Tesla’s futuristic Robotaxi rollout—launched in Austin, Texas—has quickly transitioned from innovation showcase to legal and regulatory flashpoint.

Key Developments

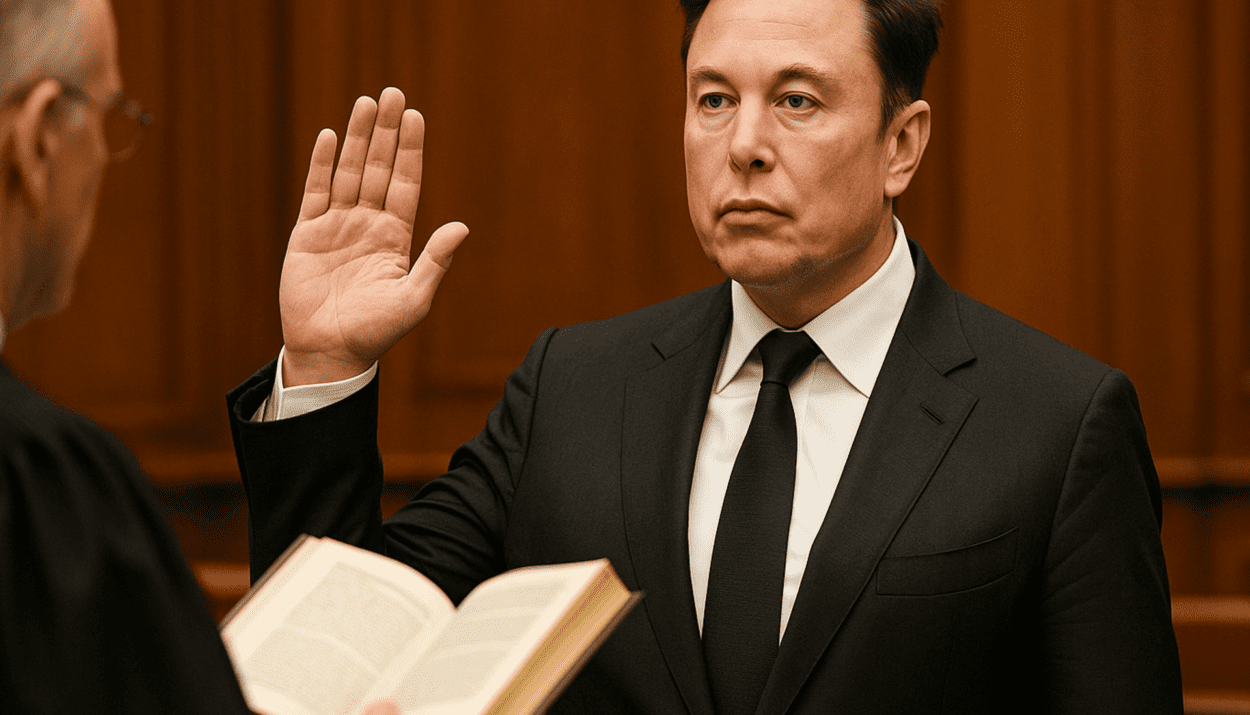

Shareholder Class Action Filed

On August 4, 2025, investors filed a federal securities fraud lawsuit in Texas naming Tesla, CEO Elon Musk, and CFOs Vaibhav Taneja (current) and Zachary Kirkhorn (former). They allege the company overstated Robotaxi safety and readiness, causing a $68 billion market value loss after videos surfaced of erratic driving.

Safety Watchdog Steps In

The NHTSA opened an investigation into Robotaxi’s public debut after viewers spotted traffic violations: wrong-lane driving, improper stops, erratic braking, and more. Tesla’s responses remain confidential to regulators.

Tesla Boosts Testing Staffing

The company is hiring Robotaxi test operators in cities like New York, Texas, and California at around $25–$33/hr to gather ride data. This signals Tesla’s push to refine the service amid heightened scrutiny.

Regulatory Approval in Texas

Tesla secured a transportation network company permit from Texas regulators, allowing legal Roblox-like operations in Austin. However, the service still operates with a safety monitor on board until DMV approval enables fully driverless rides.

Why It Matters

Financial at Stake

The lawsuit and Associated $68B stock slide highlight how overly hyping autonomy can provoke serious investor backlash when reality falls short.

Regulation vs. Innovation

Texas’s lead in approving the technology contrasts with California’s continued regulatory pushback, signaling competing visions for autonomous rollout.

Safety Concerns Amplified

Legal and regulatory pressures, especially spotlight from NHTSA, cast a long shadow over future rollouts—not just for Robotaxis but for Tesla’s entire Full Self-Driving narrative.

Investor and Industry Watchpoints

- Tesla’s Response: Will the company push back or double down on promises?

- Further Regulators Involved: Will NHTSA escalate to recalls or public hearings?

- Market Behavior: Will this trigger a broader skepticism around auto tech and valuation?

Tesla’s Robotaxi launch is a high-stakes gamble: bold promises met with literal roadblocks. As Tesla pursues public deployment, it’s being reminded that autonomy demands rigorous proof, not just hype. The next few months will determine whether innovation leads or gets pulled over by accountability—and whether investors remain passengers or demand better navigation.

Could Tesla’s ambitious rollout get backed by better hardware, safer software, and tighter regulation—or will it drive the company into deeper legal traffic ahead? Let’s see how it unfolds.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Secret White House Spreadsheet Ranks US Companies by Loyalty to Trump

Why Stock Market Keeps Climbing Despite Tariffs and Tensions

Billionaire Investors Reveal Q2 2025 Portfolio Moves: Buffett, Ackman, Tepper, Burry & More

Trump’s Auto Tariffs Deliver $11.7 Billion Blow to Global Carmakers — No Relief in Sight

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?