The Trump administration’s aggressive tariff strategy has reshaped US trade policy, boosted government revenue, and revived protectionist economics. But beyond its visible effects on prices and supply chains, economists warn it is also creating less obvious risks for the US Treasury market, a cornerstone of global finance.

While Treasury markets are expected to remain broadly stable in 2026, longer-term trade and fiscal trends linked to tariffs could gradually push borrowing costs higher, with consequences for households, businesses, and global markets.

Tariffs Bring Revenue, But Deficits Still Loom

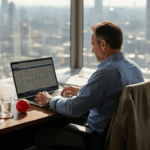

Tariffs have surged to around 16 percent, the highest level since the 1930s. As a result, US customs revenue jumped sharply, with the government collecting $195 billion in duties in fiscal year 2025, more than triple the previous year.

In theory, this extra income helps reduce the amount of debt the government must issue. The Congressional Budget Office estimates tariffs could lower deficits by about $3 trillion over the next decade, assuming current rates remain in place.

But economists caution that this fiscal cushion is fragile.

- Legal challenges could strike down some tariffs.

- New spending bills are projected to add $3.4 trillion to deficits over ten years.

- Future administrations may scale back broad tariffs, reducing revenue.

If deficits stay large while tariff income fades, the government would need to issue more bonds. More supply without equal demand typically means higher long-term yields.

Why Treasury Yields Matter So Much

TThe 10-year US Treasury yield is one of the most important numbers in global finance because it acts as a benchmark price of money for the entire economy.

At its core, the yield represents what investors demand to lend money to the US government for ten years. Because US Treasuries are considered the world’s safest assets, this rate becomes the starting point for pricing almost all other long-term borrowing.

For households, the 10-year yield heavily influences mortgage rates, car loans, and student borrowing. When it rises, banks charge higher interest to consumers, making homes, vehicles, and large purchases more expensive. When it falls, borrowing becomes cheaper and spending usually increases.

For businesses, the yield shapes corporate borrowing costs and investment decisions. Higher yields raise the cost of issuing bonds and financing expansion, often slowing hiring, capital spending, and economic growth.

For the federal government, higher Treasury yields mean more expensive debt servicing. As interest payments take up a larger share of the budget, policymakers have less room to spend on infrastructure, defense, healthcare, or respond to economic shocks.

Globally, the 10-year yield affects capital flows, currencies, and financial stability. Rising US yields attract foreign capital, strengthening the dollar and tightening financial conditions worldwide. That can pressure emerging markets, raise global borrowing costs, and increase market volatility.

Because of this central role, even modest moves in long-term Treasury yields can ripple across the economy, influencing growth, inflation, markets, and financial stability far beyond the bond market itself.

Demand Risks: Foreign Buyers and New Players

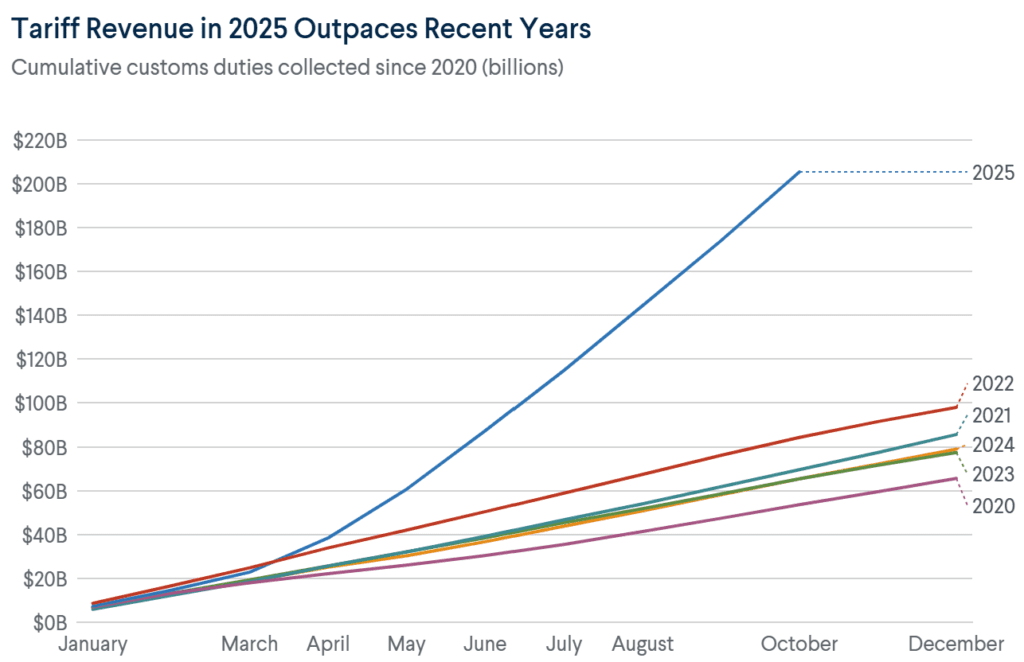

Historically, demand for Treasuries came from the Federal Reserve, US banks, and foreign governments. That support is weaker today.

- These buyers now hold about 50 percent of the Treasury market, down from roughly two-thirds before the pandemic.

- Foreign investors still hold just over 30 percent, and recent data shows they have not pulled back sharply.

- However, many central banks plan to gradually diversify away from the dollar, often toward gold.

- Foreign investors are also holding shorter-term bonds, making it easier to reduce exposure quietly over time.

Trade policy plays a role here. If tariffs push trading partners to shift commerce away from the US, reserve managers may eventually reduce dollar and Treasury holdings.

Stablecoins Add Demand, and New Risks

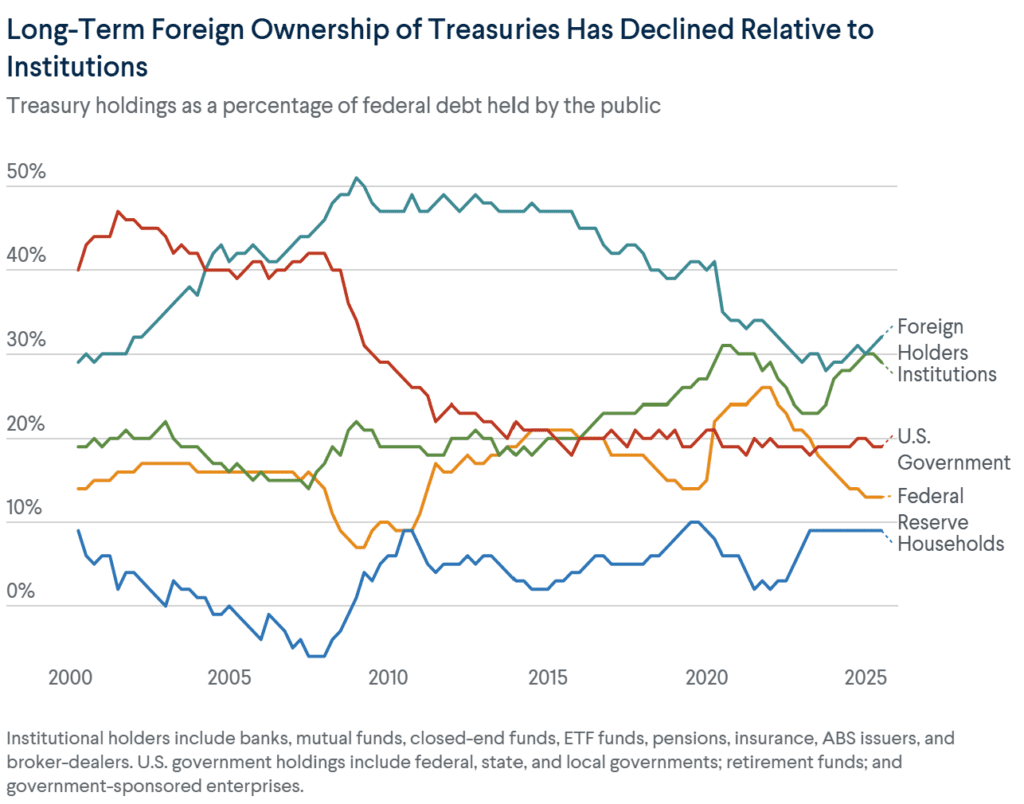

One surprising source of Treasury demand is US dollar stablecoins. These digital assets must be backed by cash and short-term Treasuries to maintain their dollar peg.

More about: How Could Stablecoins Shake Up $6T Treasury Bill Market?

Growing adoption could increase demand for Treasury bills, but it also introduces risk.

- Stablecoin issuers rely on money-market instruments that can face liquidity stress.

- A sudden loss of confidence could force rapid asset sales, pushing short-term yields higher.

- Some issuers also hold volatile assets like bitcoin or metals, which could destabilize pegs in stressed markets.

Tariffs, Inflation, and the Fed

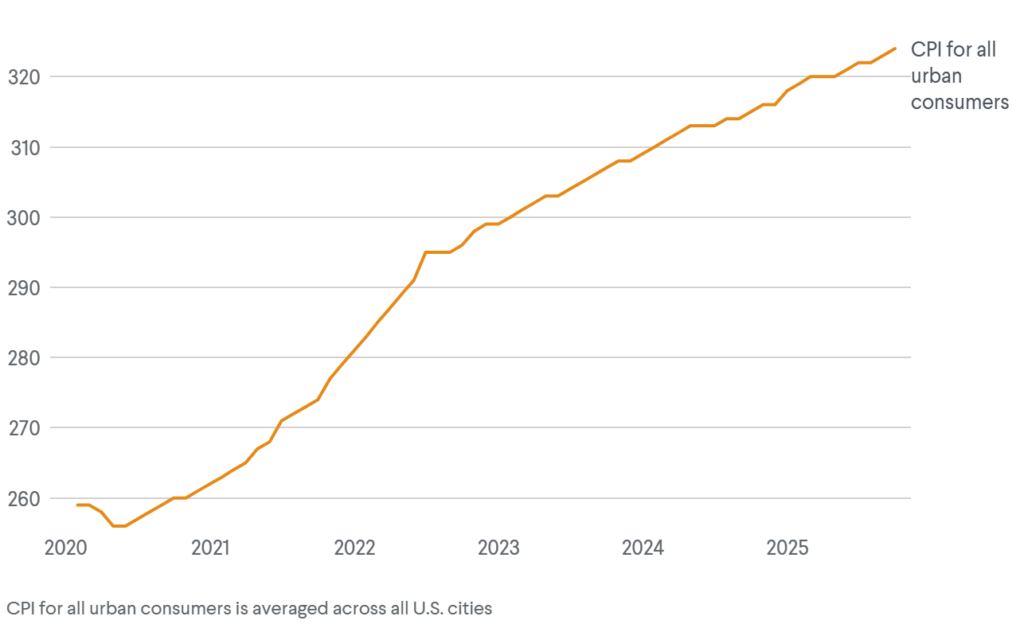

Tariffs influence Treasury yields not only through supply and demand, but also through inflation and monetary policy.

After major tariff announcements earlier this year, markets priced in:

- Slower growth.

- Higher inflation.

- A steeper yield curve, with long-term yields rising rapidly.

Federal Reserve officials have repeatedly pointed to tariffs as a contributor to sticky inflation. If inflation remains elevated, the Fed may cut rates more slowly than expected, keeping long-term yields higher for longer.

| Category | 2026 (Near Term) | Medium to Longer Term |

|---|---|---|

| Bond Supply | • Supreme Court rulings on reciprocal tariffs and White House responses will shape expectations for new Treasury issuance • Treasury likely to favor shorter-maturity debt into late 2026 to reduce pressure on long-term yields | • Higher tariffs may generate revenue, but impact depends on consumer and business behavior • Fed–Treasury coordination could lead to a more activist issuance strategy |

| Bond Demand | • Treasury efforts such as bank reforms and stablecoin adoption could lift demand • Foreign central banks expected to slowly diversify away from US assets | • Global trade shifts away from the US could reduce foreign Treasury demand • Long-term demand from banks and stablecoins remains uncertain |

| Growth & Inflation | • Fed remains undecided on tariffs’ inflation impact and policy response • Many US companies expected to raise prices in 2026 • Trade uncertainty weighs on investment and hiring | • Trade policy may push countries to diversify trade and investment away from the US • Political pressure could lift inflation expectations • Unclear how long monetary policy can continue supporting growth |

Treasury markets may look stable heading into 2026, but the longer-term risks are building quietly. Tariffs can bring in revenue and delay pressure on bond issuance, yet they do little to fix the deeper issues. Structural deficits remain large, foreign demand is becoming less reliable, and new buyers like stablecoins are untested in a real stress event.

At the same time, tariff-driven inflation risks complicate the Fed’s job, raising the chance that long-term yields drift higher even without a crisis. The table makes that trajectory clear. Near-term stability gives way to medium-term uncertainty across supply, demand, and inflation.

In short, tariffs may buy time, but they do not buy stability. Without clearer trade policy, credible fiscal discipline, and a fully independent Fed, today’s protectionism risks turning into tomorrow’s higher borrowing costs, for households, markets, and the global financial system alike.

This article is based on analysis from the Council on Foreign Relations, “Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism” (cfr.org).

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Japan Bond Market Explained: Why Yen Carry Trade Still Moves Stocks And Crypto?