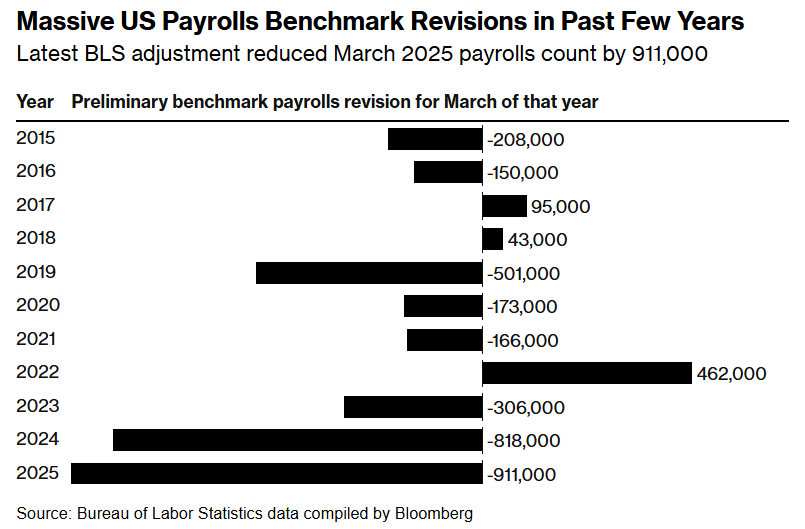

On Tuesday, the BLS issued its annual “benchmark revision” to payrolls data, covering the 12 months through March 2025. The agency concluded that the economy added 911,000 fewer jobs than first reported — an average of 76,000 fewer jobs per month. That makes the downgrade the largest on record since revisions began in 2002.

The cuts were broad-based but particularly sharp in services industries, including leisure and hospitality — sectors that had been holding up employment growth in recent years.

This revision comes on top of already weak recent data: July payrolls were revised lower, and August showed just 22,000 jobs created, the smallest monthly gain since 2020, with unemployment ticking up to 4.3%.

Political and policy backdrop

The data lands in a politically charged environment. President Donald Trump recently fired BLS commissioner Erika McEntarfer, accusing her of manipulating numbers to damage his administration. Tuesday’s revision, which also covers the tail end of the Biden administration, complicates that narrative — offering Trump ammunition while also confirming economists’ concerns that his tariffs and immigration policies are weighing on growth.

The White House seized on the report. Press Secretary Karoline Leavitt said, “President Trump was right: Biden’s economy was a disaster and the BLS is broken.” She renewed calls for Fed Chair Jerome Powell to cut rates immediately.

Market reaction

Despite the historic revision, equities barely flinched.

- Dow Jones Industrial Average gained 0.09%,

- S&P 500 slipped 0.04%,

- Nasdaq Composite fell 0.06%.

Indexes had closed near record highs on Monday, driven by tech strength. Investors treated the revisions as backward-looking, but bond markets and rate traders took notice.

Treasuries reversed a four-day rally, with yields ticking higher after an initial dip. Futures markets tracked by CME FedWatch continue to price a 100% probability of a 25 bps rate cut at the September Fed meeting, with odds of a 50 bps “jumbo cut” at ~8%.

Gold extended its run, touching another record above $3,580/oz, while oil jumped on reports of an Israeli strike in Doha targeting Hamas leaders. Bitcoin held above $110,000.Sector and stock movers

What it means for the Fed

The BLS revision makes it harder for the Federal Reserve to argue that the labor market is still resilient. With job creation far weaker than thought and unemployment rising, the case for easing policy has strengthened. Futures now fully price in a September rate cut, but the size of that move remains uncertain.

For Powell and his colleagues, the risk is twofold: cut too little, and markets fear a recession spiral; cut too much, and they risk reigniting inflation just as Trump’s tariffs push up import costs. The upcoming CPI and PPI reports will be pivotal in deciding whether the Fed sticks to a quarter-point cut or considers a larger 50 bps move.

Voices from Wall Street

- Jamie Dimon, JPMorgan CEO, told CNBC: “I think the economy is weakening. Whether it’s on the way to recession or just weakening, I don’t know.”

- Chris Zaccarelli, CIO at Northlight Asset Management, warned: “The jobs picture keeps deteriorating and while that should make it easier for the Fed to cut rates this fall, it could also throw some cold water on the recent rally.”

- Bradley Saunders, Capital Economics, said: “With services being the last bastion of employment growth, this does not bode well for the overall health of the labor market.”

What to watch next

Markets now turn to this week’s inflation data:

- Wednesday: Producer Price Index (PPI)

- Thursday: Consumer Price Index (CPI)

These reports will determine if the Fed has room for a bigger rate cut at its Sept. 16–17 meeting. Any surprise uptick in inflation could revive stagflation fears — slowing growth alongside rising prices — a scenario investors have been reluctant to price in.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

France’s Government Collapses — What Moved in Markets and What’s Next

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility