Global markets kicked off Wednesday with a cautious lean as trade tensions flare, central banks hold their ground, and investors gear up for a pivotal day of earnings. While Japanese stocks celebrated trade optimism, Wall Street remains trapped between solid fundamentals and geopolitical uncertainty.

Asia Rallies on Auto Tariff Optimism

Japanese automakers drive early gains amid signs of a breakthrough in US trade talks.

Asian markets posted modest gains overnight, powered by a strong session in Japan. The Topix Index jumped 1%, lifted by automakers like Toyota and Honda on hopes that the US will scale back its proposed auto tariffs during negotiations this week. The MSCI Asia Pacific Index rose 0.4%, while oil prices bounced for the first time in five days, lifting sentiment across energy and materials sectors.

Even with Chinese markets still weighed by US chip bans and export controls, the region as a whole is cautiously hopeful. A weaker US dollar also offered support to risk assets.

Trump’s Trade Escalation Continues

New threats include 250% pharma tariffs, a 25% penalty on India, and deeper cracks with the EU.

President Trump is keeping global markets on edge with a fresh batch of trade threats that could reshape supply chains and escalate tensions with major US partners. In a wide-ranging interview Tuesday, Trump signaled no slowdown in his tariff offensive.

More about: Trump Set to Announce Semiconductor and Pharma Tariffs “Next Week or So”

“We’ll be putting a initially small tariff on pharmaceuticals, but in one year — one and a half years, maximum — it’s going to go to 150%. And then it’s going to go to 250%, because we want pharmaceuticals made in our country.” – President Trump, CNBC interview

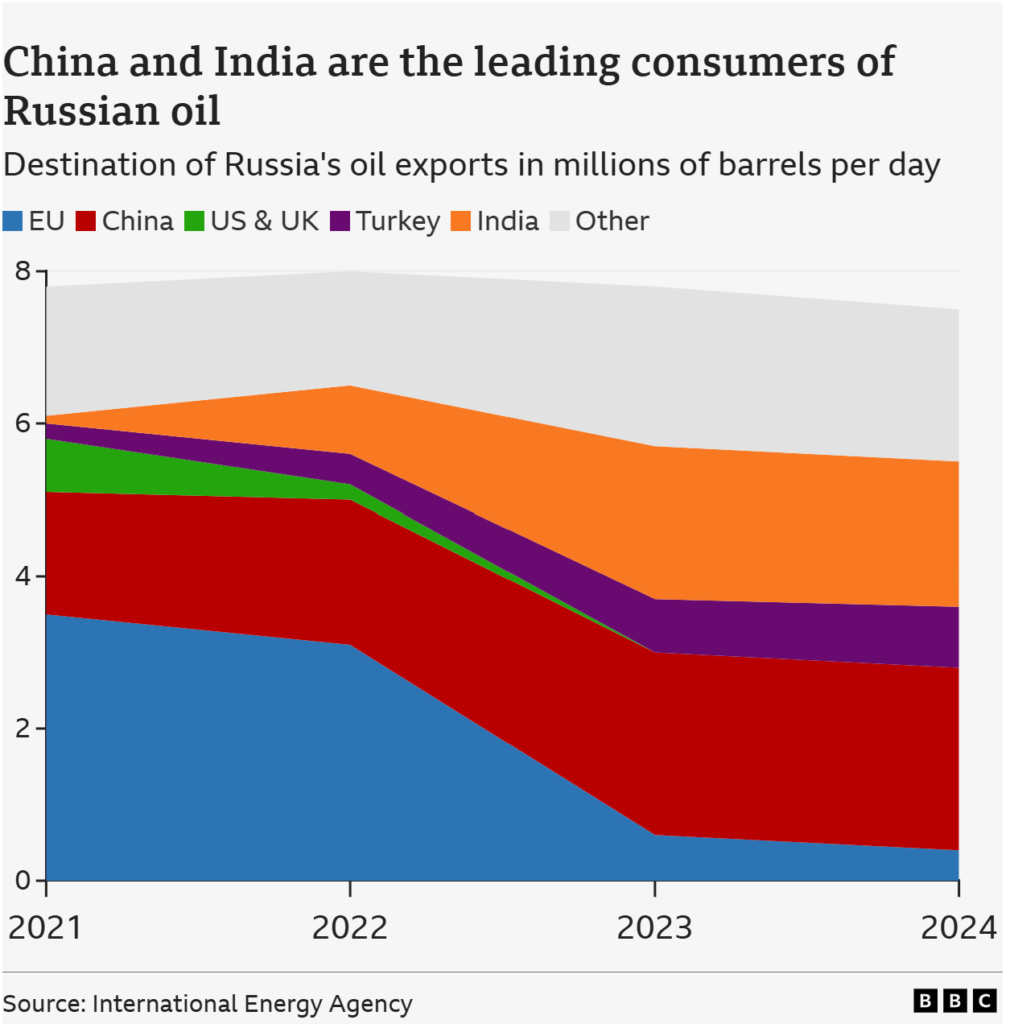

India, meanwhile, will be hit with a 25% tariff starting this month, a penalty for its ongoing oil imports from Russia — a move Trump says sends the wrong signal. India has condemned the tariffs as “unjustified and unreasonable” and accused the US of a double standard, pointing to continued energy ties between the EU and Russia.

“Tariff of 35% on EU if doesn’t meet obligations.” – President Trump, via Wall St Engine

Tensions with the European Union also reached a new level, with Trump warning of a 35% tariff on EU goods unless the bloc follows through on its $600 billion investment pledge in the United States.

“The details are $600 billion to invest in anything I want. Anything. I can do anything I want with it.” – President Trump on his EU trade deal, via Wall St Engine

In addition to broader regional penalties, Trump also signed multiple new trade orders:

- Ending the de minimis exemption on imports under $800, applying tariffs from August 29

- Imposing 50% tariffs on semi-finished copper products from Brazil

- Expanding duties across semiconductors, autos, and other key sectors

On energy and global diplomacy, Trump brushed off inflationary fears linked to rising crude prices.

“Not worried about oil prices.” – President Trump, via Wall St Engine

And as global investors await clarity on US-China trade relations, Trump dropped a hint about a potential meeting:

“Xi called for the meeting. I will meet with China’s Xi before the end of the year, if there is a trade deal.” – President Trump, via Wall St Engine

Meanwhile, speculation over the next Federal Reserve chair cooled as Trump confirmed that one of the most-discussed names — hedge fund titan Scott Bessent — is not in the running.

“He does not want it. He wants to work with me. It’s such an honour.” – President Trump on Bessent, via Wall St Engine

The takeaway? Global trade relationships are being rewritten in real-time, with economic nationalism front and center. Supply chains are entering a volatile, unpredictable phase — and markets are struggling to price it all in

India Holds Rates but Sounds the Alarm

RBI pauses at 5.5%, but warns US tariffs may shave 40 bps off growth.

India’s central bank delivered exactly what markets expected – no change to the benchmark repo rate, which stays at 5.5%. The move follows a 100-basis-point easing campaign this year aimed at supporting a cooling economy.

While headline inflation dropped to a six-year low of 2.1%, RBI Governor Sanjay Malhotra warned that it’s mostly due to volatile food prices. He also slashed the full-year inflation forecast to 3.1%, but flagged that US tariffs could knock as much as 40 basis points off GDP and dent private investment.

Indian equities fell slightly on the news, while bond yields ticked up. Traders now await clarity on the country’s trade and investment strategy as global risks rise.

Tuesday Recap: When ‘Not Bad’ Isn’t Good Enough

Strong revenue wasn’t enough for AMD or SNAP, and traders took no prisoners.

Investors showed little mercy Tuesday as high-profile names delivered results that fell just short of soaring expectations:

- AMD (▼4%): The chipmaker posted record revenue and matched EPS estimates at $0.48, but gross margins slipped due to an $800M inventory hit from US chip export bans. Despite a strong Q3 outlook ($8.4–$9B in sales), the stock fell as the market questioned if it can maintain momentum after a 140% rally from April lows.

- SMCI (▼16%): A miss on both top and bottom lines sent shares plummeting, even as retail sentiment remained bullish on Stocktwits.

- SNAP (▼15%): The company blamed a botched ad platform overhaul and tariff-related e-commerce pain for a $262M loss, despite beating revenue expectations.

- Rivian (▼2.1%), Lucid, and Opendoor also dropped following weak results or guidance. Meanwhile, Hinge Health ($HNGE) held firm after delivering its first earnings post-IPO, impressing investors despite reporting a net loss.

The theme? In a market this frothy, “good enough” just isn’t good enough.

Today’s Market Calendar

Here’s a quick breakdown of what to watch today:

| Time (ET) | Event / Earnings | Details |

|---|---|---|

| 10:30 AM | Crude Oil Inventories | Key for energy sector, especially after oil’s recent slide |

| 12:45 PM | FOMC Member Daly Speaks | Potential insight on rate cut timing and Fed’s take on tariffs |

| 1:00 PM | 10-Year Note Auction | Market-sensitive, especially amid rising rate cut bets |

| Pre-Market | Earnings: $DIS, $SHOP, $UBER | Disney and Uber in focus for consumer trends and cost control |

| Shopify expected to show if AI integration is driving sales | ||

| After-Hours | Earnings: $ABNB, $BYND, $DKNG, $OXY | Airbnb guidance will shape travel stocks; DraftKings faces macro headwinds |

Market Sentiment: Balanced… for Now

The CNN Fear & Greed Index sits squarely in neutral territory, mirroring the market’s indecision. On one hand, earnings growth and rate-cut hopes keep investors optimistic. On the other, Trump’s tariff rollercoaster is creating unpredictable downside risk.

Markets are balancing on a tightrope. Today’s earnings could shift sentiment in either direction, especially if Disney or Uber show resilience in consumer demand. But geopolitics remain a dominant risk – with every new Trump tariff threat, volatility rises.

Investors would be wise to stay nimble. The battle between fundamentals and politics is heating up fast, and as we’ve seen this week – even strong earnings aren’t safe from a surprise pullback.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years