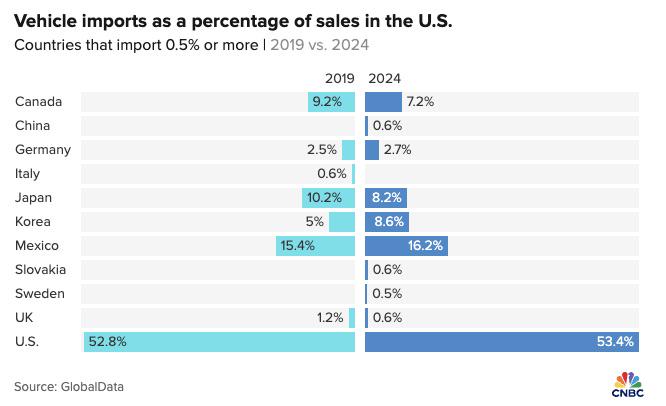

President Donald Trump’s 25% auto tariff announcement has shaken the global auto industry. Starting April 3, all non-U.S.-made cars and parts will face a permanent 25% tariff — a move Trump claims will “spur growth like you haven’t seen before.”

But which companies are most exposed? Who builds cars in the U.S., and who imports most of their fleet? Here’s what you need to know — from Ferrari’s 10% price hike to JPMorgan’s $14B hit prediction for General Motors.

What Are Auto Tariffs and Who Do They Hit?

Trump’s directive slaps a 25% tariff on all cars not made in the U.S., as well as foreign-sourced auto parts. Tariffs will apply on top of existing rates and are legally grounded in a 2019 Commerce Department report citing “national security” concerns. The tariffs aim to:

- Boost U.S. car manufacturing

- Penalize countries like Germany, Japan, and South Korea

- Reduce America’s budget deficit via tariff revenue

The tariffs will hit hardest for automakers with large import exposure — and benefit those with higher domestic manufacturing.

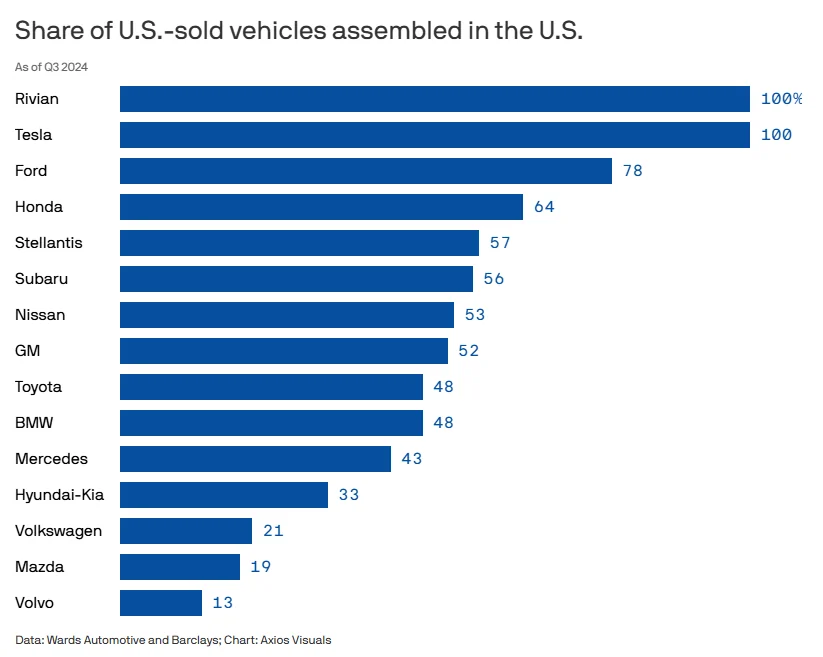

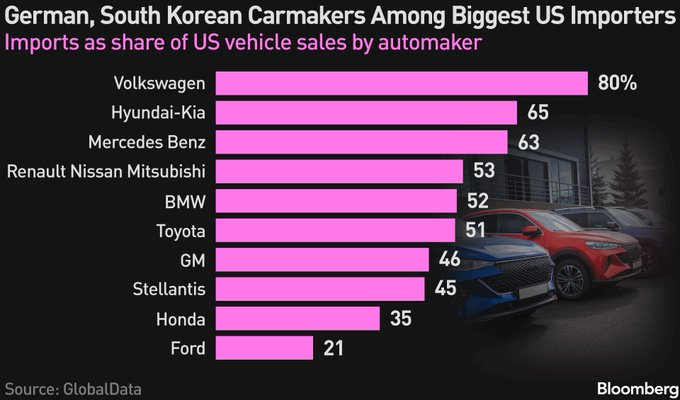

Volkswagen Group (Germany)

⚠️ IMPORT DEPENDENT

- 80% of VW’s U.S. vehicle sales come from imports

- Only 21% of VW’s U.S.-sold cars are assembled domestically

- One of the most exposed brands to Trump’s auto tariff plan

📉 Stock Impact: VW shares fell sharply, with global investors pricing in major cost pressures. U.S. tariffs could sharply raise vehicle prices, particularly for Audi and Porsche.

Mercedes-Benz (Germany)

⚠️ IMPORT HEAVY

- 63% of Mercedes vehicles sold in the U.S. are imported

- 43% of U.S.-sold cars are assembled in the U.S.

📉 Stock Impact: Mercedes-Benz stock dropped ~3.2% after Trump’s announcement. Higher tariffs could raise average Mercedes vehicle prices by several thousand dollars.

BMW (Germany)

- 52% of BMW’s U.S. sales are imports

- 48% assembled domestically — mostly from its Spartanburg, SC plant

BMW is slightly more balanced, but still at risk. BMW’s X-series SUV exports help offset some tariff impact.

📉 Stock Movement: BMW shares slipped ~2% on tariff fears.

Hyundai-Kia (South Korea)

⚠️ MAJOR RISK

- 65% of Hyundai-Kia U.S. sales are imports

- Only 33% of vehicles are assembled in the U.S.

Despite a large U.S. factory in Alabama, the bulk of Hyundai/Kia’s high-margin models are still made overseas.

📉 Stock Movement: Shares in Seoul fell as much as 5%. Hyundai is also a top exporter to the U.S., making it highly exposed.

Toyota (Japan)

- 51% of Toyota’s U.S. sales come from imports

- 48% of vehicles are assembled domestically

Toyota has invested heavily in U.S. manufacturing (Kentucky, Texas, Indiana). Still, the Lexus line and select hybrid models are imported.

📉 Stock Sentiment: Analysts warn of higher costs but expect Toyota to weather tariffs better than German rivals.

Nissan + Mitsubishi + Renault (Japan/France)

- 53% of U.S. sales are imports

- 53% of U.S.-sold vehicles assembled locally

While Nissan builds popular models in Tennessee and Mississippi, others — like the Ariya EV — are imported.

Honda (Japan)

- 35% of vehicles sold in the U.S. are imports

- 64% of cars assembled domestically

Honda is one of the best-positioned Japanese brands to avoid tariffs. The Accord, Civic, and CR-V are made in Ohio and Indiana.

General Motors ($GM)

- 46% of U.S. sales come from imports

- 52% of vehicles assembled in the U.S.

- BUT: Domestic vehicles carry only 29% U.S.-sourced content

🔻 JPMorgan Warning:

- Estimated $14 billion in tariff cost

- “Essentially all of GM’s global profits” could be wiped out

- GM’s import exposure (~$38B) could lead to a $10B tariff bill

- Tariffs also hit ~$4B in imported parts

📉 GM stock fell ~3% following the announcement.

Ford ($F)

- 21% of vehicles sold in the U.S. are imports — lowest of all major carmakers

- 78% of cars assembled in the U.S.

- But domestic content is only 30%

🔻 JPMorgan Forecast:

- Tariff exposure: ~$6 billion

- ~75% of Ford’s 2025 expected global profits at risk

📉 Ford shares were flat to slightly up post-announcement, seen as relatively safe.

Stellantis ($STLA) – Chrysler, Jeep, Dodge

- 45% of U.S. sales come from imports

- 57% of vehicles built domestically

- Domestic content: 47%

Stellantis is moderately exposed. Jeep and Ram are mostly built in the U.S., but many Dodge and Alfa Romeo models are imported.

Subaru

- 56% of cars assembled in the U.S. (Lafayette, Indiana)

- Low-volume imports from Japan may face tariffs

Mazda & Volvo

- Mazda: Only 19% of U.S.-sold cars built domestically

- Volvo: Just 13% U.S. assembly rate

These brands are highly exposed and likely to pass costs on to consumers.

Ferrari ($RACE)

✅ Response Already Published

- 2025 financial guidance remains unchanged

- No price hike on Ferrari 296, SF90, or Roma

- Other models may see up to 10% price increases for U.S. buyers

🟢 Commercial terms will remain unchanged for orders placed before April 2. Ferrari expects minimal disruption thanks to its ultra-premium positioning.

Tesla ($TSLA)

- 100% of U.S.-sold vehicles are built in the U.S.

- Domestic content estimated at 65–70%

- Tariffs are technically “net neutral or maybe good,” per Trump

Musk said the tariff impact is “still significant,” but Tesla remains best positioned domestically.

📌 For full Tesla impact, Cybercab expansion, and April 10 Saudi launch — see full article:

Trump’s Tax Twist: Loan Interest Deductions?

As part of the rollout, Trump proposed a new tax deduction for Americans buying U.S.-made vehicles: deduct the interest on car loans from federal taxes — only if the vehicle is made in the U.S.

This could soften the blow of higher prices while reinforcing the “Made in America” strategy.

Market Reactions So Far

German automakers: Down across the board

- Porsche: -4%, Mercedes-Benz: -3.2%, BMW: -2%

🇮🇹 Ferrari: Unchanged (thanks to strong luxury demand and policy clarification)

Ford & GM:

- GM: -3% (JPMorgan warning)

- Ford: Slightly up

📊Broad Auto Stock Index: Mixed sentiment as investors digest long-term implications

Final Take

Trump’s auto tariffs mark a turning point in U.S. trade policy. While they could help reshore jobs and boost domestic production, they also risk:

- Price hikes for consumers

- Profit hits for automakers

- Global trade retaliation

Every brand will be affected differently. Tariff exposure depends on where the car is built, how much of it is made with U.S. parts, and how global their supply chains are.

Disclosure: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with a financial advisor before making investment decisions.