The US government has signed a presidential proclamation introducing a major change to the H-1B visa program: a one-time, $100,000 fee for new visa applicants who are applying from outside the US The measure, effective from September 21, 2025, signals tightening policy for skilled foreign workers. The decision has sparked strong reactions across the tech sector, immigrant communities, and from India, which sends the majority of H-1B visa holders.

What the Policy Says

- The $100,000 fee is required for new H-1B visa petitions filed after 12:01 a.m. ET on September 21, 2025. This includes the 2026 lottery cycle.

- It is not an annual fee, despite earlier statements by some officials specifying otherwise. Press briefings and official clarifications confirmed it is one-time per petition.

- The fee does not apply to current H-1B visa holders (those with valid visas) or those seeking to renew existing visas.

- It will be implemented for new petitions abroad; people outside the country are urged to return before the deadline, to avoid potential barriers. However, the government clarified that current holders will not be barred from reentry.

Reactions & Concerns

India’s government warned that the fee could have “humanitarian consequences,” particularly for families of skilled workers. The Ministry of External Affairs expressed concern about disruptions and said it is studying the implications.

IT industry & business bodies in India (notably Nasscom) said the clarity that the fee applies only to new applications offers some relief, but they still deem the fee prohibitively high.

Tech companies in the US reacted quickly: Memos to employees urged those abroad to return before the rule takes effect; some advised H-1B visa holders not to travel abroad until details were fully clarified.

Stock markets, especially Indian IT stocks, dropped after the announcement. Investors saw risk to revenue models reliant on sending Indian workers to the US under H-1B.

Implications & Risks

For Foreign Skilled Workers: Many are facing uncertainty around travel, career plans, and family logistics. The abruptness raised questions of whether people outside the US or planning to travel could be stranded or face disproportionately high costs.

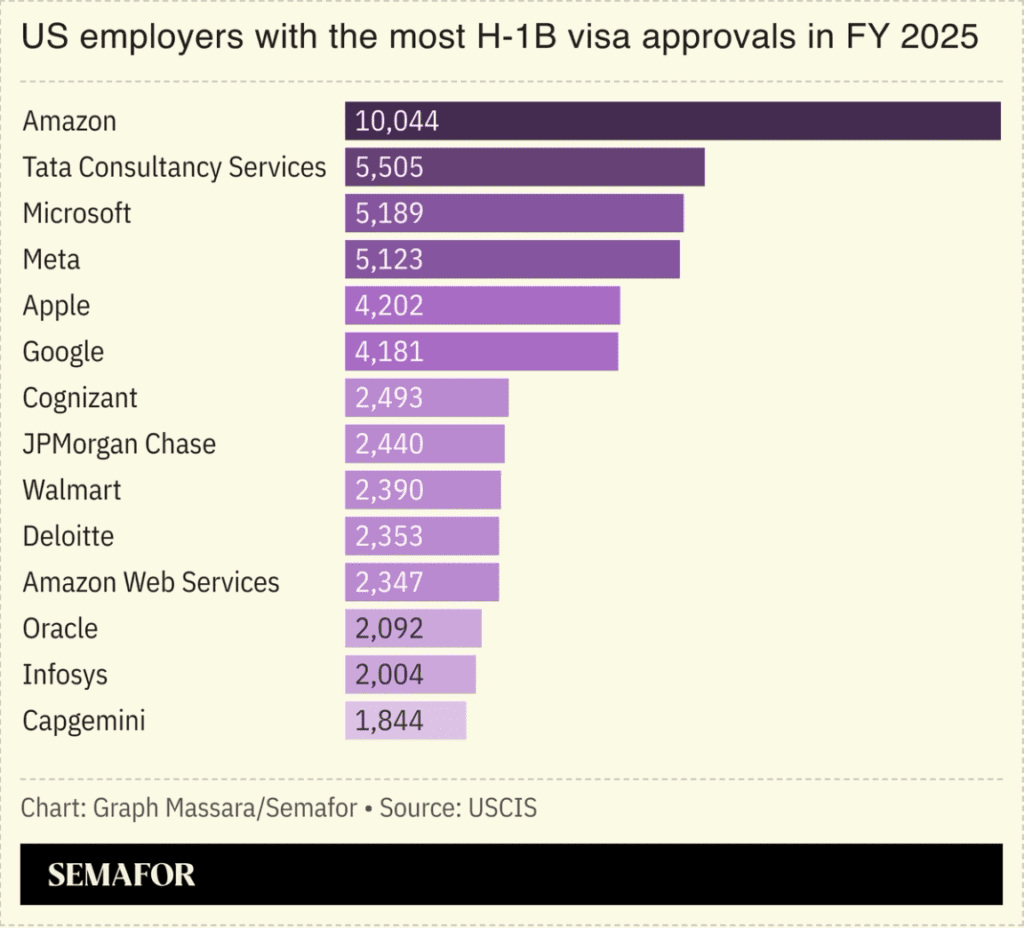

For Companies: Firms that heavily rely on H-1Bs (tech, healthcare, research) may find it far more expensive to hire foreign talent. Smaller companies may struggle more than large ones. Some may re-evaluate staffing models or increase hiring domestically.

For US-India Relations: This move adds another strain. With India being the origin of ~70% of H-1B visas last year, the fee hike is seen as disproportionately targeting Indian professionals. It may prompt diplomatic negotiations or trade consequences.

What to Watch

- Implementation details — Will there be legal challenges? Will the “national interest” exemptions be invoked, and how often?

- Impact on tech staffing and hiring — Will companies shift more work overseas or speed up automation/local hiring?

- Regulatory adjustments — Are there likely to be further clarifications, or even rollback if pressure builds?

- Travel & logistics chaos — More memos, last-minute travel, changes in visa status may keep causing disruption.

- Market responses — Indian IT companies’ stock performance, companies in the US dependent on imported tech talent, and investor sentiment around immigration policy.

This is one of the most aggressive hikes in H-1B visa costs by the US in recent memory. While existing visa holders and renewals are spared, the barrier for new applicants is now extremely high. The change immediately affects planning, travel, and hiring decisions, and risks both disrupting lives and reshaping how companies source talent. On the diplomatic front, the move has triggered concern, but also pushed for clarification and calm by US officials.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Nvidia Stakes $5 Billion in Intel: A Strategic Revival for the Chipmaker

Powell Frames Cut as “Risk Management” Amid Weakening Jobs, Tariff Risks