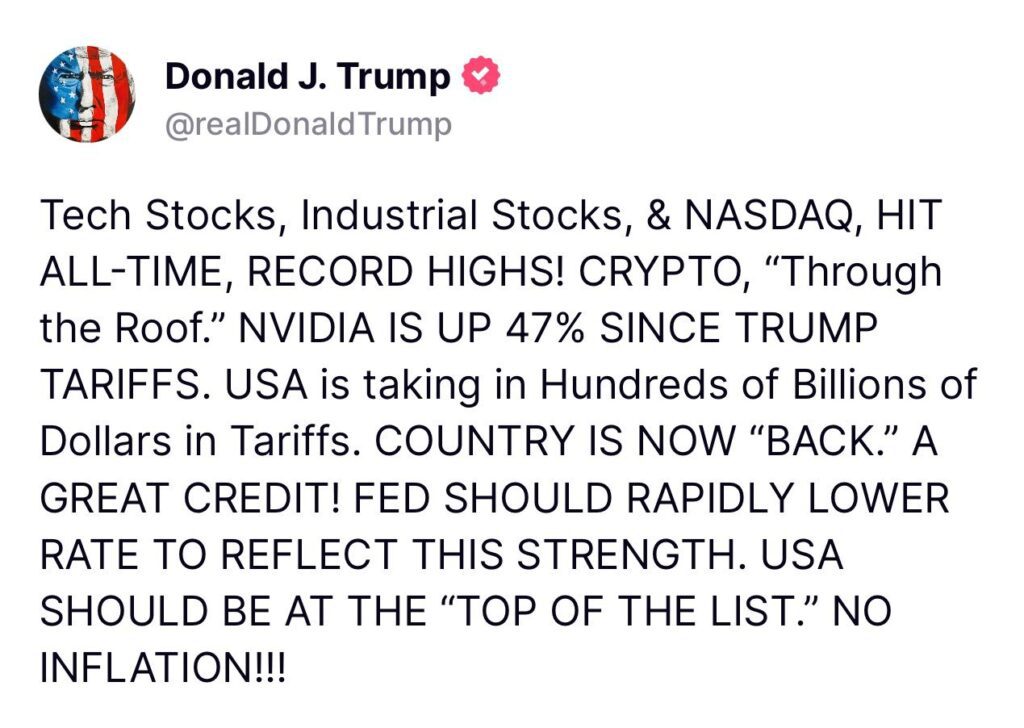

Donald Trump took to Truth Social on Thursday to hail what he called an “all-time, record” rally in tech, industrials and crypto while pressing the Federal Reserve to slash interest rates “to reflect this strength.”

“Tech Stocks, Industrial Stocks, & NASDAQ, HIT ALL-TIME, RECORD HIGHS! CRYPTO, ‘Through the Roof.’ NVIDIA IS UP 47 % SINCE TRUMP TARIFFS… FED SHOULD RAPIDLY LOWER RATE,” Trump wrote in a post peppered with capital letters.

Markets mixed after new tariff details

The social-media blast came less than 24 hours after the White House confirmed a 50 % tariff on imported copper and on all goods from Brazil, effective 1 August, alongside fresh duty letters to more than 20 other countries.

- Dow Jones Industrial Average was up about 0.4 % in late-morning trade, shrugging off tariff jitters.

- S&P 500 edged 0.1 % higher, while the Nasdaq Composite slipped 0.1 % after clocking a record at the open.

- Brazil’s iShares MSCI Brazil ETF (EWZ) fell more than 2 % as President Luiz Inácio Lula da Silva vowed reciprocal measures.

Coffee & OJ Futures Perk Up After Trump Slaps Brazil With 50 % Tariff

US breakfast staples got pricier on Thursday: coffee futures briefly spiked and orange-juice contracts jumped 6 % after the White House said all Brazilian imports will face a 50 % duty starting Aug. 1. Brazil supplies about one-third of America’s unroasted coffee and roughly three-quarters of its orange juice, so higher costs could soon filter down to grocery aisles. The news also hit Brazilian assets— the real slid to 5.60 per dollar and the iShares MSCI Brazil ETF (EWZ) fell more than 1 %. President Lula called the move “unilateral” and vowed to respond under Brazil’s reciprocity law.

AI still the market’s engine

Investor enthusiasm for artificial-intelligence plays continues to overshadow protectionist headlines. Nvidia (NVDA) briefly held a $4 trillion market value on Wednesday and remains up nearly 50 % since the first round of “Liberation Day” tariffs were unveiled in April.

Wharton economist Jeremy Siegel told CNBC that AI productivity gains could “counteract any price increases from the tariffs,” adding that the bull market “has further to run” unless trade frictions spark broader cost shocks.

Fed in focus

Traders are parsing Thursday’s initial jobless-claims reading, which fell to 227 000, and awaiting comments from Fed officials Alberto Musalem, Christopher Waller, and Mary Daly later in the day. CME FedWatch futures still price roughly 67 % odds of a September rate cut, but policymakers have said any tariff-driven inflation will likely be “temporary or modest,” according to minutes from the June FOMC meeting.

Earnings and sector moves

- Delta Air Lines (DAL) soared 13 % after guiding for stronger Q3 and full-year profits, lifting airline peers and the Dow Transports.

- WK Kellogg (KLG) exploded 30 % on reports of a $3 billion takeover by Nutella-maker Ferrero.

- The SPDR S&P Metals & Mining ETF (XME) jumped to its highest level since 2011, aided by a 54 % surge in MP Materials after the Pentagon agreed to take a stake in the rare-earth producer.

For now, Wall Street seems willing to bet that “T-A-C-O” — “Trump Always Chickens Out” — will hold, and that any near-term tariff costs will be eclipsed by AI-driven earnings momentum. Whether the Fed responds to Trump’s call for rapid easing remains an open question as the central bank tries to balance cooler inflation data against rising geopolitical risk.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Shaken, Not Stirred: Markets brush off Trump’s latest tariff barrage

Wall Street Remains Resilient Amid New Tariff Threats

Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners

Global Stocks Are Crushing US – But Which Ones?

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump