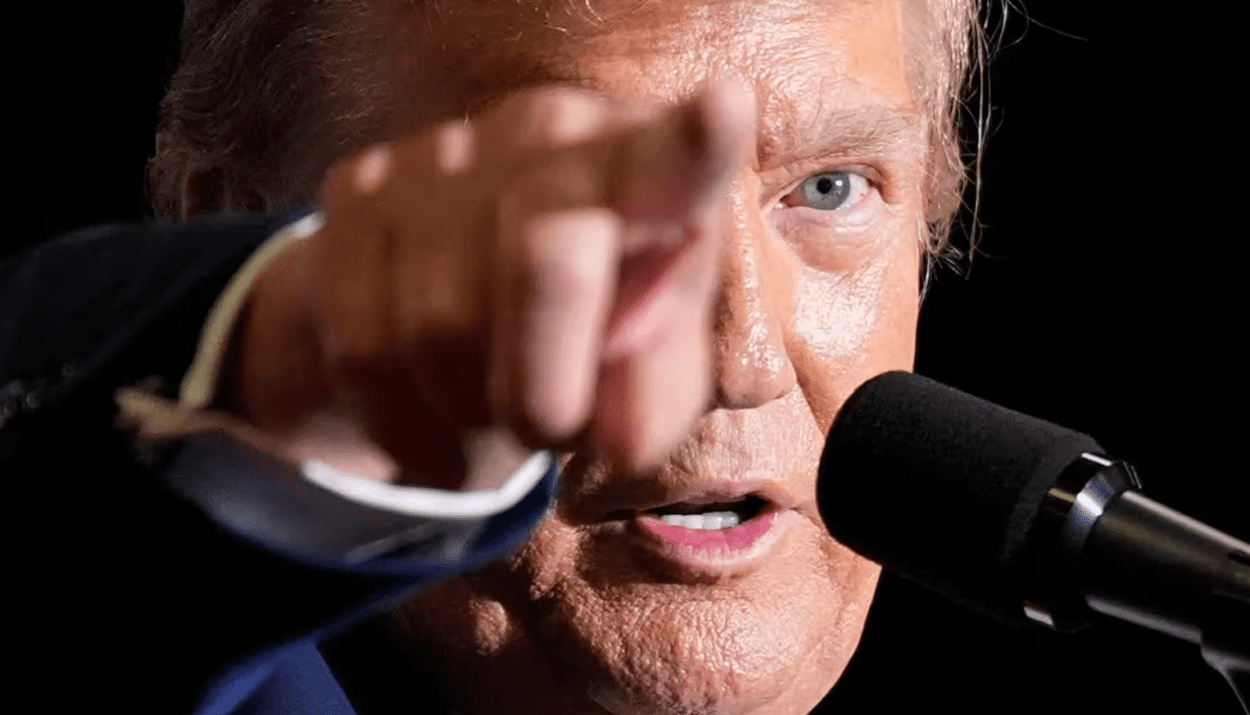

On November 6, 2024, Donald Trump was elected as the 47th president of the United States, securing 312 electoral votes. While his first term saw significant stock market gains — with the Dow Jones up 57%, the S&P 500 up 70%, and the Nasdaq up 142% — he inherits a market with historically high valuations, signalling potential turbulence ahead.

- Shiller P/E Ratio:

- Current level: 38.20 (double the 153-year average of 17.17).

- Comparable peaks: Before the dot-com bubble and late 2021/early 2022.

- Buffett Indicator:

- Measures market cap-to-GDP.

- Hit 206%, far above the 85% historical average.

- Previous peaks: 144% (dot-com bubble) and 107% (2008 financial crisis).

- Correction Risks:

Both indicators suggest heightened risk of a market correction.

Silver Linings

- Economic Cycles:

- Post-WWII recessions typically resolve in less than a year.

- Economic expansions last disproportionately longer than contractions, fostering corporate growth.

- Bull vs. Bear Markets:

- Average bear market: 286 days (9.5 months).

- Average bull market: 1,011 days (3.5 times longer).

- History shows patience is rewarded for investors.

- Unified Republican Leadership:

- Historically, the S&P 500 has delivered an average annual return of 14.52% under unified GOP control.

While Trump faces a historically overvalued market, long-term trends and economic resilience offer hope for investors. Patience and focusing on market fundamentals will likely be key in navigating the challenges ahead.