President Donald Trump announced Tuesday that the U.S. has finalized a sweeping trade agreement with Indonesia, unlocking full market access for American exporters to a nation of 280 million people for the first time.

Under the terms of the deal, Indonesia has agreed to:

- Purchase $15 billion worth of U.S. energy

- Buy $4.5 billion in U.S. agricultural products

- Acquire 50 Boeing ($BA) aircraft, including numerous 777s

Trump emphasized the trade asymmetry: “Indonesia pays tariffs here; we pay zero there.” Indeed, the agreement imposes a 19% blanket tariff on all Indonesian exports to the U.S., while U.S. goods will enter Indonesia tariff-free and face no non-tariff barriers.

Commerce Secretary Howard Lutnick said the new policy “flips the imbalance” and sends a message to trading partners: “No tariffs there; they pay tariffs here.”

Deal Highlights:

- Tariff structure:

- U.S. exports to Indonesia: 0% tariffs

- Indonesian exports to U.S.: 19% tariffs

- Exception: Transshipped goods will face additional tariffs

- Sectors involved:

- Energy (LNG, oil, natural gas)

- Agriculture (soybeans, corn, wheat)

- Aviation (Boeing jets, potentially parts & maintenance)

- Possible future exemptions for copper, a key Indonesian export, as Trump hinted it “might be used” in U.S. supply chains

Geopolitical Implications

Indonesia becomes the fourth country in three months to announce a trade agreement with the Trump administration, following similar, vague deals with Vietnam, India, and Mexico. While some prior announcements lacked follow-through, this deal includes detailed figures and tariff structures—making it one of the most concrete so far.

Trump also signaled that India “is working along the same line,” suggesting more reciprocal trade deals are on deck.

Business Impact

The deal will significantly reshape U.S.–Indonesia trade, which totaled $38 billion last year, according to the Commerce Department. Top U.S. imports from Indonesia include apparel, footwear, and electronics—all of which will now be subject to the 19% tariff.

For American exporters, especially in energy and aerospace, this is a windfall. The Boeing ($BA) order alone—50 aircraft, largely wide-body 777s—could be worth well over $10 billion at list prices, giving the company a boost amid intense competition from Airbus and domestic rivals.

However, businesses warn the deal is a double-edged sword. The unpredictability of Trump’s tariffs—many of which can be altered or imposed overnight—has left manufacturers hesitant to place long-term orders or invest in global supply chains.

“Great deal for everybody,” Trump posted on Truth Social. “I dealt directly with their highly respected president.”

The Indonesian government has not yet commented publicly on the deal.

Trump’s latest trade maneuver may bolster U.S. exports, but it also deepens tariff uncertainty for importers. The aggressive stance could boost American manufacturing—but at the risk of costlier goods for U.S. consumers.

BusinessStock MarketTrending News

June inflation breakdown: Consumers feel the pinch with tariffs looming

ByGuntakin Mehnatli

ByGuntakin Mehnatli - July 15, 2025

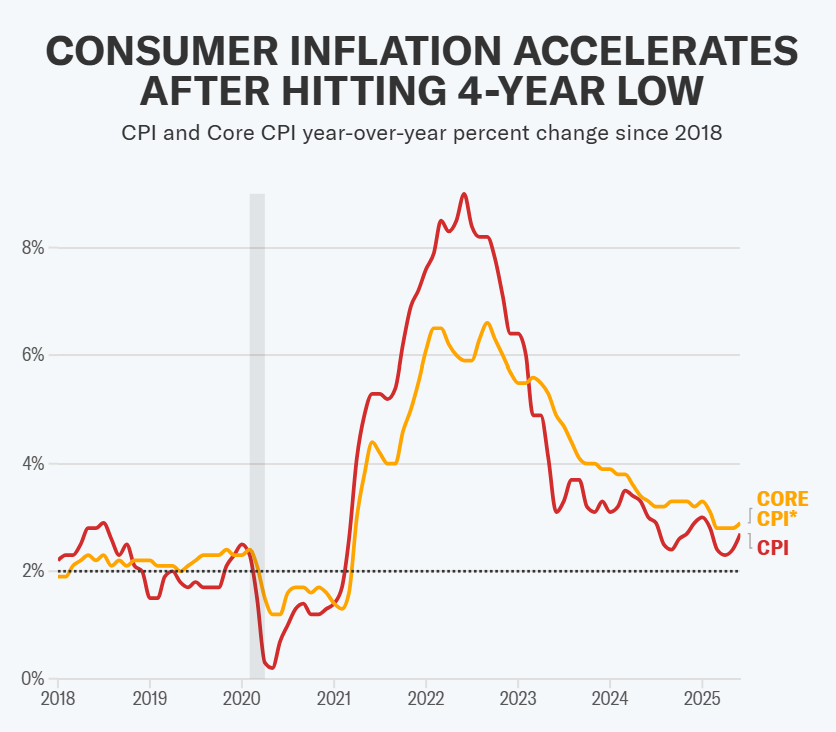

Inflation picked up speed in June, ending a four‑month cooling streak. The 0.3 % month‑on‑month rise was exactly what forecasters feared and lifted the annual CPI rate to 2.7 %, the fastest since January. Core inflation (which strips out food and energy) also inched up, underscoring that underlying price pressure is still sticky.

| May ’25 | June ’25 | Street est. | |

|---|---|---|---|

| CPI y/y | 2.4 % | 2.7 % | 2.6 % |

| CPI m/m | 0.1 % | 0.3 % | 0.3 % |

| Core y/y | 2.8 % | 2.9 % | 2.9 % |

| Core m/m | 0.1 % | 0.2 % | 0.3 % |

Tariff Fingerprints Emerge

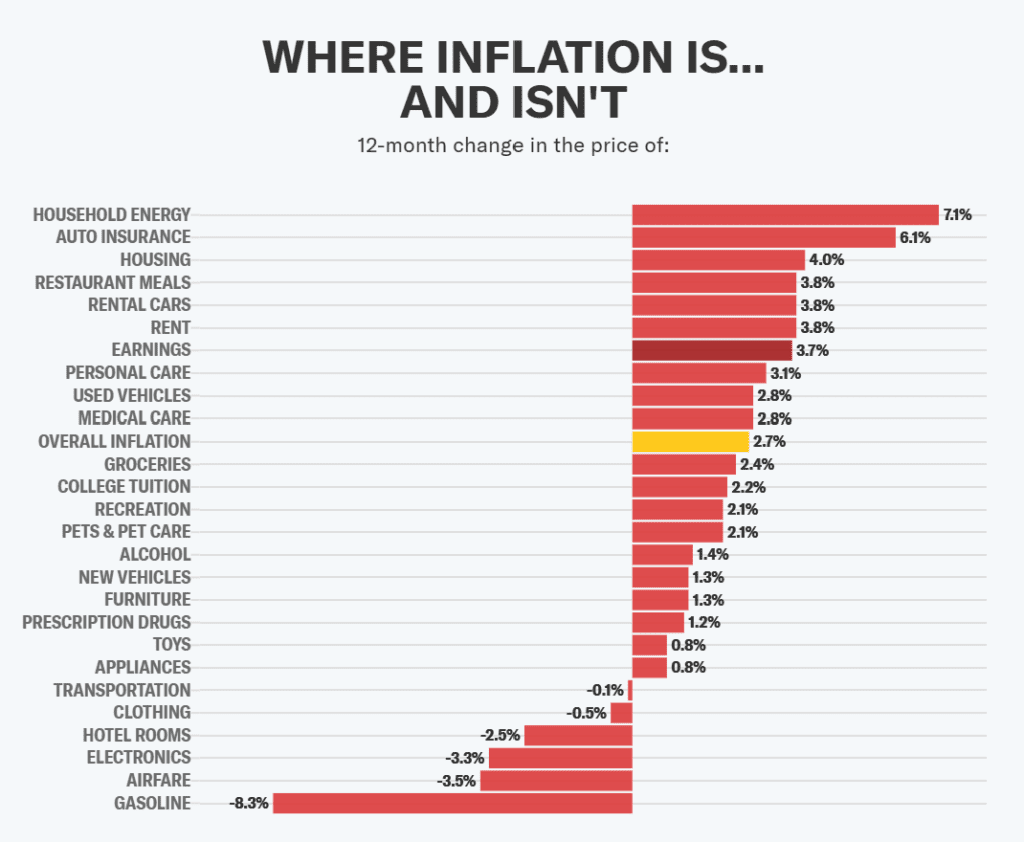

Economists have warned that the fresh 20–50 % duties on imports from Canada, Mexico and the EU would seep into prices once pre‑tariff inventories ran down. June’s CPI offered the first broad confirmation: tariff‑exposed goods drove more than a quarter of the monthly core increase.

Subscribe to our Newsletter

Receive our latest trending news and business updates in your inbox.

Opt in to receive news and updates. By ticking the checkbox, you agree with Privacy Policy.Subscribe

Biggest movers (m/m):

- Household furnishings & operations +1.0 % — largest jump since Jan 2022

- Apparel +0.4 % (footwear +0.7 %)

- Recreation commodities +0.4 % (audio‑video equipment +1.1 %)

- Major appliances +0.3 %

What’s Getting Pricier — Category Deep‑Dive

Beyond tariffs, the usual inflation pain points still nipped consumers. Food and medical bills kept climbing, while shelter costs—though easing—remained the biggest single CPI driver.

| Category | MoM % | YoY % | Quick take |

|---|---|---|---|

| Coffee | +2.2 | +4.7 | Arabica futures + tariff pass‑through |

| Beef (ground) | +0.9 | +9.8 | Drought & feed costs |

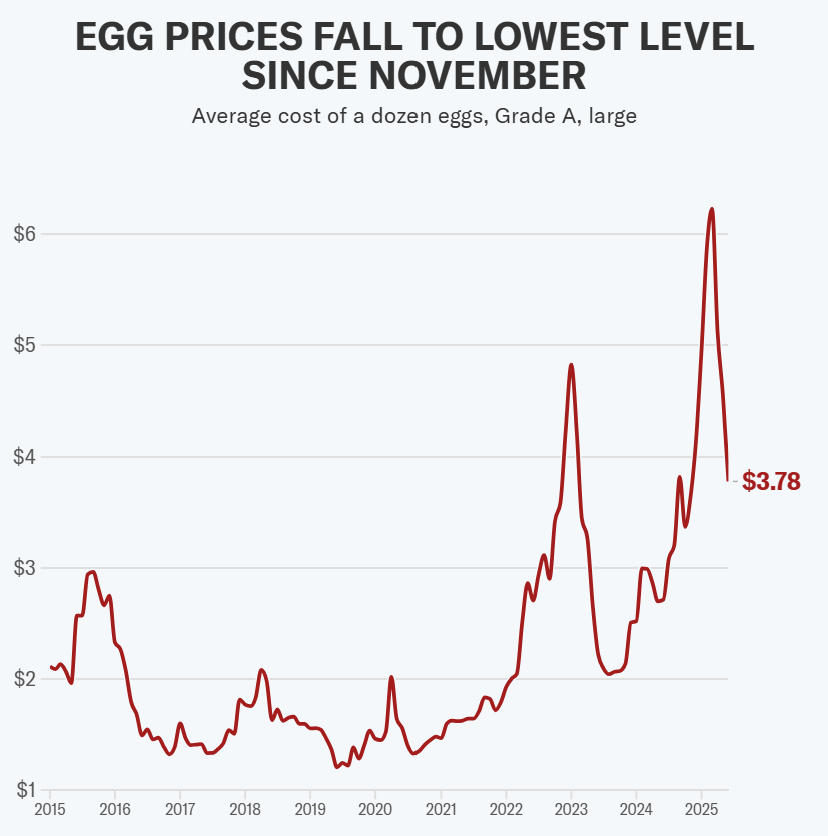

| Eggs | –7.4 | +27.4 | Avian‑flu recovery, but still elevated |

| Medical services | +0.6 | +3.4 | Hospital costs +0.7 % |

| Shelter | +0.2 | +3.8 | Slowest annual gain since 2023 |

| Used cars | –0.7 | +2.8 | Pandemic spike unwinding |

| Gasoline | +1.0 | –8.3 | Still cheaper than a year ago |

How Markets Reacted

Traders viewed the report as a modest setback for rapid Fed easing—but not a game‑changer. Bond yields edged up, the dollar’s bounce fizzled, and equities kept a cautious bid.

- Two‑year Treasury: +5 bp to 4.59 %

- Fed‑funds futures: September‑cut odds fell to ~40 %

- S&P 500 futures: trimmed early gains but stayed positive, buoyed by Nvidia chip news

- Dollar Index: gave back a knee‑jerk pop; euro holds near $1.17

What It Means for the Fed

The data landed just as President Trump labeled Chair Jerome Powell a “knucklehead” for not slashing rates below 1 %. Economists say the report hands Powell cover to sit tight in July and maybe September:

- Scott Anderson, BMO: June is “a step in the wrong direction that will keep the Fed on the sidelines.”

- Seema Shah, Principal: Tariff levies are “slowly filtering through core goods prices,” so the Fed should wait for the full impact.

Futures now imply fewer than two rate cuts in 2025, down from three just a week ago.

Looking Ahead

Tariff escalation and housing‑market cooling will dominate the next data prints. If Trump’s across‑the‑board 15 %–20 % levy launches on Aug 1, economists warn of a second inflation bump into Q4.

| Date | Event | Why it matters |

|---|---|---|

| Jul 24 | Fed Beige Book | First anecdotal take on post‑tariff price hikes |

| Jul 30 | FOMC meeting | 95 % odds of “hold” |

| Aug 1 | Tariffs on Canada, EU, Mexico take effect | Direct hit to durable‑goods CPI |

| Aug 12 | July CPI | Last read before the September FOMC |

| Mid‑Aug | Big‑box retailer earnings | Corporate color on pass‑through |

| Sep 11 | Aug CPI | Potential decider for a fall rate cut |

Tariff timer: Aug 1 duties on Canada, Mexico and the EU could add fresh bumps in coming months.

Fed watch: Next pivotal data points are July PPI (Aug 14) and August CPI (Sep 11), the last read before the September FOMC.

Corporate lens: Big‑box retailers and appliance makers will face pointed questions on pass‑through in Q2 calls over the next three weeks.

Inflation isn’t back to the 2022 panic highs, but tariffs are finally starting to bite—one sofa, steak and cup of coffee at a time—leaving the Fed little room to loosen policy until the trade smoke clears.

The main source is Yahoo. Finance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches

Week Ahead (July 14 – 18): Inflation Check, Big Bank Earnings, Tech Titans

Hegseth Orders Every US Squad Armed by 2026: Defense Stocks Up

Tesla Paid for Elon’s Politics — Will the “America Party” Help or Hurt?

Shaken, Not Stirred: Markets brush off Trump’s latest tariff barrage

Wall Street Remains Resilient Amid New Tariff Threats

Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals