Interest rates are a critical economic tool the Federal Reserve manages to balance inflation and economic growth. Whether high or low, these rates influence everything from consumer spending to corporate investments. Understanding their impact can help individuals and businesses make informed financial decisions.

What Are Interest Rates and How Do They Work?

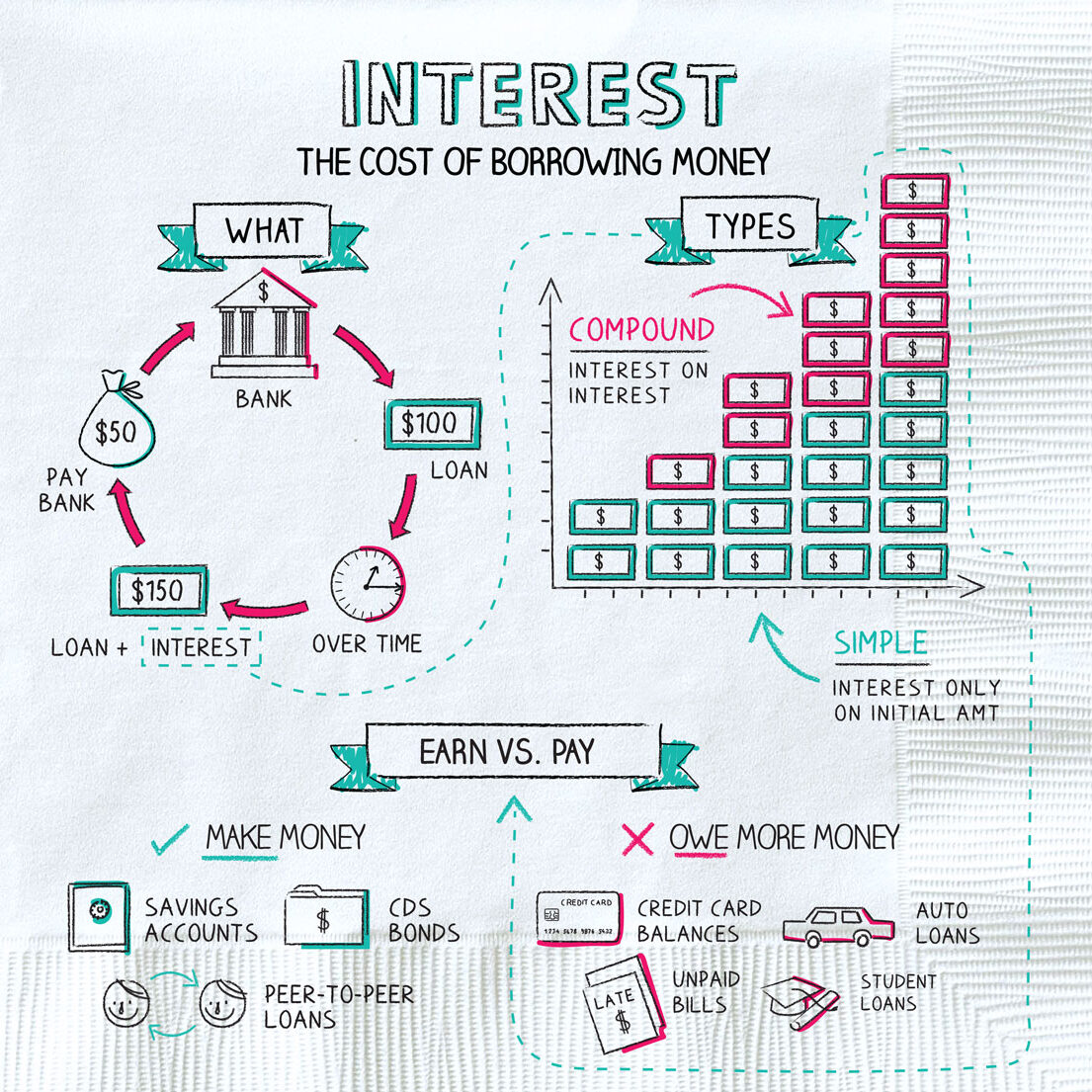

Interest rates are essentially the price of borrowing money or the reward for saving it, represented as a percentage of the loan or deposit amount. They play a fundamental role in the economy by influencing spending, saving, and investing behaviors for both individuals and businesses.

How Do Interest Rates Work?: Interest rates are determined by multiple factors, including government policies, market conditions, and borrower risk. Here’s a breakdown of how they function:

- Borrowing Money

When you take out a loan, the lender charges an interest rate as a fee for providing you the funds. This is how banks and other financial institutions generate profit. For example, if you borrow $10,000 with an annual interest rate of 5%, you’ll pay $500 in interest for the year (assuming simple interest). - Saving Money

On the flip side, when you deposit money in a savings account, the bank pays you interest for using your money to lend to others. For example, if you deposit $10,000 at a 3% interest rate, you’ll earn $300 in a year. - Federal Reserve’s Role

In the U.S., the Federal Reserve (the Fed) sets the Federal Funds Rate, which is the interest rate banks charge each other for overnight loans. This rate indirectly influences consumer interest rates, such as mortgages, personal loans, and savings accounts. - Risk Premium

Interest rates also vary based on the borrower’s creditworthiness. Higher-risk borrowers are charged higher interest rates to compensate lenders for the increased chance of default. For example, someone with a lower credit score may pay a 20% annual interest rate on a personal loan, while someone with excellent credit may pay only 5%. - Inflation and Interest Rates

Central banks like the Fed use interest rate adjustments to manage inflation. When inflation is high, raising rates makes borrowing more expensive, reducing consumer spending. Conversely, lowering rates can stimulate economic growth by making borrowing cheaper.

| Type | Explanation | Example |

|---|---|---|

| Fixed Interest Rate | The rate remains constant throughout the loan or investment term. | A mortgage with a fixed 5% interest rate. |

| Variable Interest Rate | The rate fluctuates based on market conditions or a benchmark like LIBOR or SOFR. | Credit cards with rates tied to market changes. |

| Simple Interest | Calculated only on the principal amount of the loan or deposit. | A $1,000 loan at 5% annual simple interest. |

| Compound Interest | Calculated on the principal and previously accrued interest, leading to exponential growth. | A savings account where interest compounds monthly. |

Example: How Interest Rates Work in Practice

- Borrowing Example:

Suppose you take a $20,000 car loan at a 5% annual interest rate for 5 years. Using simple interest, your total interest cost would be:

$20,000 x 5% x 5 = $5,000.

Your total repayment will be $25,000. - Saving Example:

If you deposit $10,000 into a savings account offering 2% compound interest annually, your balance after 3 years would be:

$10,000 x (1 + 0.02)^3 = $10,612.08.

Interest rates impact everyone, from individuals borrowing for mortgages and student loans to businesses seeking capital to expand. By influencing how money flows in the economy, they act as a powerful lever for financial stability and growth.

| Term | Definition |

|---|---|

| Federal Funds Rate | The rate at which banks lend to each other overnight. |

| Prime Rate | The interest rate banks offer to their most creditworthy customers, based on the Fed’s rate. |

| APR (Annual Percentage Rate) | The yearly cost of borrowing, including fees, as a percentage. |

Why Does the Fed Adjust Interest Rates?

The Fed uses interest rate adjustments to regulate economic activity:

- Controlling Inflation: High interest rates make borrowing more expensive, reducing spending and slowing inflation.

- Stimulating Growth: Low interest rates encourage borrowing and investment, stimulating economic activity during recessions.

- Balancing Unemployment: By influencing business investments, rates can indirectly affect job creation or layoffs.

High Interest Rates: Pros and Cons

| Pros | Cons |

|---|---|

| Reduces inflation, helping stabilize the economy. | Increases borrowing costs for businesses and consumers. |

| Encourages saving by offering higher returns on deposits. | Discourages spending and investment, potentially slowing economic growth. |

| Controls speculative bubbles in housing or stock markets. | Higher mortgage and credit card rates strain household budgets. |

Low Interest Rates: Pros and Cons

| Pros | Cons |

|---|---|

| Boosts consumer and business spending, driving economic growth. | Can lead to inflation if demand outpaces supply. |

| Lowers borrowing costs for mortgages, loans, and business investments. | Reduces returns on savings accounts, discouraging saving. |

| Encourages riskier investments in stocks or real estate for higher returns. | Risk of asset bubbles due to over-leveraging and speculation. |

How Interest Rates Impact Consumers and Businesses

1. Loans and Mortgages

- High Rates: Increase monthly payments for variable-rate loans and mortgages, discouraging borrowing.

- Low Rates: Lower the cost of borrowing, making homeownership and large purchases more accessible.

2. Savings Accounts

- High Rates: Offer better returns on savings and fixed-income investments.

- Low Rates: Provide minimal interest on deposits, pushing savers toward riskier investments.

3. Investments

- High Rates: Make bonds and fixed-income assets more attractive, reducing stock market activity.

- Low Rates: Encourage stock market participation by reducing returns on safer alternatives like bonds.

When Do We Want High or Low Interest Rates?

| Scenario | Preferred Rate Type | Why? |

|---|---|---|

| High Inflation | High Interest Rates | Reduces demand, slowing inflation. |

| Economic Recession | Low Interest Rates | Stimulates borrowing and investment, boosting economic activity. |

| Rising Housing Prices | High Interest Rates | Discourages speculative buying, stabilizing the housing market. |

| Low Consumer Spending | Low Interest Rates | Encourages borrowing and spending to revitalize the economy. |

Factors Influencing Interest Rates

- Federal Reserve Policy: The Fed sets the Federal Funds Rate, which directly influences borrowing and lending rates across the economy.

- Inflation: Higher inflation often leads to higher interest rates to prevent excessive borrowing and spending.

- Economic Growth: In periods of robust growth, rates may rise to prevent overheating. In downturns, lower rates stimulate activity.

- Supply and Demand for Credit: When demand for loans increases, lenders may raise rates. Conversely, higher savings rates can lower borrowing costs.

Tools to Monitor Fed Rate Decisions

| Tool | Purpose | Example |

|---|---|---|

| Federal Reserve Announcements | Provides updates on rate adjustments and economic outlook. | Federal Reserve Website |

| Economic Indicators | Tracks inflation, unemployment, and GDP growth to anticipate rate changes. | Bureau of Labor Statistics |

| Investment Platforms | Offers tools to analyze the impact of rates on different asset classes. | Bloomberg Terminal |

Related articles:

- Top Ways to Fund Your Business: A Complete Guide

- How to Build a Personal Brand Online

- Top Emerging Industries to Start a Business In

Sources: