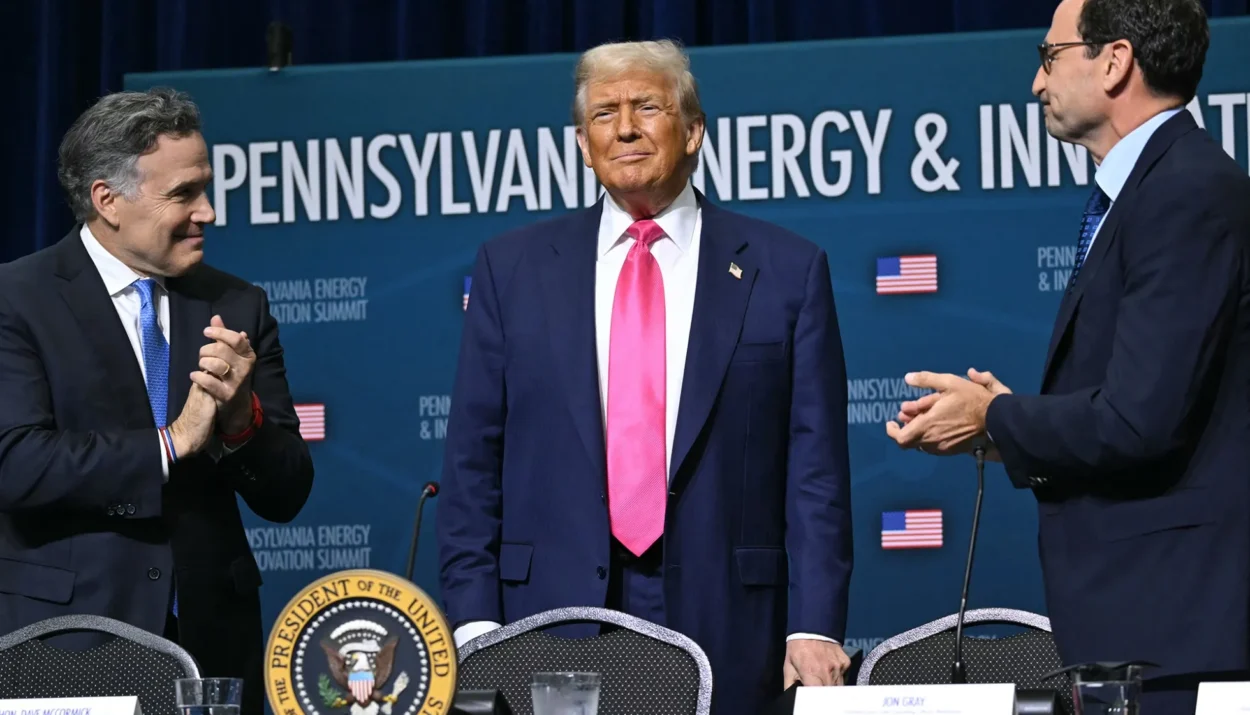

President Trump rolled into Pittsburgh’s Energy & Innovation Summit touting $92 billion in private money—Google, Blackstone, CoreWeave and others, to build AI‑ready data centres and the firm power (gas, hydro, nuclear) to run them, effectively casting Pennsylvania as the pilot “AI power corridor” he wants nationwide.

What Was Announced — At a Glance

Google – $25 B to expand data‑center capacity across the PJM grid plus $3 B to modernize two Brookfield hydro plants (Safe Harbor & Holtwood), adding 670 MW of clean power.

Blackstone + PPL – $25 B for “colocated” data centers fed by new gas‑fired plants; Jon Gray says the JV could “catalyze another $60 B.”

CoreWeave – $6 B for an NVIDIA‑ready data center in Lancaster, starting at 100 MW and scaling to 300 MW; shares popped 7 %.

FirstEnergy – $15 B to harden and digitize the grid in 56 Pennsylvania counties.

Homer City Redevelopment – $15 B PA‑gas deal to resurrect a shuttered coal site as a 4 GW gas plant.

Energy Capital Partners – $5 B York II data center plus 51 community‑solar projects (24 k homes).

Other pledges – Anthropic, GE Vernova ($100 M), Constellation ($2.4 B uprate at Limerick nuclear plant), Westinghouse, Equinor, TC Energy and more round out the total.

Trump’s pitch: “This is a really triumphant day for the Commonwealth and for the United States of America — we’re doing things nobody ever thought possible.”

Google’s Ruth Porat: “These investments will increase energy abundance and empower Americans to thrive in the AI era.”

Context: DOJ grid study warns AI and reshoring could double blackout risk by 2030 if firm capacity lags demand.

Why It Matters

- A New “AI Power Corridor.” Pennsylvania’s shale gas, legacy hydro assets and idle coal sites make it uniquely suited for colocation — shrinking interconnection queues that have slowed projects elsewhere. Winners: gas producers (EQT), transmission builders (PPL), and data‑center REITs.

- Fossil‑First Energy Policy. Trump’s recently‑passed “big, beautiful bill” slashes wind‑solar tax credits and steers financiers toward gas, coal and nuclear. The summit’s mix of hydro, gas and nuclear reflects that tilt, even as Google and Meta tout “clean” AI.

- Grid Reliability vs. AI Explosion. DOE projects AI data‑center load to jump 35–108 GW this decade — equal to 20 % of today’s US peak demand. Without firm generation, blackout frequency could rise 100 %. Utilities are scrambling to lock long‑term contracts before equipment backlogs worsen.

- Market Implications.

- Alphabet (GOOGL): CapEx guide already trending toward $75 B for 2025; today’s $28 B pledge underscores urgency.

- Blackstone (BX): Bets on power‑adjacent real‑estate could add recurring infrastructure fees and boost carry.

- PPL & FirstEnergy: Rate‑base growth accelerates; regulatory scrutiny likely.

- Small‑caps: CoreWeave’s scale signals room for niche AI‑cloud players, but power contracts become king.

Deep Dive – Company & Project Highlights

| Company / Project | Spend | Key Details | Jobs & Timeline |

|---|---|---|---|

| Google + Brookfield hydro | $3 B (of $28 B total) | Repowering 1910‑era Safe Harbor & Holtwood dams; 20‑yr PPA for 670 MW | 300 jobs; turbines online 2028 |

| Blackstone / PPL JV | $25 B | Build gas plants beside data centers; “special sauce” is zero‑mile transmission | 6 k construction, 3 k permanent; first 600 MW block by 2027 |

| CoreWeave Lancaster DC | $6 B | Up to 300 MW, liquid‑cooled H200 clusters | 600 construction, 175 ops; first racks 2026 |

| Homer City Redevelopment | $15 B | 4 GW combined‑cycle gas on former coal site | 10 k construction; 2029 COD |

| Energy Capital Partners York II | $5 B | 2.5 m sq ft AI data center; 51 solar sites statewide | 2.5 k construction; phasing 2026‑2028 |

What’s Next

- July 23 – “Winning the AI Race” address: Trump will unveil an AI Action Plan and an executive order streamlining Clean Water Act permits for data centers.

- DOE Reliability Roadmap: Expected Q4 2025, detailing firm‑capacity incentives and fast‑track nuclear approvals.

- Financing Watch: Blackstone aims to syndicate equity stakes to sovereign funds; Google may issue a green bond tied to hydro upgrades.

The Pittsburgh summit crystallizes a new alliance between Big Tech and Big Energy — and signals that in the scramble to power AI, location with kilowatts beats location with fiber. For investors, the next decade of AI returns may be won not in silicon, but in steel, steam and shale.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches

Week Ahead (July 14 – 18): Inflation Check, Big Bank Earnings, Tech Titans

Hegseth Orders Every US Squad Armed by 2026: Defense Stocks Up

Tesla Paid for Elon’s Politics — Will the “America Party” Help or Hurt?

Shaken, Not Stirred: Markets brush off Trump’s latest tariff barrage

Wall Street Remains Resilient Amid New Tariff Threats

Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals