Donald Trump said the next Fed chair should lower interest rates when markets and the economy are performing well, signalling his preference for a more market-friendly central bank as he prepares to replace Jerome Powell.

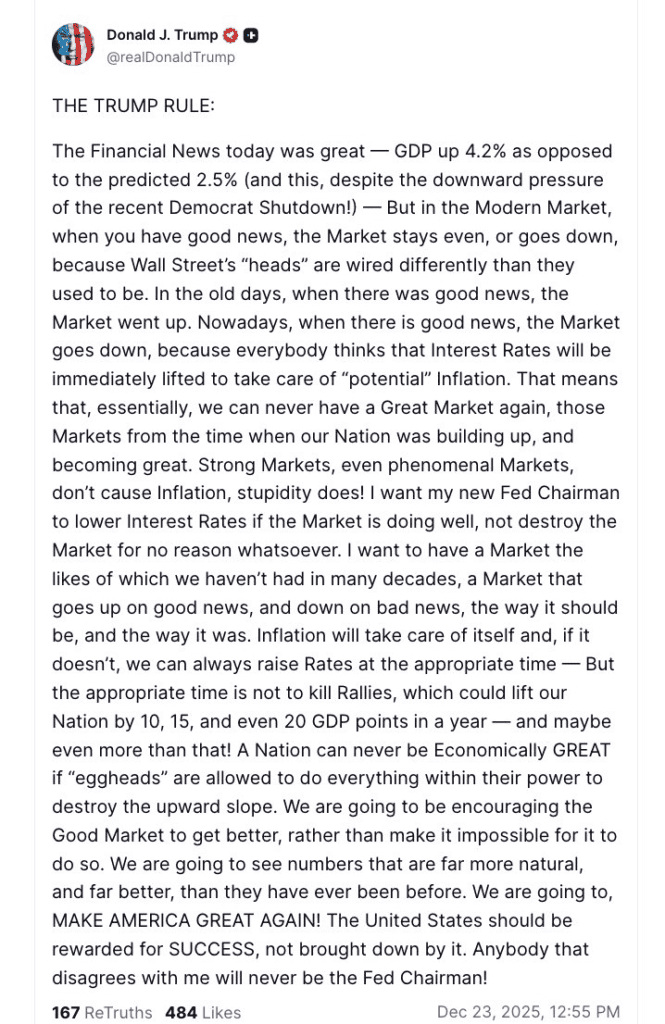

In a social media post on Tuesday, Trump said he wants a Fed chair who cuts rates if the market is doing well, arguing that strong economic data should no longer trigger fears of tighter monetary policy. He added that anyone who disagrees with this view “will never be the Fed Chairman.”

Trump criticized what he described as a shift in market dynamics, where positive economic news now leads to stock selloffs due to concerns that the Federal Reserve will raise rates to combat potential inflation. According to Trump, this mindset prevents markets from sustaining long-term gains.

Tuesday’s market action ran counter to that pattern. New data showed US gross domestic product grew at a 4.3% annualized pace in the third quarter, beating most estimates. Stocks rose for a fourth straight session, with the S&P 500 on track for another record close.

The comments come as Trump looks to reshape Fed leadership amid voter pressure over affordability, housing costs, and borrowing expenses. He has repeatedly argued that lower interest rates would help revive the housing market and support economic growth. Trump has also said he expects to be consulted by his eventual Fed chair on rate decisions.

Last week, Trump said his shortlist for the role includes “three or four” candidates, with a decision expected within weeks. He has named Kevin Hassett, director of the National Economic Council, Kevin Warsh, a former Fed governor, and current Fed Governor Christopher Waller as leading contenders.

Earlier this month, the Federal Reserve cut its benchmark rate to a range of 3.5% to 3.75%, marking its third consecutive reduction. Still, divisions remain within the Federal Open Market Committee over how much further rates should fall. Trump has previously called for rates to be lowered toward 1% or even below.

Trump’s stance underscores growing political pressure on the Fed, raising questions about central bank independence and how future monetary policy could respond to strong growth, inflation risks, and market performance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Big Year for Old School Wall Street Trades Gets Lost in AI Hype

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch