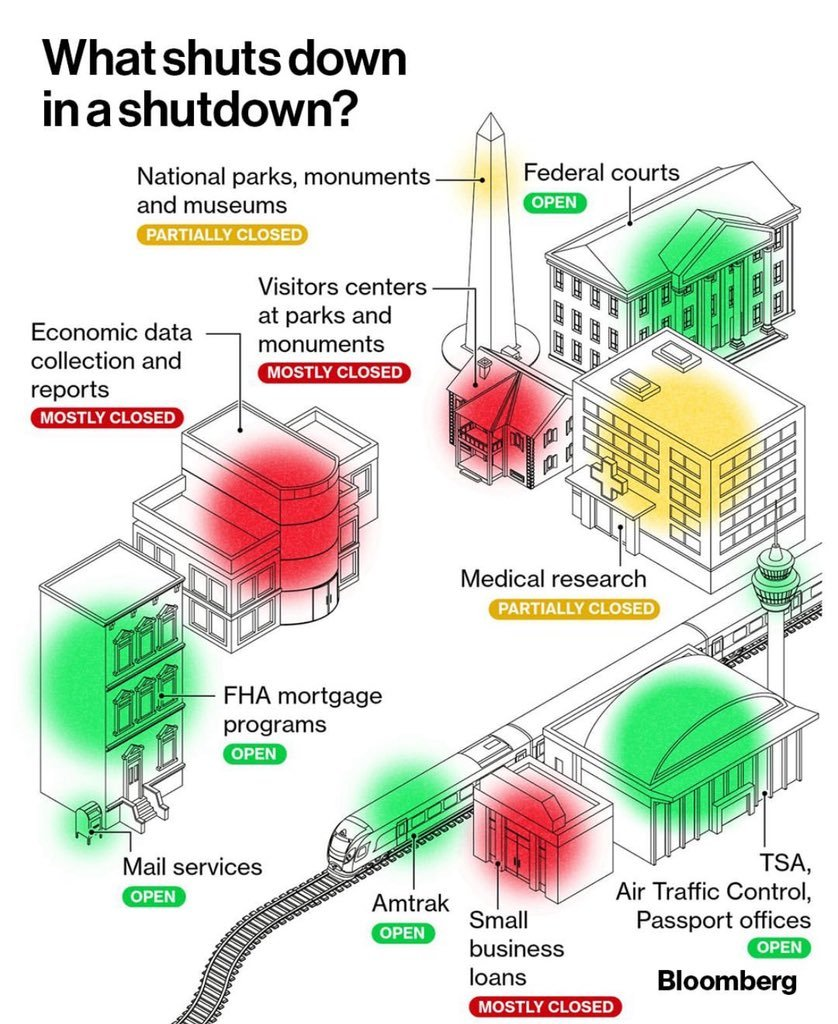

The United States government officially entered a shutdown at midnight on Wednesday — the first since 2018 — after lawmakers failed to strike a deal on funding. The impasse has already furloughed around 750,000 federal workers, delayed critical data releases, and left global investors debating whether this time the shutdown could have more lasting consequences.

Historical Playbook: Markets Usually Look Past Shutdowns

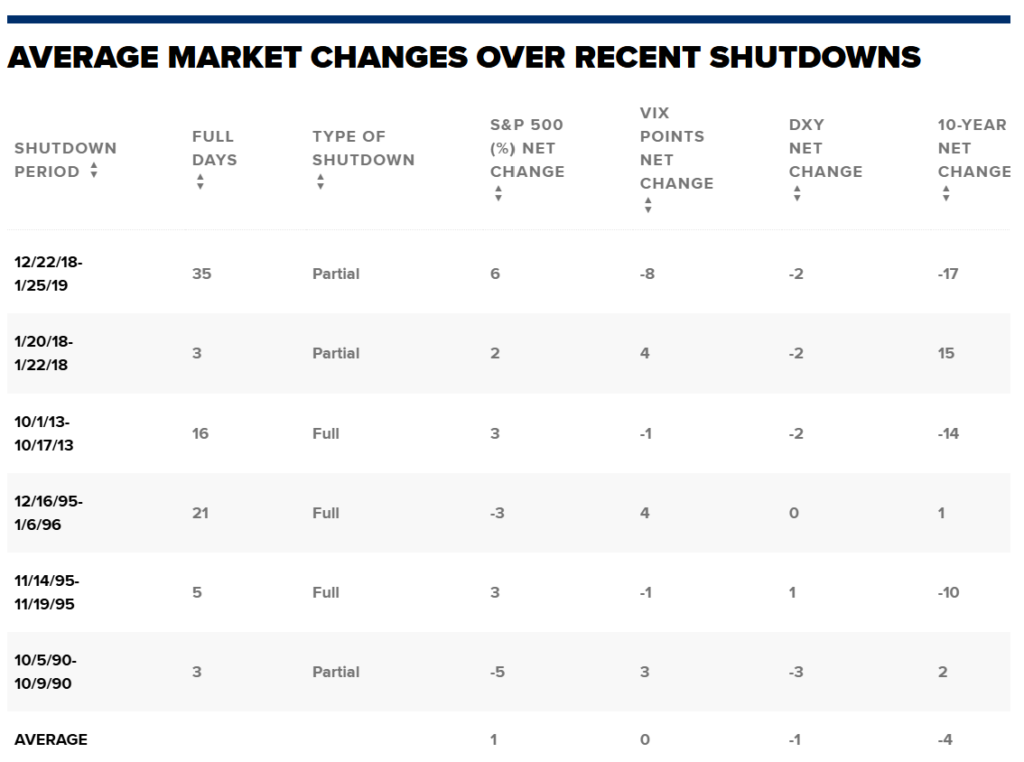

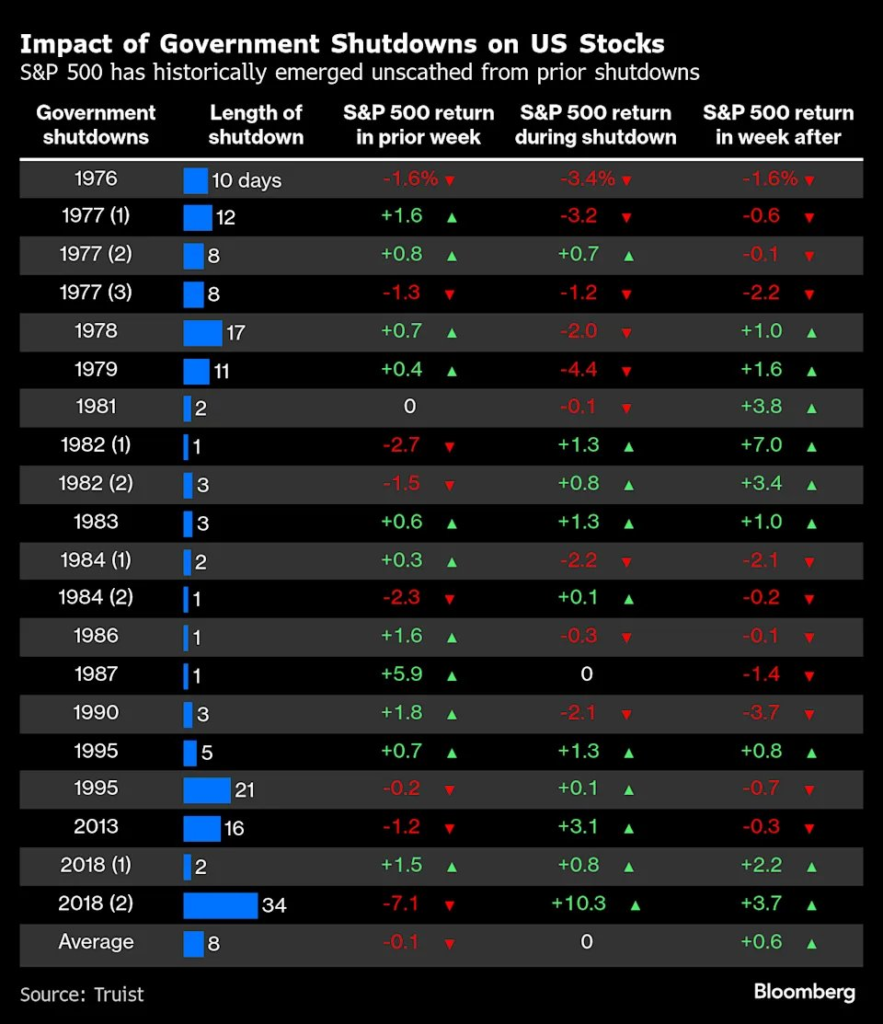

History suggests government shutdowns rarely deliver lasting blows to markets. Since 1976, there have been 20 shutdowns averaging about a week. On average, the S&P 500 posts no net change during shutdowns but gains in the aftermath — up 13% one year later on average, including an 11% rally after the record 35-day shutdown of 2018-2019.

Traders note that during shutdowns, the government defers about $400 million in daily costs, and the Fed often adopts a more dovish stance as economic data flow dries up.

Why This One Feels Different

Despite the historical calm, economists warn that this episode could be riskier than previous shutdowns. President Donald Trump has threatened to enact mass layoffs of federal workers during the shutdown — a sharp break from past practice where furloughed staff were repaid and rehired. Permanent cuts could deliver a more durable hit to growth and push unemployment higher.

Stephanie Roth, chief economist at Wolfe Research, warned such layoffs would be “a really big economic problem,” while Jared Bernstein, a former Biden advisor, said it would be “profoundly unfair” and economically reckless.

Economic Data Goes Dark

One of the most immediate impacts is the blackout of key government reports. The September jobs report, due Friday, won’t be released if the shutdown continues. Other critical releases — including inflation reports the Fed relies on for rate policy — would also be delayed.

Nathan Sheets, global chief economist at Citigroup, said this would complicate monetary policy decisions: “It’s already complicated enough to interpret the labor market data. If we have a period of time where the data isn’t available, those challenges would significantly increase.”

Private data, such as Thursday’s ADP report showing a 32,000 decline in private-sector jobs, will therefore carry extra weight. Challenger, Gray & Christmas also reported September layoffs of 54,064, with year-to-date cuts nearing 950,000 — the highest since 2020.

Market Reaction So Far

Wall Street initially dipped but closed higher on Wednesday, with the Dow up 43 points, the S&P 500 +0.34%, and the Nasdaq +0.42% — both the Dow and S&P notching record closes. Investors are betting the shutdown will be short-lived.

But safe-haven demand surged. Gold hit a record $3,900/oz before easing, now up 47% year-to-date. Silver also rallied, gaining 63% in 2025. UBS analysts urged clients to “look past shutdown fears” and focus on other drivers such as Fed rate cuts, corporate earnings, and AI investment.

Still, currency markets showed jitters. The US dollar halted a four-day losing streak, but economists warned prolonged dysfunction could push capital into the euro and yen. Emerging-market currencies already slipped on Thursday.

What It Means for Your 401(k)

For retirement savers, past experience suggests little long-term impact. Since shutdowns tend to mimic a “hurricane or snowstorm” — temporarily delaying activity but quickly making up for it — most economists argue that 401(k) investors should stay the course.

However, the Trump administration’s threat of permanent layoffs and the economy’s weaker footing in 2025 make this shutdown more unpredictable. As David Kelly, chief global strategist at JPMorgan Asset Management, put it: “The timing is bad. It’s a little bit more dangerous this time.”

Shutdowns are usually political theater with limited market impact. But this one is unfolding against a backdrop of slowing job growth, heightened tariff pressures, and Fed uncertainty. If Trump follows through with federal layoffs or if the shutdown stretches toward the 2018 record, markets could stop shrugging and start recalibrating risk.

For now, Wall Street is betting on history — that the lights will come back on in Washington sooner rather than later.

Related: US Government shutdown watch: what it means for markets — and your wallet

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.