US stocks suffered steep losses Friday as Iran launched a missile barrage in retaliation for Israel’s overnight airstrike, marking one of the most dangerous escalations in the region in recent years. But despite the chaos, President Trump told The Wall Street Journal that Israel’s strike could ultimately be “great for the market.”

“Iran won’t have a nuclear weapon — that was a great threat to humanity,” Trump said. “It will be great for the market — should be the greatest thing ever for the market.”

Market Reaction:

- Dow Jones (^DJI): -1.92%, down over 800 points

- S&P 500 (^GSPC): -1.18%

- Nasdaq Composite (^IXIC): -1.30%

- Crude Oil (CL=F): +8.23%, spiking to $73.64, after briefly soaring 13%

- Gold (GC=F): +1.60%, trading at $3,456.70/oz, nearing record highs

- Bitcoin (BTC-USD): Stabilized around $105,000 after overnight dip

Key Events:

- Israel launched a “preemptive strike” targeting Iranian nuclear facilities.

- Iran responded, calling it a “declaration of war,” and fired dozens of missiles.

- Israeli Defense Forces: “All of Israel is under fire.”

- Prime Minister Netanyahu said strikes “will continue for as many days as it takes.”

Washington Response:

- Trump urged Iran to “make a deal” via Truth Social: “JUST DO IT, BEFORE IT IS TOO LATE.”

- Secretary of State Marco Rubio said Israel acted unilaterally with no US involvement, but warned Iran not to target US personnel or assets.

- JPMorgan now sees a 17% probability of a worst-case scenario that could push oil to $120 and drive US CPI to 5%.

Energy & Safe-Haven Moves:

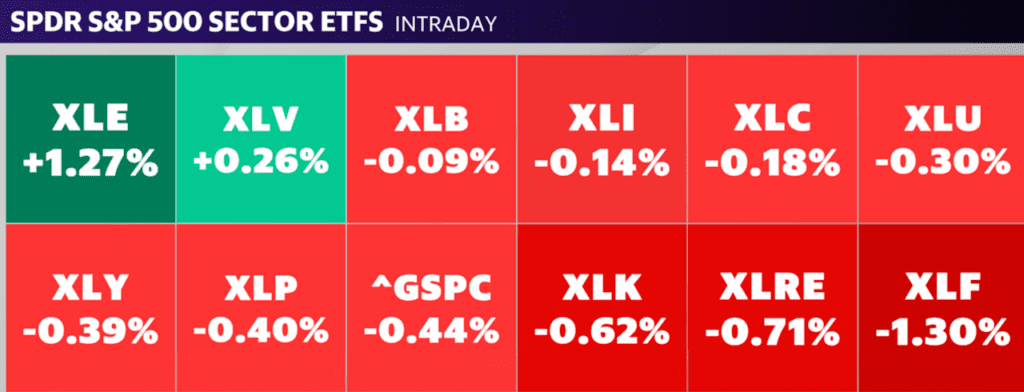

- S&P 500 Energy Select ETF (XLE): +1%

- Platinum prices: hit highest since Feb 2021

- Gold futures: +1.7%, now up ~32% YTD

Sector Movers:

- Visa ($V): -5.28% — hit by stablecoin reports from Amazon ($AMZN) and Walmart ($WMT)

- Adobe ($ADBE): -5.17% — despite strong earnings, AI competition weighs

- RH ($RH): +6.36% — stock rallied after surprise Q1 profit

EV Sector:

- Tesla ($TSLA): +2.57%, despite US registrations falling 16% YoY

- Chevy (GM): EV registrations surged 215%

- Ford ($F): Slipped to third place, sales down 33%

- Overall EV market share dropped to 6.6% in April (from 7.4%)

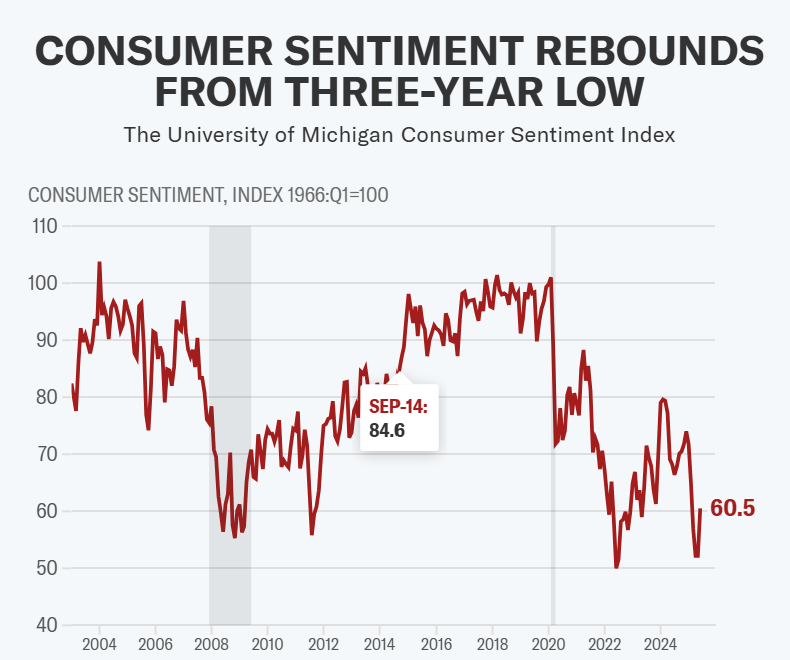

Consumer Outlook:

- University of Michigan Sentiment Index rose to 60.5, first rebound in six months

- One-year inflation expectations fell to 5.1% (from 6.6%)

- Trump’s tariff pauses credited with calming pessimism

As geopolitical tensions flare, Wall Street is bracing for volatility, but Trump remains confident: “Iran won’t have nukes. Markets win.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

10 Reasons China Is Leading the Robot Race

Trump Unloads on EV Mandates, Talks Musk, Tariffs, and National Guard: Here’s What He Said

Why gold beat Euro to become world’s second-largest reserve asset

Trump-Musk Feud Last Phase: Tesla WON

Washington Starts to ‘De-Musk’: 5 Stocks Poised to Gain From the Shift