The S&P 500 notched its ninth record close in July, the most in a single month since August 2021. Meanwhile, the Nasdaq Composite hit a record for the 13th time this month, the biggest monthly streak in nearly five years. The Dow Jones Industrial Average also posted gains, climbing 1.3% this week.

But while the numbers look euphoric, investors are bracing for a storm.

A Methodical Rally, Not a Mania

This year’s climb has been steady, driven not by meme-stock madness but by resilient earnings, muted inflation, and a tech-led AI boom. This past week, the S&P 500 gained 1.5%, the Nasdaq rose 1%, and the Dow added 208 points on Friday alone.

Yet beneath the surface, market strategists are watching closely.

- Deckers Outdoor jumped 11% after a blowout earnings report.

- Charter Communications plunged 18%, marking its worst day ever due to mobile slowdown concerns.

- Meme stocks like Kohl’s and American Eagle saw quick surges fade just as fast.

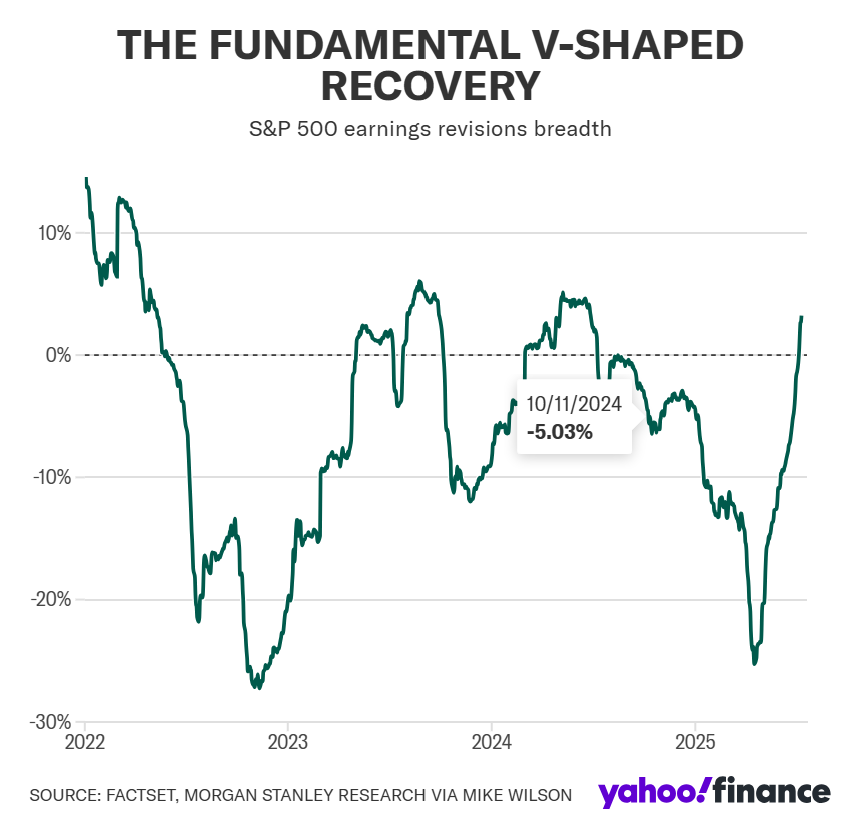

The V-Shaped Recovery in Earnings Is Real

According to data from Creative Planning’s Charlie Bilello, the S&P 500 has now surged 28% since its April 8 lows, marking the second-fastest rebound from a 19%+ drawdown in 75 years.

A massive rally from 4,987 to 6,389 has traced a classic V-shape — not just in prices, but in fundamentals.

Morgan Stanley CIO Mike Wilson told Yahoo Finance that earnings revisions breadth (the number of companies raising guidance versus lowering it) has soared in tandem with the index. His view: this is one of the most fundamentally supported rallies in modern market history.

“The rebound in earnings revisions helps justify the rally and supports a bullish outlook for the next 6–12 months,” Wilson said.

With 34% of S&P 500 companies having reported, Q2 earnings are tracking at 6.4% growth, up from 5% expected a month ago, per FactSet.

Big Week Ahead: AI, Jobs, Rates, and Tariffs

Next week, the market faces a quadruple test:

- Big Tech Earnings: Can AI giants like Apple and Amazon justify their sky-high valuations?

- Federal Reserve Decision: Will Jerome Powell finally hint at a rate cut—or hold steady?

- Jobs Report: July’s employment numbers could shift recession and inflation expectations.

- Trump’s Tariff Deadline: August 1 marks the President’s self-imposed deadline for finalizing trade deals.

Trump has already inked agreements with Japan and the Philippines, but talks with Canada, Mexico, and the EU remain unresolved. Trump told reporters Friday there’s a “50-50 chance” of a deal with the EU, and added ominously, “Canada may just get tariffs.”

Wells Fargo analysts warned clients that the fluidity of Trump’s trade policy has left many firms “paralyzed.”

Speculation, Valuations, and What Comes Next

Despite strong fundamentals, there are still red flags:

- S&P 500 valuation: Now trading at 22.4x forward earnings, well above its 5-year (19.9x) and 10-year (18.4x) averages.

- Retail frenzy: The meme-stock revival and options activity suggest pockets of speculation.

- Durable goods spending: Friday’s federal data showed weakness in business investment, particularly in industrial equipment.

Still, the market remains resilient.

“Tariffs haven’t derailed earnings the way many feared,” Wilson noted. “And arguably, the most important driver of stocks — earnings — is once again moving higher.”

Wall Street is booming, but August could be the turning point.

With rate decisions, job data, and geopolitical trade deals all colliding, investors will soon learn whether this record-setting rally can withstand the heat — or whether a correction is finally around the corner.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: