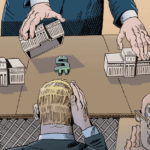

President Donald Trump has proposed at least nine different uses for his growing, though recently shrinking, tariff revenues, from $2,000 “tariff dividend” checks to paying down the national debt, even as receipts fell for the first time since his second-term trade duties began.

According to Yahoo Finance, November tariff revenues slipped to $30.76 billion, down from $31.35 billion in October, after Trump lifted tariffs on consumer staples like coffee, cocoa, and oranges to ease inflation concerns. Despite that drop, Trump continues to promote tariffs as the financial backbone of his economic vision.

At a rally in Pennsylvania, he called “tariff” one of his favourite words,, second only to “family” and “religion”, and insisted the policy would fund a list of ambitious programs. Among them:

- $12 billion in farm bailouts

- Tariff dividend checks for Americans

- Tax cuts and debt reduction

- Childcare funding

- A sovereign wealth fund

- A Ukraine “victory fund” financed by new China tariffs

- Elimination of income taxes

Trump’s administration has already redirected tariff funds to keep federal programs afloat, including a $300 million boost to the WIC nutrition program during the government shutdown.

However, analysts say Trump’s promises far exceed what tariffs actually bring in. With $236 billion collected so far this year, the numbers don’t add up, one round of $2,000 payments alone could cost up to $600 billion, according to the Committee for a Responsible Federal Budget.

Economists warn that using tariffs to fund such programs could widen the deficit rather than reduce it. “A better way to provide relief from the burden of tariffs would be to eliminate the tariffs,” the Tax Foundation said.

Adding to the uncertainty, the Supreme Court is set to rule on the legality of Trump’s trade policies, a decision that could invalidate many tariffs or even force refunds of up to $100 billion.

Despite the risks, Trump remains defiant, calling tariffs “a beautiful word” and a tool to both finance America’s future and punish foreign nations. Whether that vision holds up may soon depend on the courts.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.