Tesla reports fiscal Q2 earnings after the bell today, and the market is bracing for a rough ride. Analysts expect revenue to fall by double digits and profit to decline sharply as EV competition intensifies and Tesla continues slashing prices. Still, the company’s energy segment is booming, and its robotaxi pilot program has generated buzz. The big question: Can Tesla stabilize margins and regain growth — or are its best days behind it?

Consensus Estimates (Q2 FY2025):

- Revenue: $22.6B–$22.8B

- YoY Change: ↓ ~10–13% (vs. $25.5B last year)

- EPS: $0.40–$0.43 (vs. $0.55 a year ago)

- Automotive Gross Margin: ~16.4% (vs. 18.3% in Q2 2024)

- Deliveries: ~384,000 vehicles (↓13.5% YoY)

- Production: ~410,000 vehicles (inventory buildup)

- Deferred FSD Revenue: >$800M (unlock potential in coming quarters)

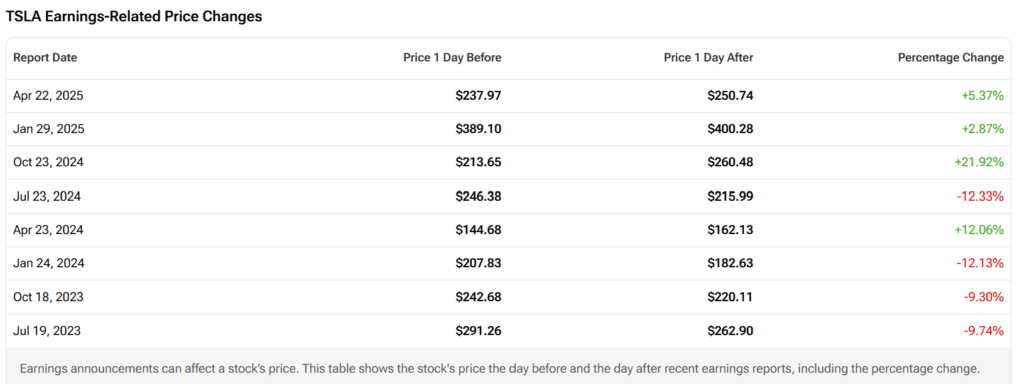

Previous Earnings Snapshot

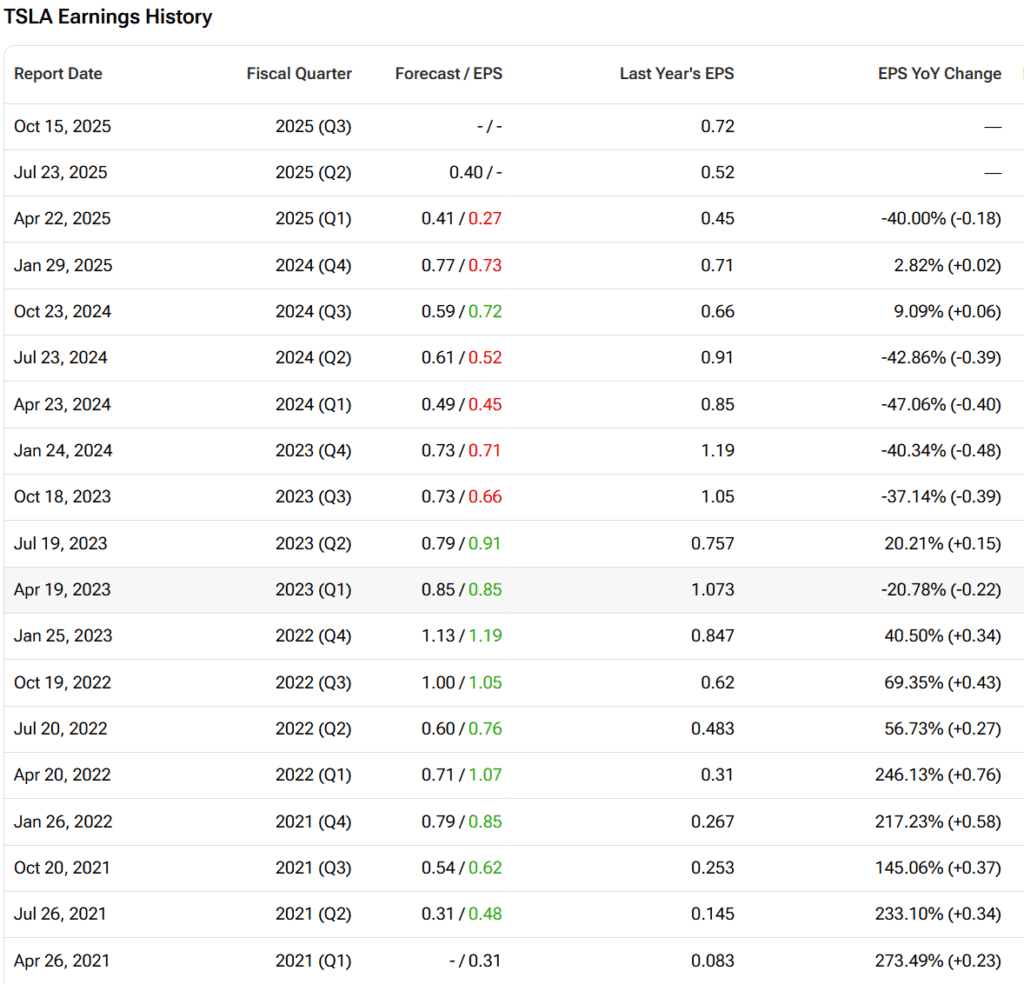

Tesla’s last few quarters have shown a clear slowdown:

| Quarter | Revenue | EPS | Forward Guidance | Key Notes |

|---|---|---|---|---|

| Q3 2024 | – | Slight beat (FSD boost) | Given | Delivery weakness began |

| Q4 2024 | – | $0.73 (miss) | Given | Margin pressure flagged |

| Q1 2025 | $19.3B | $0.27 (missed by ~30%) | Withdrawn | No guidance; sharp EPS miss |

Trend: Two straight EPS misses and falling delivery volumes paint a cautious picture.

Automotive Business: Still Pressured

Tesla’s core car business is showing cracks. Deliveries were weak, margins are under pressure, and price cuts haven’t meaningfully lifted demand.

Key points:

- Model Y and Model 3 prices were cut aggressively in the US, China, and Europe.

- Gross margins remain stuck near 16.4%, compared to 25%+ in 2022.

- US EV tax credit loss and China price war have added further pressure.

- Tesla produced more cars than it sold — indicating inventory buildup.

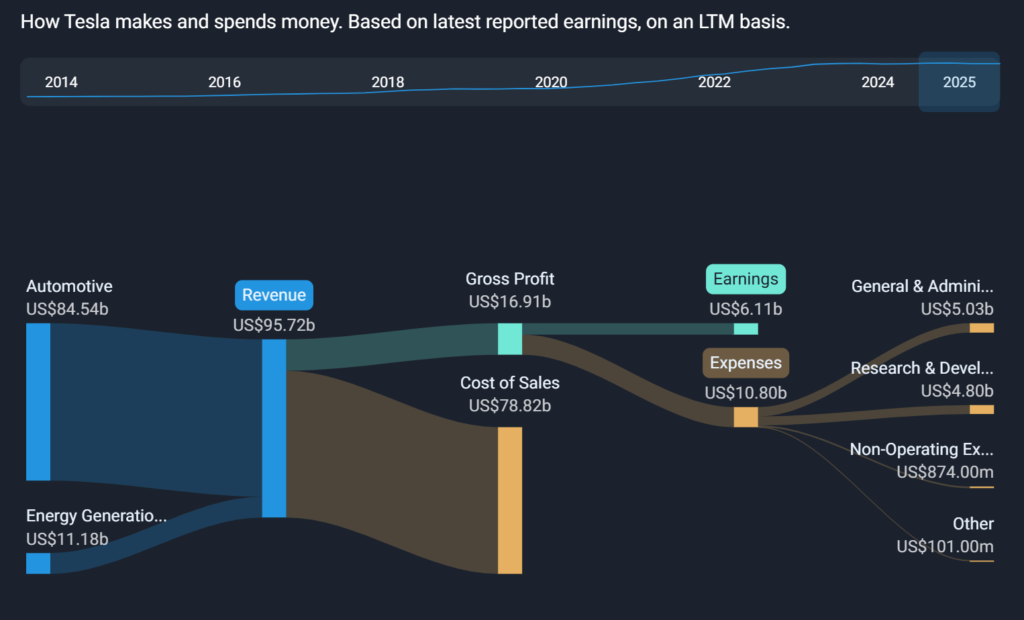

Energy: A Quiet Growth Engine

Tesla’s energy and storage division has emerged as a stabilizing force:

- Energy revenue now ~10% of total.

- 9.6 GWh of storage deployed in Q2, just shy of Q1’s record.

- High-margin, long-term contracts support better profitability.

- The Shanghai Megapack factory, set to open by 2026, could double capacity.

Many analysts see energy as Tesla’s most underrated asset — especially as margins in EVs compress.

Robotaxi & FSD: Big Hype, Slow Rollout

Tesla’s autonomous tech ambitions are gaining attention again — but the rollout remains early.

- Robotaxi pilot launched in Austin in late June using 20+ Model Y vehicles with safety drivers.

- Elon Musk teased a Bay Area expansion, but regulatory approvals are still in progress.

- Over $800M in deferred FSD revenue could be recognized if feature set expands.

- Software margins are extremely high — any FSD monetization directly boosts EPS.

Investors are hoping for a clear timeline and regulatory roadmap in the earnings call.

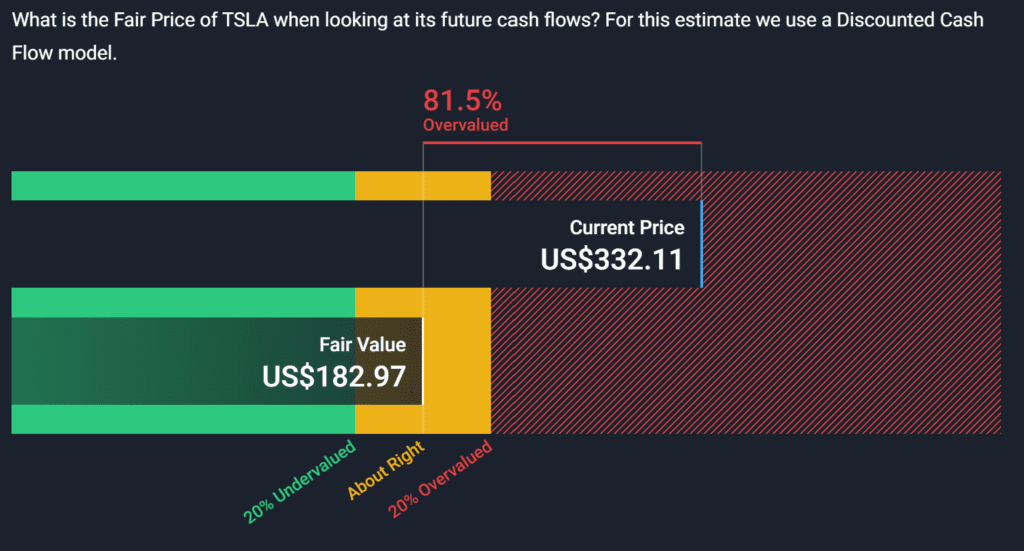

Valuation & Market View: Lofty but Fragile

Tesla is still priced like a tech leader — but the market is asking tougher questions.

Valuation snapshot:

- Market Cap: ~$1.07T

- Forward P/E: ~170x

- Price-to-Sales: ~12x

- YTD Stock Performance: ↓18%

- Free Cash Flow: Expected neutral-to-negative in Q2 due to capex and price cuts

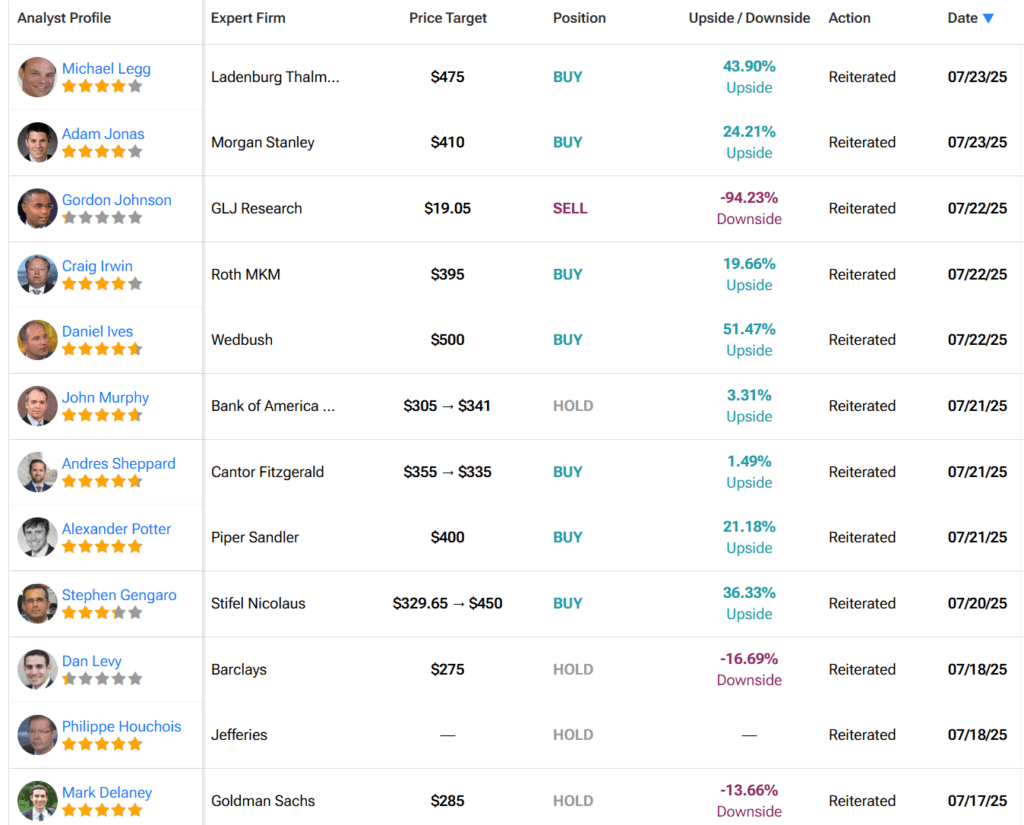

Wall Street Ratings:

- 9 Buys, 5 Holds, 4 Sells

- Avg. PT: ~$310

- Wedbush Target: $500

- JPMorgan Bear Case: $115

Bulls vs. Bears: Narrative Divide Widens

Bulls argue:

- Energy and services margins are strong

- Robotaxi monetization could start in 2025

- Tesla’s AI stack gives it first-mover advantage in autonomy

- Healthy balance sheet ($20B cash) supports long-term R&D

Bears counter:

- EV demand is softening globally

- Tesla lost EV tax incentives in the US

- Cybertruck ramp is slow and costly

- Elon Musk’s political distractions create reputational risk

What to Watch on the Earnings Call

Investors will zero in on the following:

- Q3 delivery outlook and full-year guidance (if reinstated)

- FSD revenue recognition timing

- Update on robotaxi expansion & permits

- Model 2 (“$25K car”) roadmap

- Cybertruck margins and production pace

- Strategy for offsetting tariffs and tax credit loss

Tesla’s Q2 earnings may not impress on the surface — but the narrative is evolving. This could be the bottoming quarter if margins stabilize and autonomous monetization begins. But if guidance stays withdrawn, and margins fall further, Tesla’s tech premium could continue eroding.

The stock’s next big move may depend not just on what Tesla delivers — but how Elon Musk tells the story.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sources

Investopedia – Tesla Q2 2025 Earnings Preview

Yahoo Finance – Tesla Earnings Estimates & Delivery Breakdown

CNBC – Analysts Split on Tesla’s Outlook Ahead of Q2 Results

Business Insider – Tesla China Rebound and Regulatory Outlook

The Globe and Mail – Tesla Market Share and UAW Impacts

Morningstar – Tesla Valuation Metrics

Barron’s – Wall Street Price Target Range for Tesla

Reuters – Tesla Deliveries and Production Data

Seeking Alpha – Tesla Robotaxi, FSD Revenue & Piper Sandler Report

IG Group – Tesla Q2 Earnings Preview and Technicals

Tickeron – Tesla Trading Signals Ahead of Q2