In continuation of our earlier coverage, the second day of US-China trade talks kicks off today in London, following a six-hour closed-door session Monday that signaled cautious optimism but left key issues unresolved.

Trump Talks Tough, But Hopeful

Speaking from the White House Monday night, President Trump said he’s “only getting good reports” from his London delegation, calling the first day “a good start.” Still, he added a familiar disclaimer: “China’s not easy.”

Asked about lifting export controls, Trump responded simply: “We’ll see.”

Sources close to the talks say the White House is waiting for a concrete handshake before offering any formal easing on export restrictions — particularly those targeting rare earths and semiconductors.

“We want to open up China,” Trump added, referencing Beijing’s tight grip on the global rare earth supply chain.

Bessent and Lutnick Weigh In

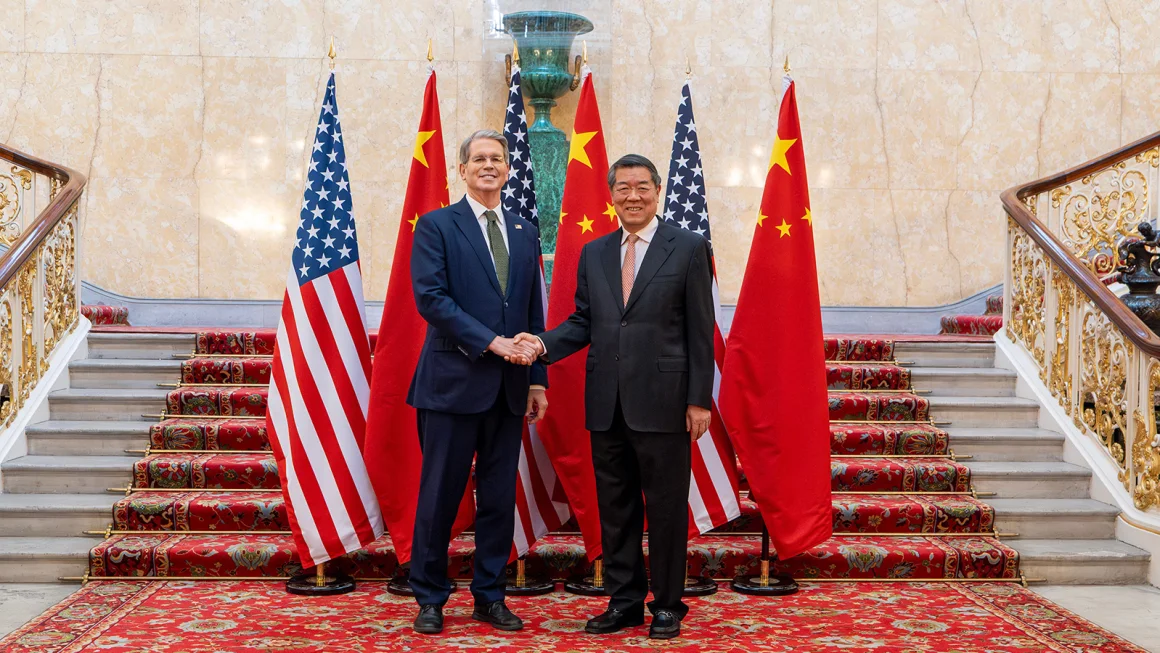

After Monday’s marathon session at Lancaster House, Treasury Secretary Scott Bessent called the meeting “good,” while Commerce Secretary Howard Lutnick labeled it “fruitful.”

Behind closed doors, Bessent reportedly pushed for rare earth shipments to resume immediately, in exchange for a phased rollback of some non-critical tech export restrictions. Lutnick’s involvement signals just how strategic the Commerce Department’s export controls have become in these talks.

Meanwhile, Kevin Hassett, head of Trump’s National Economic Council, told CNBC the US is willing to ease some chip-related restrictions — but firmly not those covering Nvidia’s AI-grade H2O chips.

“The very, very high-end Nvidia stuff is not what I’m talking about,” Hassett clarified.

Beijing Signals Willingness — But With Limits

While the Chinese delegation, led by Vice Premier He Lifeng, offered no public remarks on Monday, state-affiliated media struck a more measured tone overnight.

A commentary from CCTV’s Yuyuantantian insisted that “the US should realistically view the progress made” and called for Washington to “revoke negative measures” if it seeks serious cooperation.

China’s Ministry of Commerce did confirm limited approvals of rare earth export licenses, calling it a “compliant, case-by-case process.”

Today’s Expectations: Rare Earths or Roadblock?

As day two begins at 10:00 a.m. local time, expectations are high — and markets are watching closely.

The US wants an immediate, large-scale release of rare earth shipments, especially for automakers, EVs, and defense contractors, in return for dialed-down restrictions on chip software and industrial inputs.

However, China remains unwilling to fully surrender its rare earth leverage, particularly amid economic pressures at home. May exports to the US dropped 34.5%, and PPI deflation deepened, adding urgency for Beijing — but also hardening its negotiating stance.

“Rare earths remain China’s calibrated tool for strategic influence,” wrote Robin Xing, Morgan Stanley’s Chief China Economist.

Market Snapshot

- S&P 500: +0.09% (6,005.88)

- Nasdaq: +0.31%

- Hang Seng Tech Index: -1.16%

- CSI 300: -0.64%

- Oil (Brent): $67.21 per barrel (+0.25%)

- Dollar Index: +0.31% (99.25)

Despite upbeat sentiment from officials, Hong Kong and Mainland Chinese indices slipped ahead of Tuesday’s talks, suggesting markets still expect volatility — not resolution.

As we noted in yesterday’s report, optics matter — but execution will decide the outcome. If today ends with even a symbolic “handshake,” markets could interpret it as a sign of temporary stability. But if talks stall again over rare earth leverage or AI chip lines, expect renewed market jitters and headlines that say “progress paused.”