A partial US government shutdown could begin 12:01 a.m. ET Wednesday if Congress fails to reach a funding deal. Unlike 2019, this one comes with two twists: the job market is wobbling and the White House has floated mass layoffs (beyond standard furloughs) at unfunded programs. Markets are gaming the odds, essential services would keep running, and key economic data could go dark right when the Fed is deciding its next move.

What actually keeps running (and what doesn’t)

Even in a shutdown, essential services continue: the military, air-traffic control, border protection, law enforcement, in-hospital medical care, power-grid maintenance, and core congressional/judicial staff. Social Security, Medicare, and Medicaid benefits continue, but benefit verification and new card issuance can pause. Services funded by user fees (e.g., many immigration services) and the US Postal Service (self-funded) generally operate.

What typically pauses

- “Nonessential” federal staff are furloughed (unpaid during the lapse, historically paid retroactively).

- National parks often close or operate without services—past attempts to keep them “open” led to damage and trash buildup.

- EPA and FDA inspections are often delayed.

- SNAP (food stamps) can face disruptions once short-term authorizations lapse.

Why this shutdown risk is different

The Office of Management and Budget has signaled it may consider reductions-in-force (RIFs) for unfunded programs that don’t align with presidential priorities. Past shutdowns relied on temporary furloughs with back pay; permanent layoffs would be a major escalation that could lift unemployment and dent confidence.

How we got here (and how it might end): The immediate impasse centers on funding and an extension for Affordable Care Act subsidies. One base case from policy analysts: a 1–2 week shutdown that ends with a deal on subsidies. Messaging is entrenched: each side claims the other is blocking a “clean” short-term extension.

Markets Usually Shrug Off Shutdowns, History Shows

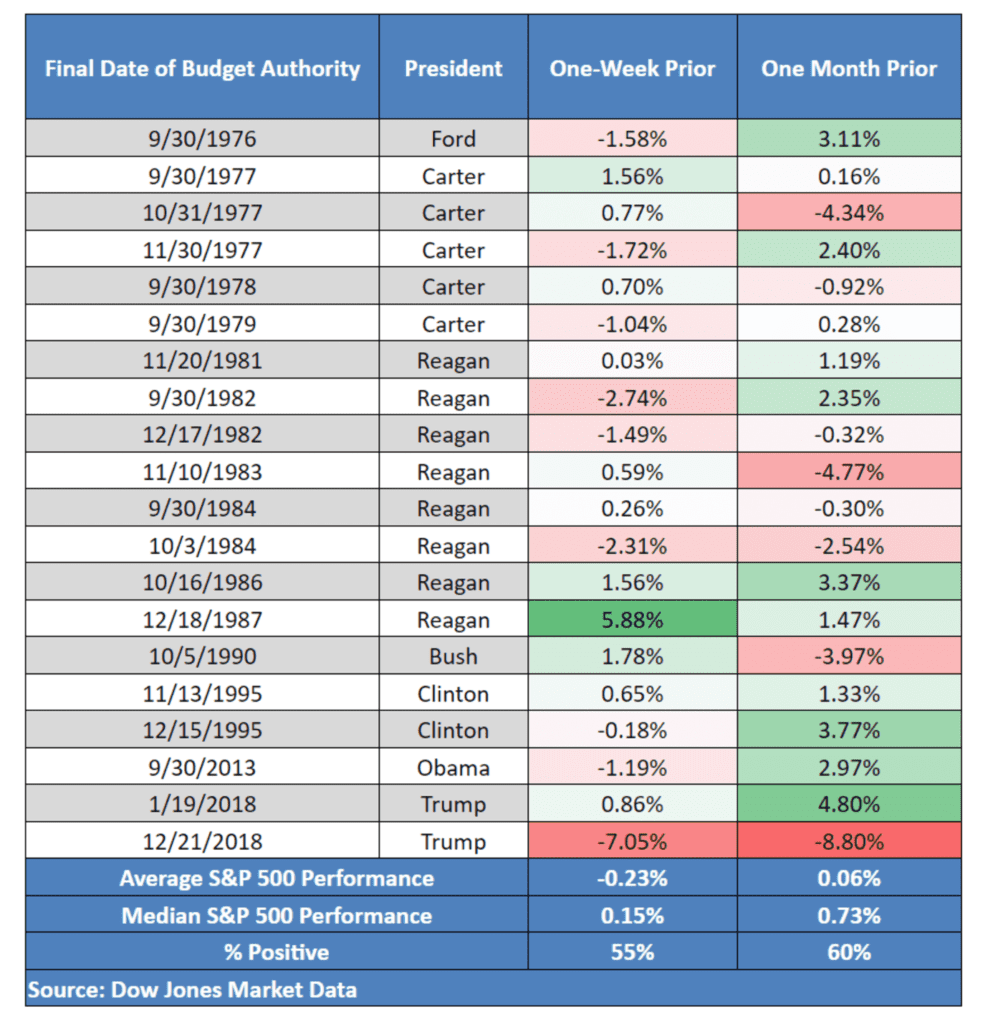

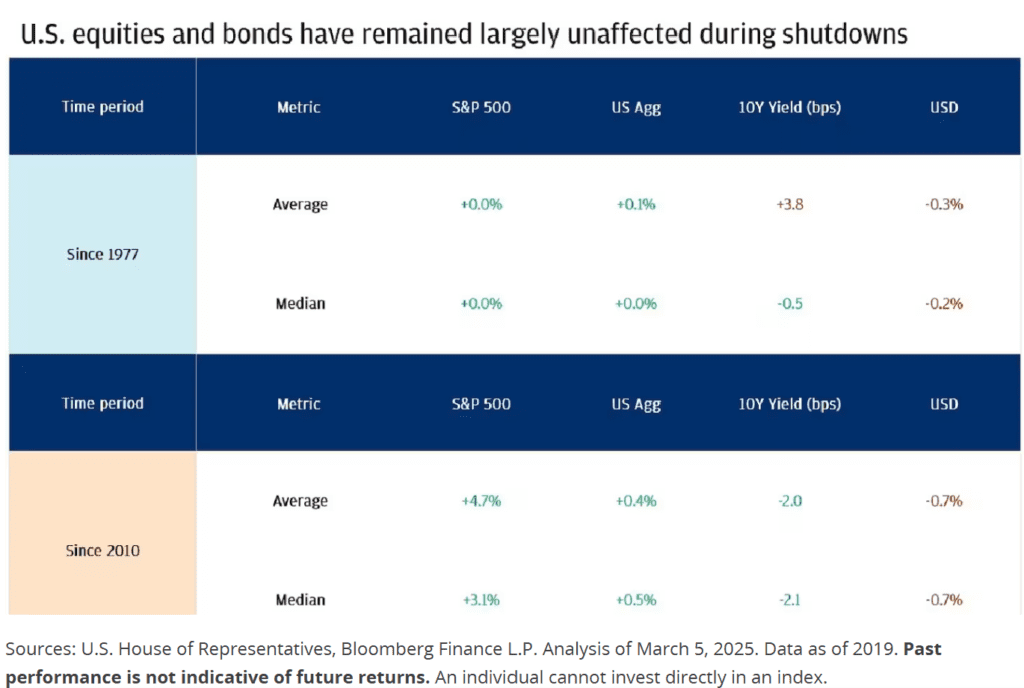

Government shutdowns create political drama, but historically the market and economy have shown resilience. Stocks often wobble in the days leading up to a lapse, yet most shutdowns have had little lasting impact on the S&P 500 or GDP. Safe-haven assets like Treasuries and gold tend to get a short-term boost, while the dollar usually weakens slightly.

- S&P 500 (week before shutdowns): Average -0.23%, Median +0.15%

- % Positive Weeks: 55%

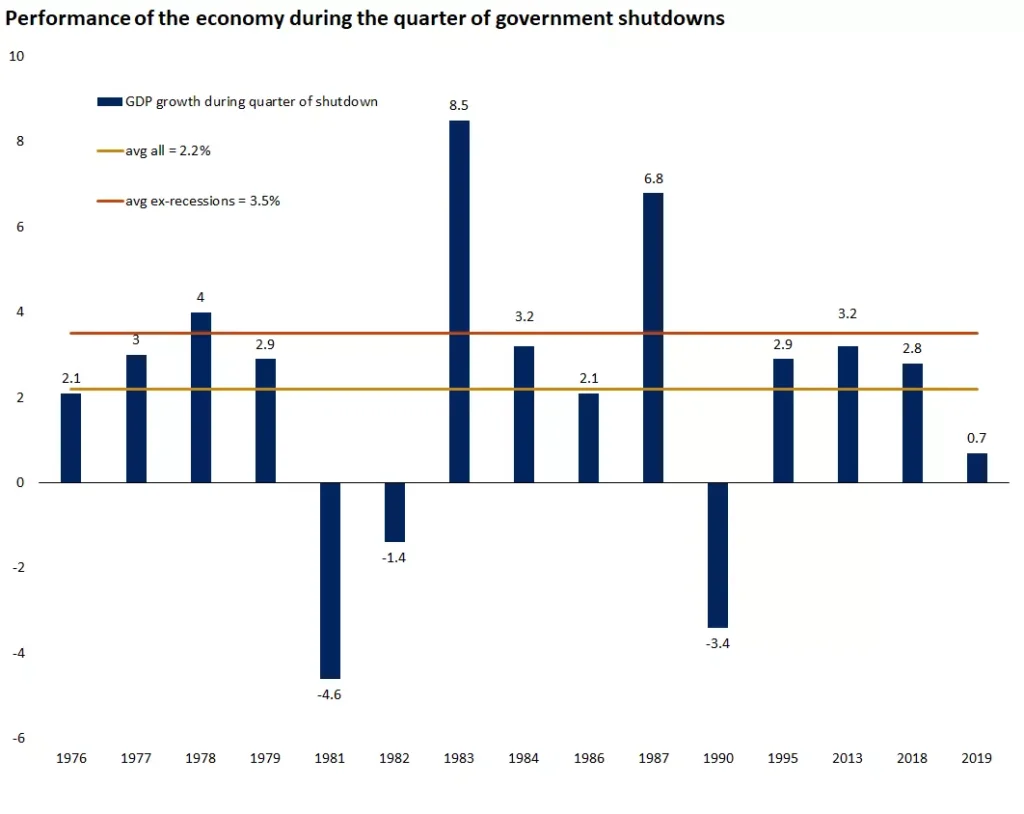

- GDP Growth During Shutdown Quarters: +2.2% on average, +3.5% excluding recessions

- 10-Year Treasury Yields: Modest dips (avg. -2 bps since 2010)

- US Dollar: Slightly weaker (avg. -0.7% since 2010)

Key shutdown years: 1976, 1995, 2013, and 2018–19.

Market odds and immediate price action

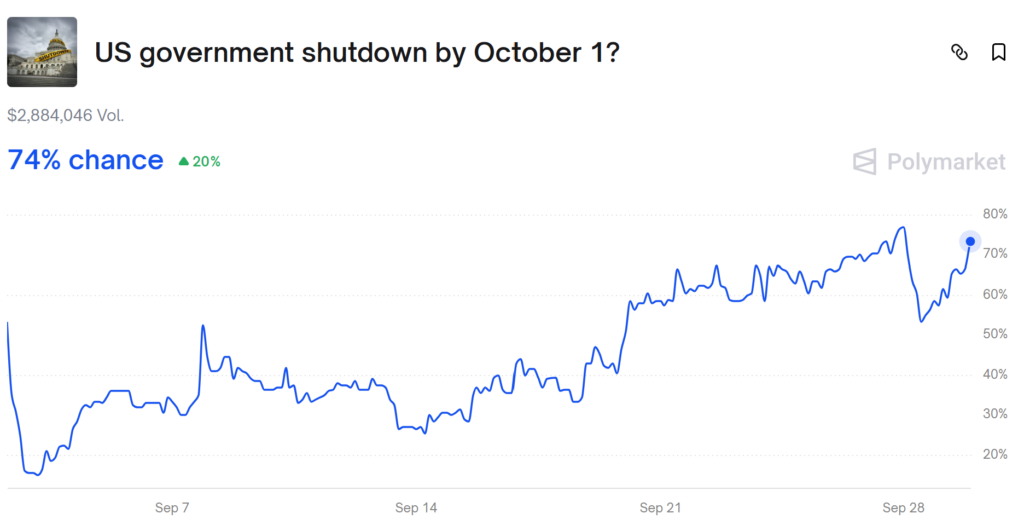

Prediction markets put shutdown odds more likely than not:

- Polymarket: ~74%

- Kalshi: ~67%

- PredictIt: ~69%

Yet, stocks weren’t panicking Monday: the S&P 500 and Nasdaq were up modestly, the Dow was roughly flat. Gold surged to fresh records above $3,800/oz as a classic haven; Treasuries firmed (yields dipped), and the dollar edged lower. Investors remember that equities often weather brief shutdowns—the S&P 500 has risen during several recent ones.

The data blackout problem (and the Fed)

A shutdown starting midweek would likely delay Friday’s jobs report and potentially monthly inflation reports, forcing executives, investors, and the Fed to fly with less visibility. If the lapse drags beyond the Oct 29 Fed meeting, policymakers may lean more on private data—marginally reducing the odds of an October rate cut, per some bank research. Markets currently imply ~90% odds of a quarter-point Fed cut in October and ~65% odds of another in December.

Macro impact: short, shallow… unless it isn’t

Rule of thumb: each week of shutdown clips about 0.1–0.2 percentage points from annualized GDP growth, usually recovered after reopening. The 2018–19 35-day lapse left limited lasting damage.

This time could bite more if:

- Permanent layoffs materialize (not just furloughs).

- Confidence weakens in a softer labor market.

- Data gaps cloud decisions on rates, hiring, and capex.

Sector check: who’s most exposed

| Sector | Why it matters | What to watch |

|---|---|---|

| Defense & Aerospace | Contract awards, mods, and payments can be delayed; program oversight slows. | Prime contractors with heavy federal exposure; cash-flow timing. |

| Healthcare & Biopharma | FDA reviews/inspections can slip; reimbursement and grants face admin delays. | Small/mid-cap biotechs with time-sensitive milestones; med-techs awaiting clearances. |

| Travel & Leisure (Parks, Tourism) | Park closures hit local tourism revenues; TSA/ATC remain, but service strain can rise. | Park-adjacent lodging and recreation names. |

| Financials (Trading & Deals) | If jobs/CPI/PPI are delayed, risk models and issuance calendars get fuzzier. | IPO pipeline (SEC staffing); rate-sensitive lenders. |

| Gold & Safe-haven assets | Policy uncertainty + softer dollar tend to support bullion. | Gold miners (operating leverage); gold ETFs. |

| Big Tech / Broad Equities | Historically shrug off brief lapses; sentiment tied to earnings, AI capex, rates. | Guidance sensitivity if macro data go missing for weeks. |

Your wallet: practical effects

Payments/benefits: Social Security/Medicare continue; paperwork requests can stack up.

Mortgages & loans: Rates still market-driven; a risk-off bid can nudge yields lower, but volatility increases.

Travel: Expect park closures and reduced services, but flights operate (pack patience).

Investing: For long-horizon investors, stay the course; for traders, expect headline-driven swings, thinner data.

Scenarios to watch next (near term)

1) Quick fix (days)

- Markets exhale; data flow resumes; Q4 seasonals support equities.

2) Base case (1–2 weeks)

- Modest GDP dent, temporary; heavier reliance on private data for the late-October Fed meeting.

3) Prolonged, with layoffs

- Confidence hit; higher measured unemployment; bigger drag on growth; volatility climbs.

Markets have seen shutdown dramas before and usually treat them like a snowstorm—disruptive, then quickly reversed. What’s different now is the hint of permanent layoffs, a softer labor backdrop, and the real risk of a data blackout just as the Fed calibrates cuts. If Congress resolves this within a week or two, the economic scar should be small and the Q4 playbook (dovish Fed, improving liquidity, year-end positioning) can reassert itself. If it drags—and especially if layoffs start—expect a firmer bid for havens (gold, high-quality duration), more cautious risk-taking, and a trickier runway for IPOs, biopharma timelines, and defense cash cycles.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s $100,000 H-1B Visa Fee: What It Means for Tech, Talent, and Markets

Fed Divide Widens as Policymakers Clash Over Pace of Rate Cut