US stock futures opened lower on Thursday morning as investors took a cautious stance despite a temporary thaw in U.S.–China trade tensions and a fresh rate cut by the Federal Reserve. The early market dip reflects a complex mix of macroeconomic uncertainty, hawkish central bank signals, and ongoing scrutiny of Big Tech earnings.

Market Snapshot at the Open

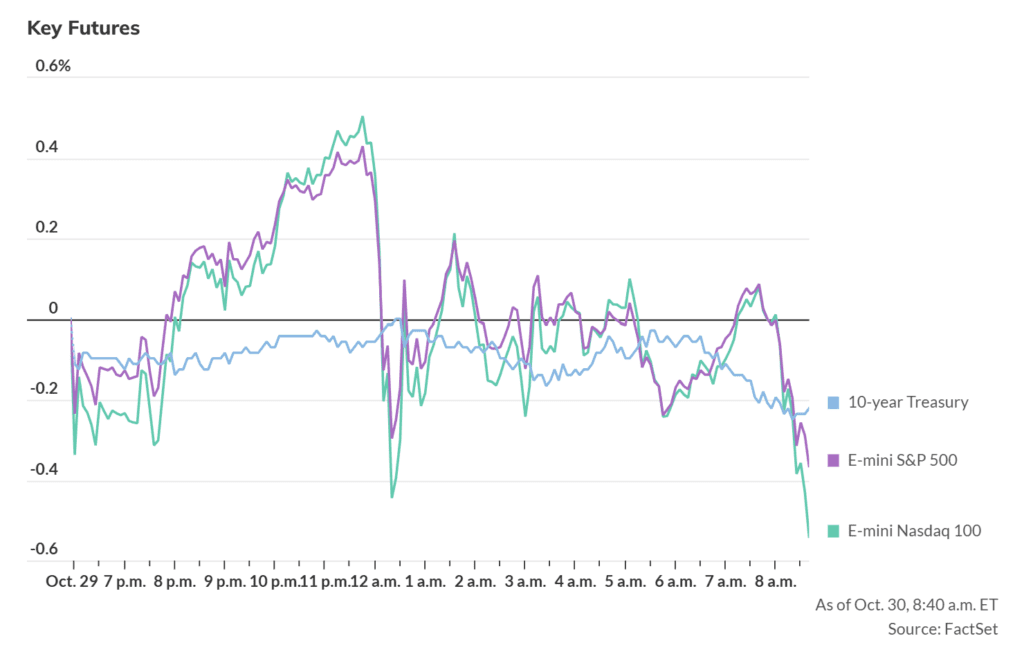

- Dow Jones Industrial Average futures dropped 0.3%

- S&P 500 futures slipped 0.3%

- Nasdaq 100 futures fell 0.5%, weighed down by mixed tech earnings

This cautious tone comes even after headlines suggested some relief on the geopolitical front, with President Trump and Chinese President Xi Jinping announcing a short-term trade agreement during their summit in South Korea.

The Trump-Xi “Trade Truce” — Relief, But Not a Rally

While the Trump-Xi meeting yielded a notable easing in trade tensions — including:

- A halving of the fentanyl-related tariffs (from 20% to 10%)

- A one-year pause in China’s rare earth export restrictions

- Renewed purchases of U.S. soybeans and other agricultural goods

— markets didn’t respond with much enthusiasm.

Analysts say this is likely because the agreement is temporary and lacks clarity on long-standing issues like semiconductors, intellectual property, and the future of TikTok in th U.S. There was also no breakthrough on Taiwan or Ukraine, and details around AI chip restrictions remain vague. Trump himself called it an “amazing meeting,” but investors seem to be holding back until more concrete terms are signed.

More about: What the Trump-Xi deal means for stability and markets

Fed Cools Rate Cut Hopes

Just a day earlier, the Federal Reserve cut interest rates by 25 basis points — the second cut of the year — but Fed Chair Jerome Powell struck a surprisingly hawkish tone in his press conference.

“A rate cut in December is not a foregone conclusion — far from it,” Powell said.

This caught markets off guard, as many had priced in a more predictable rate-easing cycle. Powell’s cautious remarks and acknowledgment of internal division within the Fed have left investors questioning whether another cut will come this year — especially in light of a data blackout caused by the ongoing government shutdown.

This pushback on future cuts has created uncertainty for equities, especially growth stocks which tend to benefit most from lower rates.

Tech Earnings in Focus: Winners and Warnings

Another major source of tension comes from Big Tech earnings.

- Alphabet (GOOG) surged over 7% after reporting strong cloud growth and beating revenue estimates.

- But Meta (META) plunged nearly 8% after disappointing guidance, and Microsoft (MSFT) also dropped 3% despite solid numbers — mainly due to cautious remarks about future capital spending.

The Nasdaq’s underperformance reflects this split among the tech giants — with investors now awaiting Apple (AAPL) and Amazon (AMZN) earnings later today.

What’s Next for Markets?

The combination of macro signals, geopolitical shifts, and tech earnings volatility means the market is currently in a “wait and see” mode.

Investors will be watching:

- Upcoming earnings reports, especially from Apple and Amazon

- More Fed commentary and any new data releases (if resumed)

- Implementation of the U.S.–China trade deal

- Treasury yields and the U.S. dollar, both of which are showing signs of recalibration after Powell’s remarks

Despite some seemingly good news — a Fed rate cut, a trade truce with China — markets are subdued rather than surging. That’s because most of the upside was already priced in, while uncertainty remains the dominant theme heading into the final stretch of 2025. With Powell pouring cold water on December rate cut hopes and Big Tech flashing mixed signals, investors are treading carefully, waiting for firmer ground.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.