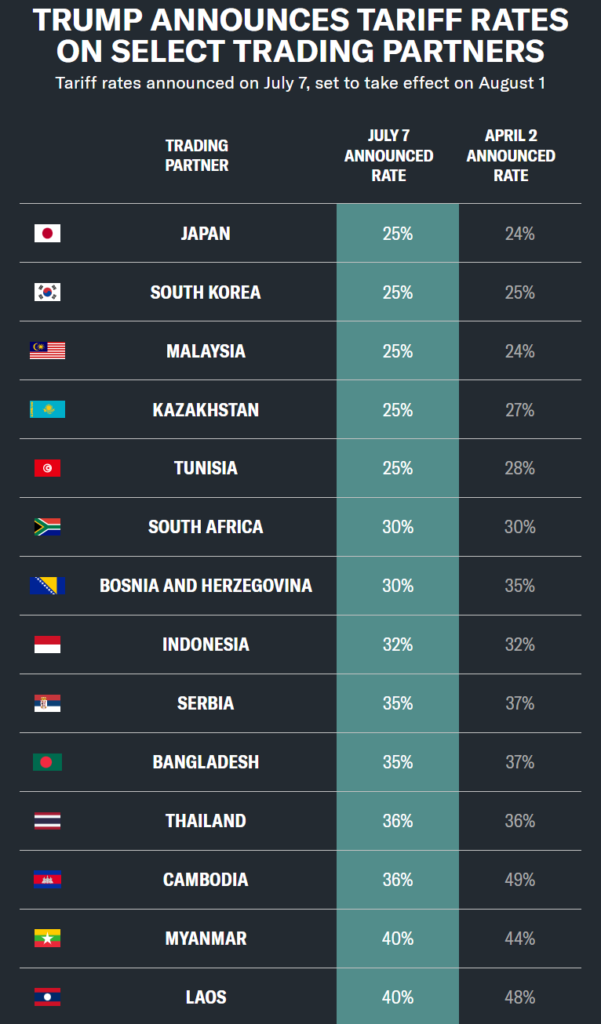

The White House confirmed letters were sent to trading partners from Japan and South Korea to Bangladesh, Indonesia, and Tunisia, warning of punitive tariffs unless deals are signed. Trump also threatened a flat 10% tariff on BRICS nations (including India, Brazil, and South Africa), citing their “anti-dollar agenda.”

While Vietnam and the UK have already reached partial deals, India and the EU are in the hot seat. Bloomberg reports a EU deal could be imminent, possibly locking in a 10% rate with select sector carveouts.

Meanwhile, China fired back, warning it will retaliate against countries that exclude it from supply chains. After a brief honeymoon period following a vague US-China trade framework last month, the tone has turned frosty again.

“One conclusion is abundantly clear,” China’s People’s Daily wrote: “Dialogue and cooperation are the only correct path.”

| Country | Tariff Rate | Key Exports to US | Response |

|---|---|---|---|

| Myanmar | 40% | Clothing, leather goods, seafood | Gov’t will follow up with negotiations |

| Laos | 40% | Shoes with textile uppers, wood furniture, electronic components, optical fiber | — |

| Cambodia | 36% | Textiles, clothing, shoes, bicycles | Tariff dropped from 49% to 36%; ready to negotiate |

| Thailand | 36% | Computer parts, rubber products, gemstones | Submitted new proposal; pushing for negotiations |

| Bangladesh | 35% | Clothing | Hopes to negotiate; worried about competitiveness |

| Serbia | 35% | Software and IT services; car tires | — |

| Indonesia | 32% | Palm oil, cocoa butter, semiconductors | — |

| Bosnia and Herzegovina | 30% | Weapons and ammunition | — |

| South Africa | 30% | Platinum, diamonds, vehicles, auto parts | Will continue diplomatic efforts; proposed framework on May 20 |

| Japan | 25% | Autos, auto parts, electronics | Tariff “extremely regrettable”; open to more talks |

| Kazakhstan | 25% | Oil, uranium, ferroalloys, silver | — |

| Malaysia | 25% | Electronics and electrical products | Will pursue talks; cabinet meeting Wednesday |

| South Korea | 25% | Vehicles, machinery, electronics | Will accelerate negotiations before tariff takes effect |

| Tunisia | 25% | Animal and vegetable fats, clothing, fruit and nuts | — |

Markets Watching, Waiting — Again

Despite Trump’s tough rhetoric, Wall Street is betting on more backing down. Goldman Sachs lifted its S&P 500 year-end target to 6,600, citing possible Fed cuts and “investor apathy” toward short-term risks. Bank of America nudged its forecast to 6,300, calling the market’s recent run “meteoric,” even if “hard to justify.”

Fed minutes are due Wednesday, offering more clarity on rate cut timelines. Meanwhile, Tesla rebounded 2.5% after Monday’s plunge, and solar stocks tumbled following Trump’s renewed push to strip clean energy tax credits.

Flip-Flop Central

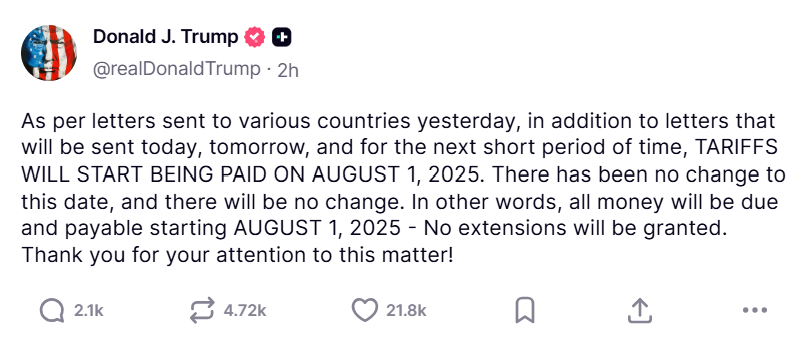

As Forbes exhaustively documented, Trump has reversed course 28 times on tariffs since April — pausing, re-imposing, threatening 80%, then settling at 10% — depending on the day and which advisor’s on TV. On Tuesday, he posted:

“There has been no change to this date, and there will be no change… All money will be due and payable starting AUGUST 1, 2025 — No extensions will be granted.”

Coming from the man who just last week called the deadline “firm but not 100% firm,” markets responded with a collective shrug.

Markets are caught in a holding pattern between panic and déjà vu. Trump’s tariff threats may stick this time — or maybe we’re just at Flip-Flop #29. Either way, investors will be watching August 1. Closely. But not holding their breath.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Markets Shaken After Trump’s New Tariff Spree — What We Know So Far

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners

Global Stocks Are Crushing US – But Which Ones?

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump

US Manufacturing Hits 3-Year High, But Tariff Fears Loom