Yesterday was packed: Trump announced a sweeping AI action plan, teased a near-final EU trade deal, and signed an executive order to expand US AI chip exports — a direct lift for $NVDA and $AMD.

At the same time, tech giants Tesla and Google reported earnings, giving investors even more to digest.

All of it helped push global markets to fresh highs — again.

Global Markets Charge Ahead on Trade & Earnings Hopes

Stocks surged from Asia to Wall Street, driven by renewed optimism that Trump’s trade strategy might be paying off.

- Trump: “We’re in the process of completing our deal with China. We’ll mostly be charging straight tariffs to the rest of the world.”

- Furthermore, behind closed doors, Trump administration officials and EU diplomats are finalising a 15% baseline tariff deal on EU goods.

More about: Trump Unveils Sweeping AI Plan as US Nears 15% Tariff Deal with EU

All major US indexes closed green, with small caps and industrials leading the charge:

- S&P 500 hit a new record

- Dow Jones crossed 45,000

- Russell 2000 jumped 1.5%

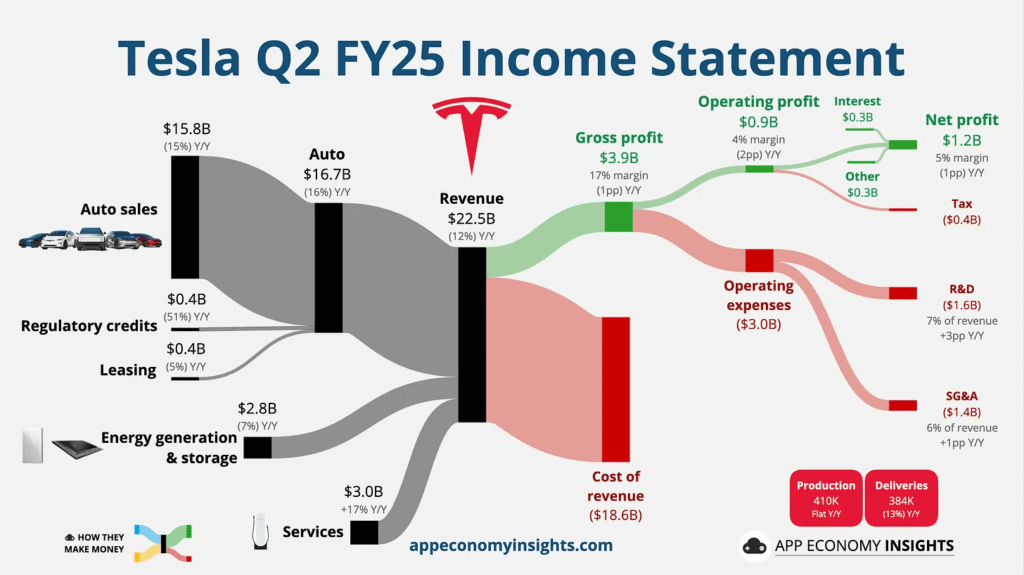

Tesla Stumbles, But Musk Sells the Future

Tesla’s Q2 earnings were weak — revenue declined more than 10%, and profits slumped — marking the company’s worst quarter in over a decade. But Elon Musk had a clear message: this is just the transition phase.

“Tesla is not going to be a car company in the long term,” Musk said. “We will be an AI and robotics company.”

He promised a full Robotaxi rollout by 2026, affordable EVs next year, and a future built on FSD, energy storage, and Optimus robots.

Despite the sharp revenue drop, shares held steady. Investors appear to be betting on the long game — again.

More about: Tesla Suffers Worst Revenue Crash in Over a Decade — Musk Warns of ‘Rough Quarters’ Ahead

Google Strong Across the Board, But Stock Dips

Alphabet posted strong top- and bottom-line results, led by double-digit growth in ads and cloud. AI continues to power every division, according to CEO Sundar Pichai. Waymo also got special attention, with its autonomous car network expanding in 10+ US cities.

Trump to Visit the Fed Today

In a surprise move, President Trump is set to visit the Federal Reserve today, just days before the central bank’s next policy meeting. While the White House hasn’t said why, many believe it’s an effort to pressure Jerome Powell into cutting rates.

Markets will be watching closely.

Today’s Data & Earnings Preview

- Economic Reports: Jobless Claims, Home Sales, Building Permits, TIPS Auction

- Pre-Market Earnings: American Airlines, Nokia, Blackstone, Honeywell, Mobileye

- After-Hours: Intel, Invesco Mortgage, Ocean Power, Newmont

Global Snapshot: Asia Extends Rally, Europe Opens Up

Asian stocks rallied again overnight — Japan’s Nikkei neared record highs, while South Korea and India posted strong earnings results. Bond spreads tightened across the region.

In Europe, futures are pointing up as investors await ECB’s rate decision. The central bank is expected to hold rates steady after seven straight cuts, though Trump’s tariff threats still loom in the background.

| Region | Market Movement | Drivers |

|---|---|---|

| Asia | MSCI Asia-Pacific ex-Japan up 0.4%Nikkei nears record high | Earnings optimism, easing trade tensions, upbeat US tech earnings |

| Japan | Nikkei and Topix extended gains | Trade deal with US, stronger financials, rate hike speculation |

| South Korea | Market up | Positive guidance from SK Hynix |

| India | Gains in major indices | Infosys earnings beat and upbeat outlook |

| Europe (futures) | DAX +1.15%FTSE +0.39%Euro Stoxx +1.17% | Anticipation of EU–US trade deal with 15% flat tariffs, ECB policy hold |

| US (prior close) | S&P 500: +0.85%Dow: +1.18%Nasdaq 100: +0.46%Russell 2000: +1.53% | Strong earnings, Trump’s trade momentum, AI chip expansion policy |

| Currencies | USD Index down Yen strengthens to 146.03 Euro up to $1.1774 | Weaker dollar on trade optimism and speculation about Trump’s Fed pressure |

| Bonds | 10Y Treasury: 4.39% (steady)2Y Treasury: 3.89% | Calm yields ahead of Fed decision |

| Commodities | Oil: $65.59 (+0.52%)Gold: $3,382/oz (slightly down) | Oil up on trade growth hopes; gold slips as safe-haven demand eases |

Market Mood This Morning: Cautious Optimism with a Side of AI

Between AI hype, tariff tailwinds, and tech resilience, bulls are holding firm. As of early Thursday, markets are in a strong spot — assuming Trump’s Fed visit doesn’t shake things up.

Keep your eyes on:

- The EU trade deal (or lack thereof)

- Fed’s response to Trump

- Intel earnings after the bell

The setup? A green open with high stakes.