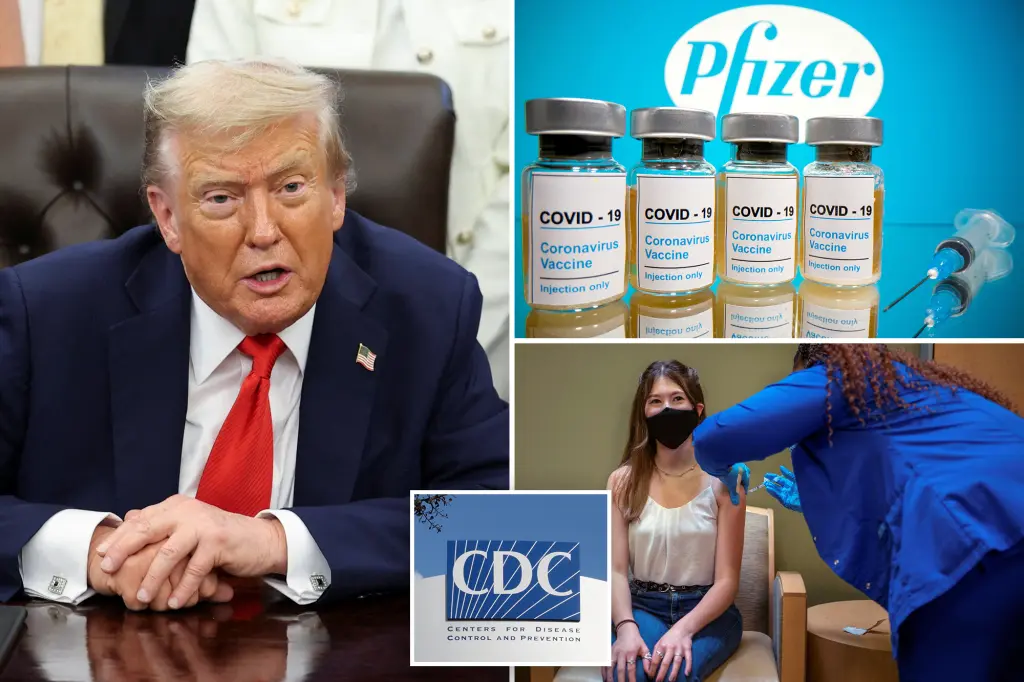

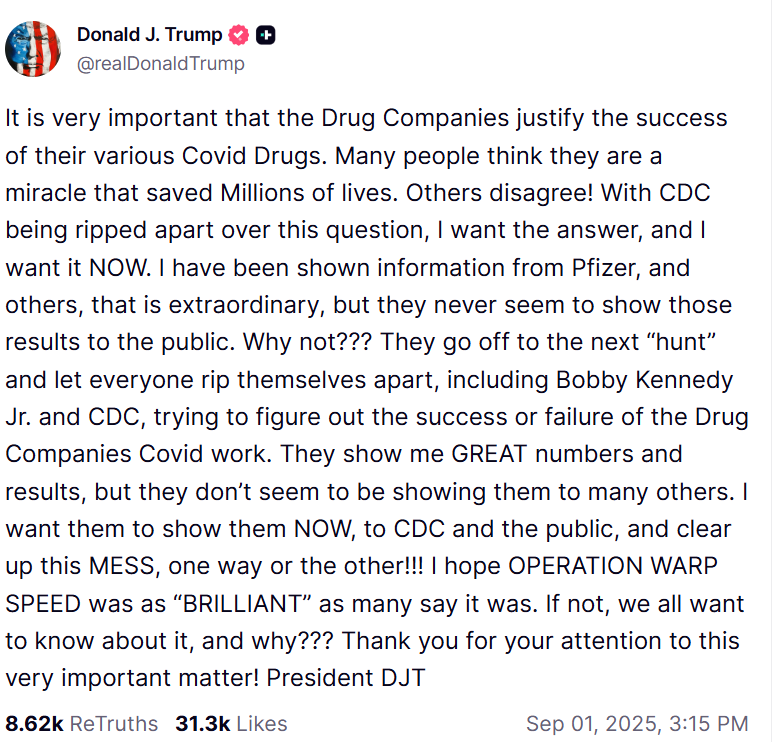

President Trump today demanded that pharmaceutical companies—including Pfizer—“justify the success” of their COVID-19 drugs, questioning why “extraordinary” results aren’t shared with the public. His remarks came days after the FDA restricted new COVID vaccines to only higher-risk groups, signalling a shift in policy.

The comments also follow turmoil at the CDC: Director Susan Monarez was fired last week after refusing to resign, while several senior officials quit in protest. HHS Secretary Robert F. Kennedy Jr., a longtime vaccine sceptic, has driven sweeping changes, cancelling mRNA studies and reshaping vaccine policy.

Trump urged more transparency, while again touting his Operation Warp Speed program from 2020, which accelerated the first vaccine rollout.

Why It Matters

Policy Shift: The FDA’s narrowing of eligibility, coupled with RFK Jr.’s influence, points to a move away from universal vaccination.

Trust & Transparency: Growing political pressure on drugmakers may force disclosure of data long kept private.

Public Health Risks: CDC turmoil, paired with rising COVID cases, raises concerns about US preparedness heading into fall.

Market Impact

Pharma Stocks: Shares of vaccine makers like $PFE and $MRNA could see volatility. Uncertainty over future demand and political scrutiny may weigh on sentiment.

Healthcare Sector: Broader health stocks may trade defensively, with investors watching whether new vaccine limits reduce revenue streams.

Market Mood: For now, Wall Street is brushing this off, focusing more on jobs data and tariffs. But prolonged policy battles could add another layer of uncertainty.

What to Expect

- Near-Term: Volatility in vaccine stocks as traders weigh the impact of restricted eligibility and Trump’s rhetoric.

- Long-Term: If transparency demands lead to new disclosures—or lawsuits—this could reshape trust in pharma earnings tied to COVID products.

- Broader Market: Investors will watch how health policy shifts intersect with the Fed’s rate-cut cycle and Trump’s wider economic agenda.

Trump’s push to make pharma “justify success” comes at a volatile moment—health agencies in turmoil, rising COVID cases, and an election-season backdrop. For markets, the real test is whether this remains political theatre or leads to fundamental changes in vaccine policy and drug revenues. Either way, healthcare stocks are entering September under a cloud of uncertainty.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)