US stocks finished Friday’s session little changed, staying close to record levels as investors paused after a strong holiday rally.

Wall Street saw light trading volumes following Christmas, with few catalysts pushing markets decisively in either direction. All three major indexes closed slightly lower on the day, ending a five session winning streak, but still posted solid weekly gains.

- Dow Jones Industrial Average fell 0.04% to 48,710.97

- S&P 500 slipped 0.03% to 6,929.94

- Nasdaq Composite eased 0.09% to 23,593.10

Markets take a breather after strong rally

Strategists said the muted session reflects consolidation rather than a shift in trend.

Ryan Detrick, chief market strategist at Carson Group, noted that markets are simply digesting gains after a powerful five day advance. He added that the rally period tied to the end of the year has only just begun.

Investors are closely watching the Santa Claus rally, a seasonal stretch covering the final five trading days of the year and the first two of the new year. Historically, strength during this period has been seen as a positive signal for markets in the year ahead.

2025 closing out with strong gains

With only three trading days left in the year, markets are wrapping up a volatile but profitable 2025. Tariff uncertainty, geopolitical tensions, and the rapid rise of AI related stocks drove sharp swings throughout the year.

Despite those challenges, all three major indexes are on track for double digit annual gains, led by the tech heavy Nasdaq.

Sector and stock highlights

Among S&P 500 sectors:

- Materials posted the strongest gains on the day

- Consumer discretionary lagged

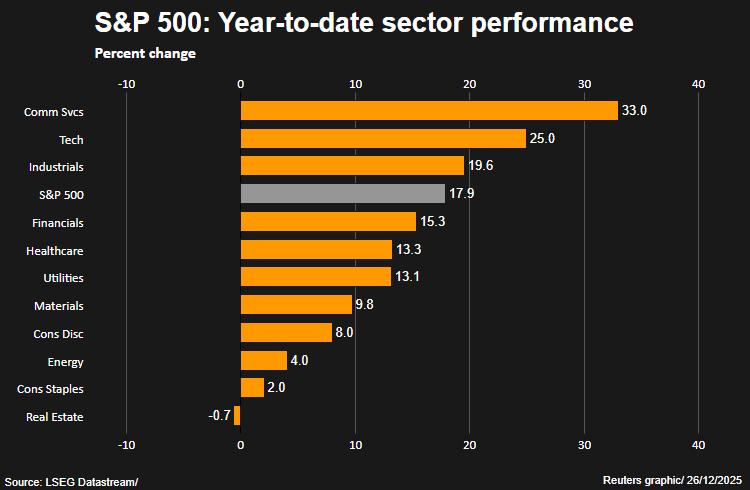

On a year to date basis, communication services, technology, and industrials have outperformed the broader market, while real estate is the only sector still down in 2025.

Shares of Nvidia rose about 1% after the AI chipmaker announced a licensing deal with Groq and hired the startup’s CEO.

Target jumped 3.1% after reports that activist hedge fund Toms Capital Investment Management has built a significant stake in the retailer.

Precious metal miners including First Majestic, Coeur Mining, and Endeavour Silver gained between 1.2% and 3%, tracking record highs in gold and silver prices.

Market breadth and volume

Advancing stocks slightly outnumbered decliners on the NYSE, while Nasdaq decliners led advancers. Trading volume remained well below recent averages, reflecting the holiday shortened session.

Wall Street is ending the year close to record highs, with momentum intact despite a quiet post holiday pause. As the Santa Claus rally period unfolds, investors remain cautiously optimistic heading into the final days of 2025 and the start of 2026.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.