Wall Street ended 2024 on a high note.

Big US banks posted their strongest quarter in years, fueled by soaring trading revenues, rebounding dealmaking, and renewed corporate confidence.

Let’s break down the results.

The Big Picture

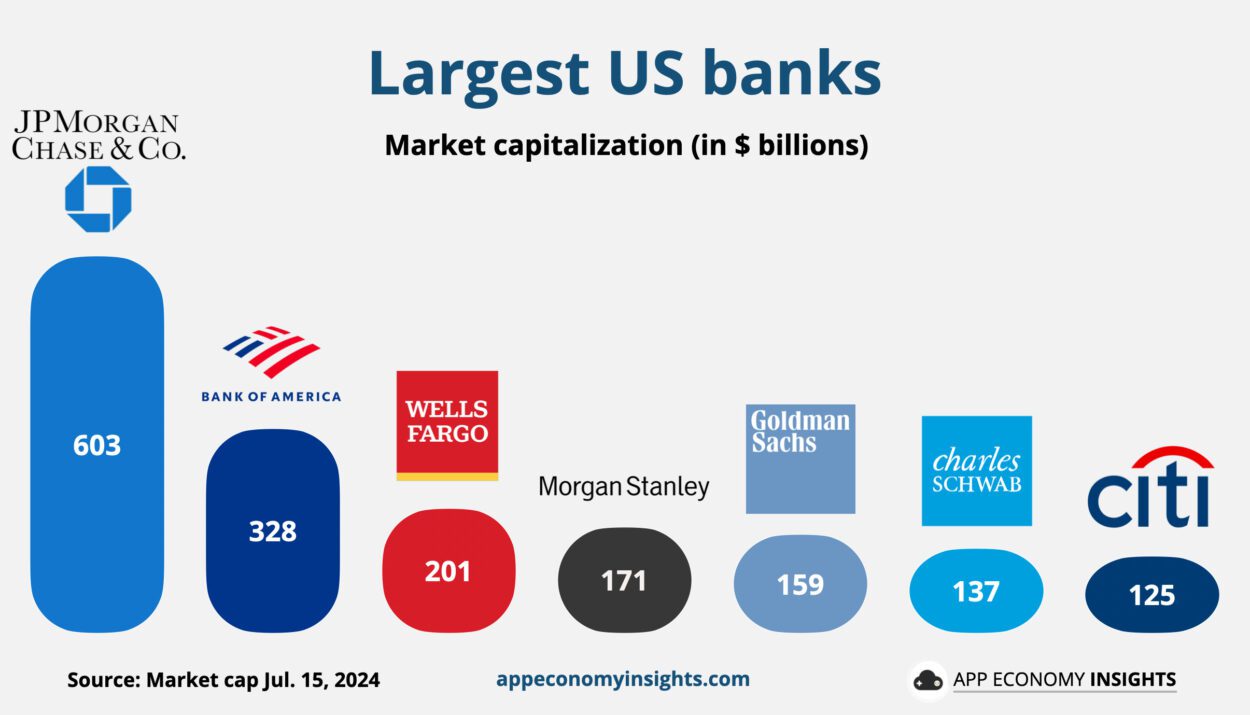

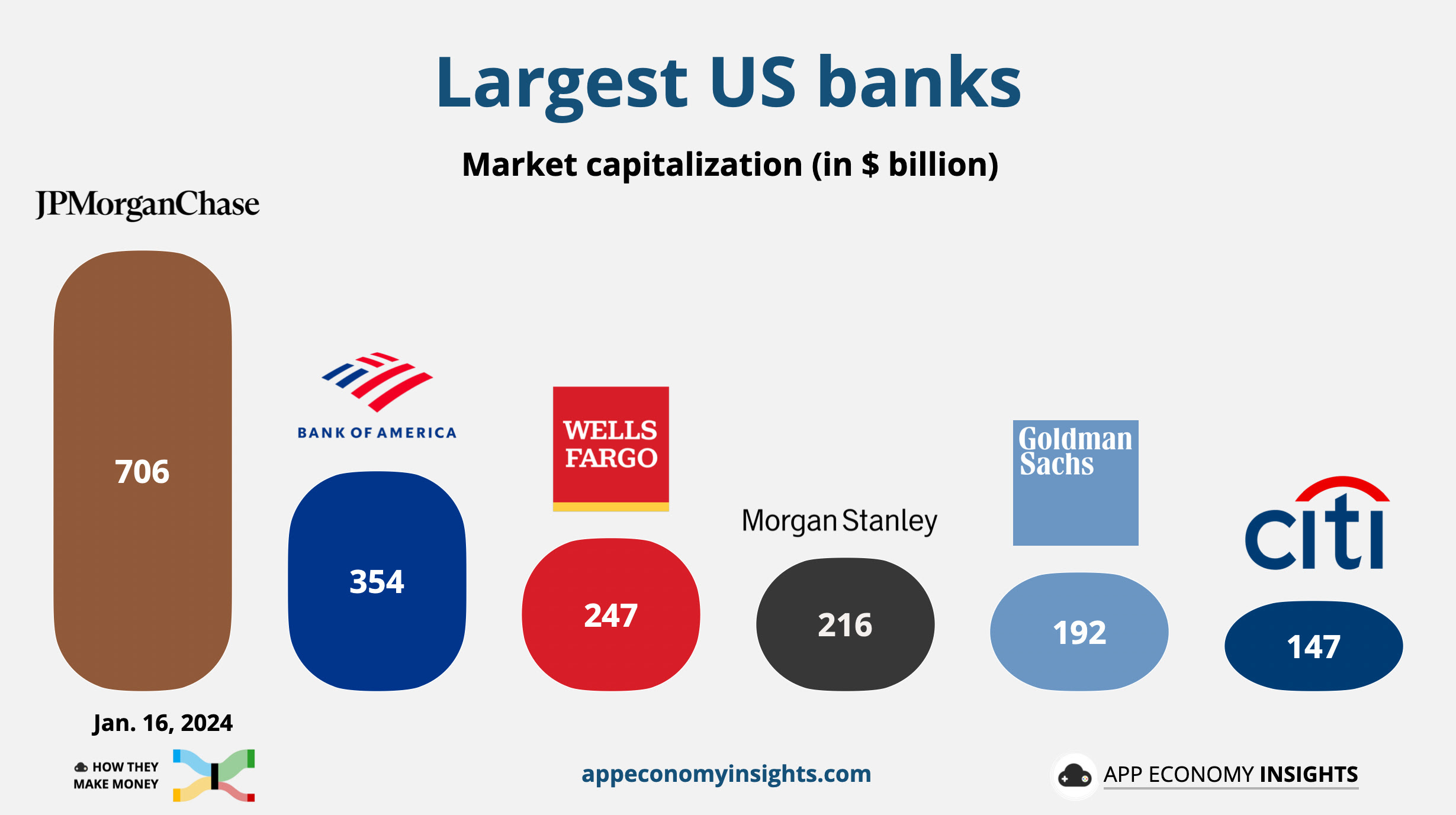

Here’s an updated look at the largest US banks by market cap.

As a reminder, banks make money through two main revenue streams:

- Net Interest Income (NII): The difference between interest earned on loans (like mortgages) and interest paid to depositors (like savings accounts). It’s the primary source of income for many banks and depends on interest rates.

- Noninterest Income: The revenue from services unrelated to interest. It includes fees (like ATM charges), advisory services, and trading revenue. Banks relying more on noninterest income are less affected by interest rate changes.

Here are the significant developments in Q4 FY24:

- Wall Street rebounds: Investment banking and trading delivered blockbuster performances across major banks. Investment banking revenue soared 24% at Goldman Sachs and 44% at BofA, reaching its highest level in three years.

- Trading boom continues: Market volatility tied to the US election and shifting rate expectations fueled record trading revenues. Morgan Stanley’s equities division hit an all-time high, while JPMorgan and Goldman Sachs saw substantial gains in fixed income.

- Corporate optimism fuels dealmaking: CEO confidence has driven a resurgence in M&A, IPOs, and private credit demand. Morgan Stanley’s M&A pipeline is the highest in seven years, signaling a multi-year comeback.

- NII stabilizes: While net interest income remained a mixed bag, forward guidance across banks suggests modest but steady growth in 2025, aided by loan demand and asset repricing at higher yields.

- Rising credit risks: Consumer lending stress persisted, with JPMorgan’s charge-offs rising 9%. Banks are bracing for higher delinquencies in credit cards.

- Commercial real estate remains a slow burn: Office sector stress continues, but banks are managing exposures cautiously with no significant shocks yet.

- Regulatory and restructuring efforts ongoing: Citigroup lowered its 2026 profitability target as it works through its turnaround, while Bank of America faced scrutiny over its anti-money laundering compliance.

- Resilient US economy: Banks see strong spending, loan growth, and corporate profitability, reinforcing the bull case for 2025 earnings momentum.

Here is the Q4 FY24 performance Y/Y at a glance.

Let’s visualize them one by one and highlight the key points.

JPMorganChase: Record Year

- Net revenue grew +11% Y/Y to $42.8 billion ($2.1 billion beat):

- Net interest income (NII): $23.5 billion (-3% Y/Y).

- Noninterest income: $20.3 billion (+15% Y/Y).

- Net income: $14.0 billion (+50% Y/Y).

- EPS: $4.81 ($0.71 beat).

- Key developments:

- Record profitability: JPMorgan achieved $58.5 billion in annual net income (+18% Y/Y), doubling its profit since 2020 and setting a new benchmark for US banking.

- Investment banking rebound: Fees rose 46% Y/Y to $2.6 billion, with advisory and equity underwriting exceeding expectations. Markets revenue surged 21% to $7.0 billion, led by a 20% rise in fixed-income revenue.

- Resilient economy: CEO Jamie Dimon highlighted strong consumer spending and business optimism but warned of persistent inflationary pressures and heightened geopolitical risks.

- Loan challenges: Consumer banking profit fell 6% Y/Y as net charge-offs increased 9% to $2.4 billion, primarily driven by credit card losses.

- Back to the office: JPMorgan announced a full return to in-office work by March 2025, sparking employee backlash and discussions of unionization within the workforce.

- Future outlook: The bank provided 2025 NII guidance of ~$94 billion ($2.7 billion beat). Adjusted expenses are projected at ~$95 billion, driven by growth initiatives and higher marketing and technology spending.

- Takeaways: JPMorgan’s record-breaking performance highlights its industry dominance. However, challenges like tighter loan margins, inflation, and workforce dissatisfaction could affect future performance.

- Key quote: CEO Jamie Dimon:

- “The US economy has been resilient. […] However, ongoing and future spending requirements will likely be inflationary […] Additionally, geopolitical conditions remain the most dangerous and complicated since World War II.”

BofA: Investment Banking Surge

- Revenue grew 11% Y/Y to $25.3 billion ($170 million beat):

- Net interest income (NII): $14.4 billion (+3% Y/Y).

- Noninterest income: $11.0 billion (+37% Y/Y).

- Net income $6.7 billion (+112% Y/Y).

- EPS $0.82 ($0.05 beat).

- Key developments:

- Strong earnings beat: BofA posted its best quarterly profit in over a year, with every revenue stream growing.

- Investment banking surge: Investment banking fees soared 44% to $1.7 billion, the highest in three years, driven by strong debt and equity underwriting.

- Trading stays hot: Sales and trading revenue climbed 10%, fueled by 13% growth in fixed income and 6% in equities, as market volatility drove client activity.

- Consumer & wealth strength: Credit card fees and asset management growth supported gains across BofA’s retail and wealth divisions. Client balances hit $4.3 trillion (+12% Y/Y).

- NII rebounds: After four quarters of decline, net interest income rose 3%, exceeding expectations, boosted by loan growth and stable deposits.

- Positive 2025 Outlook: The bank expects NII to continue rising through 2025, with projections reaching $15.7 billion per quarter by year-end.

- Takeaways: BofA enters 2025 with strong momentum, benefiting from rebounding dealmaking, trading tailwinds, and stabilizing interest income.

- Key quote:

- CFO Alastair Borthwick: “Consumers are still spending, and our business clients are profitable and increasingly optimistic. We’re entering 2025 with good momentum.”

Wells Fargo: Efficiency in Focus

- Revenue was flat Y/Y at $20.4 billion ($0.2 billion miss):

- Net interest income (NII): $11.8 billion (-8% Y/Y).

- Noninterest income: $8.5 billion (+10% Y/Y).

- Net income: $5.3 billion (+50% Y/Y).

- EPS: $1.43 ($0.07 beat).

- Key developments:

- NII challenges: While NII fell Y/Y, it grew slightly from the prior quarter and is expected to rise 1%-3% in 2025, reflecting higher reinvestment rates on maturing assets.

- Cost-cutting progress: Non-interest expenses dropped 12% Y/Y to $13.9 billion, driven by workforce reductions and efficiency initiatives, despite a $647 million severance charge.

- Investment banking rebound: Fees climbed 59% Y/Y to $0.73 billion as Wells Fargo capitalized on a resurgent dealmaking environment and efforts to strengthen its Wall Street presence.

- Capital returns: The bank returned $25 billion to shareholders in 2024, including a 15% dividend increase and $20 billion in stock buybacks, contributing to a 21% reduction in shares outstanding since 2019.

- Regulatory hurdles persist: The Fed-imposed asset cap remains a constraint, while recent fines against former executives highlighted past misconduct. CEO Charlie Scharf reaffirmed ongoing efforts to enhance compliance and risk controls.

- Future outlook: 2025 guidance includes $54.2 billion in non-interest expenses (down slightly Y/Y) and higher fee-based revenue. Efficiency gains and cost discipline should continue to drive improvements.

- Takeaways: Wells Fargo’s disciplined approach to cost-cutting and revenue diversification helped offset challenges in loan demand and NII. However, regulatory constraints remain headwinds to watch.

- Key quotes:

- CEO Charlie Scharf: “We are still in the early stages of seeing the benefits of the momentum we are building […] Efficiency will remain a significant area of focus in 2025.”

Morgan Stanley: Trading Dominance

- Revenue grew +26% to $16.2 billion ($1.2 billion beat).

- Net income: $3.7 billion (+142% Y/Y).

- EPS: $2.22 ($0.53 beat).

- Key developments:

- Blockbuster quarter: Morgan Stanley delivered a massive beat on both revenue and earnings, with profits more than doubling year-over-year.

- Trading dominance: Equity trading revenue jumped 51% to $3.3 billion, reaching an all-time high for the full year. Increased volatility post-election fueled a surge in client activity, particularly in prime brokerage and re-risking trades.

- Investment banking recovery: Investment banking revenue surged 25% to $1.6 billion, driven by a rebound in stock sales, debt underwriting, and M&A activity. CEO Ted Pick noted that the M&A pipeline is the strongest in seven years.

- Wealth management strength: The division saw $56.5 billion in net new assets, bringing total client assets to $7.9 trillion. The unit remains a stable revenue driver as Morgan Stanley pushes toward its $10 trillion asset target.

- Strategic reorganization: Morgan Stanley launched a new Integrated Firm Management division to streamline services across investment banking, trading, and wealth management.

- Takeaways: Morgan Stanley’s Q4 showcased the power of its trading and wealth engine, with record-breaking performance in equities and strong asset flows. FY25 looks bright based on the M&A pipeline, a resurgence in IPOs, and continued wealth management expansion.

- Key quotes:

- CEO Ted Pick: “Values in the M&A pipeline are the highest in seven years […] the pent-up activity we’re seeing is starting to release.”

Goldman Sachs: Doubling Down

- Revenue grew +23% Y/Y to $13.9 billion ($1.4 billion beat):

- Net income: $4.1 billion (+105% Y/Y).

- EPS: $11.95 ($3.60 beat).

- Key developments:

- Record equity trading: Equity trading revenue surged 32% Y/Y to $3.5 billion, setting an all-time high as market volatility drove increased client activity.

- Investment banking surge: Revenue climbed 24% Y/Y to $2.1 billion, with equity underwriting (+98%) and debt underwriting (+51%) seeing significant gains as capital markets rebounded.

- Asset management strength: Management fees in Asset & Wealth Management exceeded $10 billion for the year, driven by rising assets under management (+8% Y/Y to $3.1 trillion).

- Strategic evolution: Goldman continued to wind down legacy balance-sheet investments, yet these contributed a $472 million gain in Q4. The recently launched Capital Solutions Group aims to capture private credit and alternative financing growth opportunities.

- Platform Solutions growth: Revenue jumped 16% Y/Y, reflecting improvements in transaction banking and the Apple Card partnership, though Goldman signaled a potential early exit from the Apple tie-up.

- Takeaways: Goldman’s strategic pivot toward fee-based revenue streams and dominance in equity trading and investment banking shined in Q4. However, challenges remain in reducing reliance on legacy bets and navigating regulatory changes.

- Key quote:

- CEO David Solomon: “I’m encouraged that we have met or exceeded almost all of the targets we set in our strategy […] CEO confidence and private equity activity signal a strong path forward.”

Citigroup: Momentum Builds

- Revenue grew +12% Y/Y to $19.6 billion ($70 million beat):

- Net Interest income: $13.7 billion (-1% Y/Y).

- Non-interest revenue $5.8 billion (+62% Y/Y).

- Net income: $2.9 billion (compared to a $1.8 billion loss in Q4 FY23).

- EPS: $1.34 ($0.12 beat).

- Key developments:

- Market resurgence: Fixed-income markets (+37% Y/Y to $3.5 billion) and equity markets (+34% Y/Y to $1.1 billion) delivered significant growth, capitalizing on election-driven volatility.

- Banking momentum: Investment banking revenue climbed 35% Y/Y to $0.9 billion, fueled by strong corporate debt issuance and improving dealmaking activity.

- Buyback announcement: A $20 billion stock repurchase program was unveiled, with $1.5 billion scheduled for Q1 2025, reflecting management’s confidence in future earnings.

- Efficiency gains: Operating expenses declined to $13.2 billion (-2% Q/Q), aided by workforce reductions and technology investments. However, the 2026 RoTCE guidance was lowered to 10%-11%, highlighting the ongoing costs of transformation.

- Turnaround progress: CEO Jane Fraser emphasized long-term growth, citing momentum across business lines and improvements in credit quality. The planned IPO of Banamex, Citi’s Mexican retail banking unit, has been postponed to 2026 as part of the strategic overhaul.

- Takeaways: Citigroup demonstrated robust growth across key segments, supported by disciplined cost management. However, regulatory and operational challenges remain as the bank continues its transformation.

- Key quotes:

- CEO Jane Fraser: “This level is a waypoint, not a destination. We intend to improve returns well above that level and deliver Citi’s full potential for our shareholders.”

Big US banks showed strong momentum heading into 2025.

What’s next? With a resurgent IPO market, record stock trading, and sustained wealth management growth, banks are well-positioned to capitalize on renewed corporate optimism.

The big question: Will the deal frenzy continue, or will macro uncertainties put a lid on the rally?