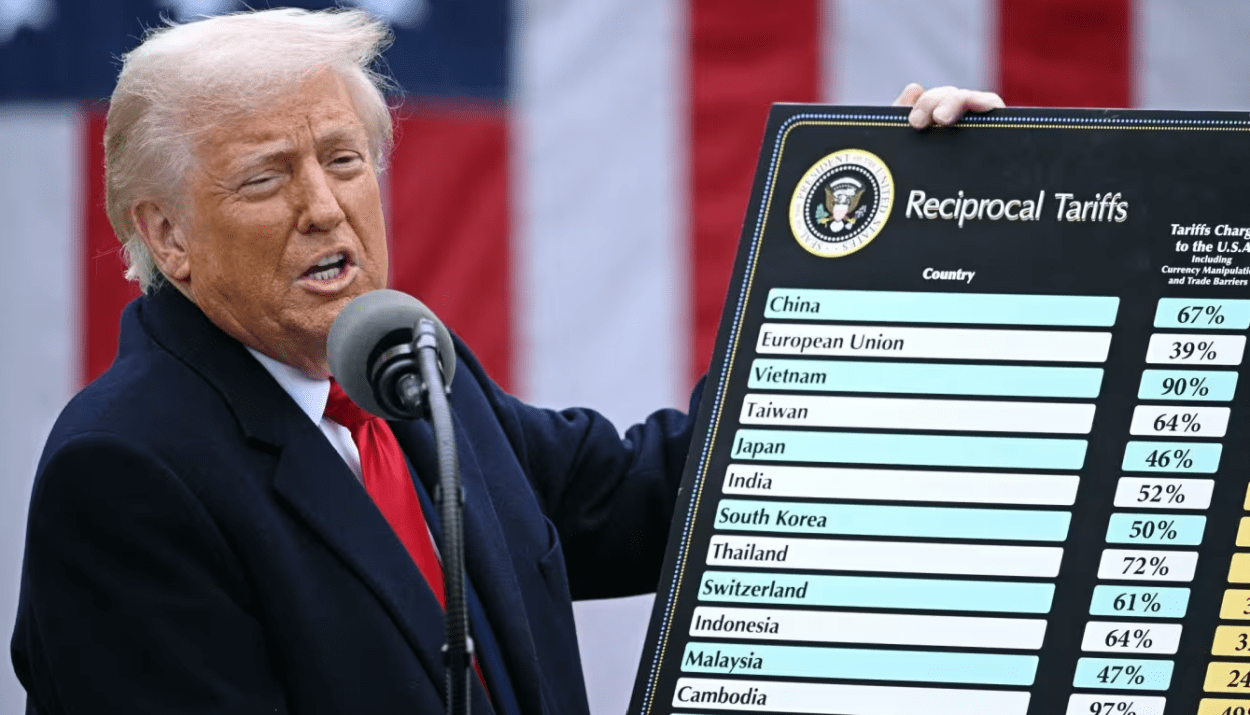

The US Supreme Court will this week hear one of the most consequential economic cases in decades, a challenge to President Donald Trump’s sweeping use of emergency powers to impose global tariffs. Trump has called the case “one of the most important in the history of the country,” warning that if the Court limits his authority, the US could be “reduced to almost Third World status.”

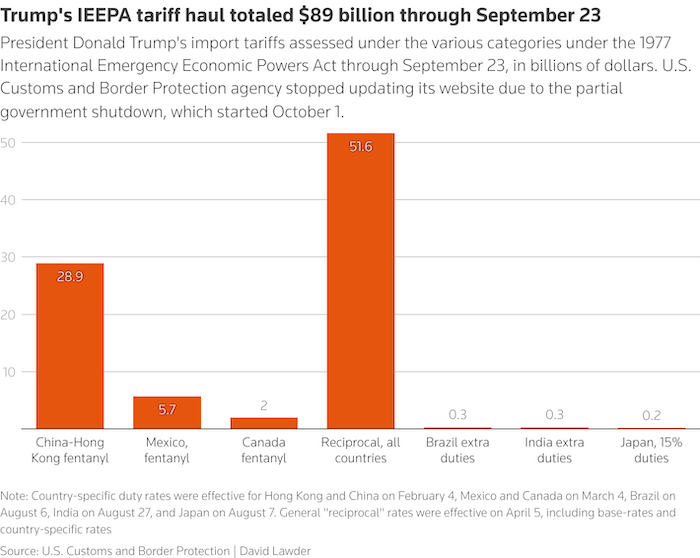

The hearing on Wednesday, November 5, will decide whether Trump’s reliance on the 1977 International Emergency Economic Powers Act (IEEPA) to levy broad tariffs was legal. Lower courts previously ruled that the administration overstepped, finding that IEEPA was designed for narrow national security sanctions, not blanket import duties.

Trump’s Argument: Tariffs as National Defense

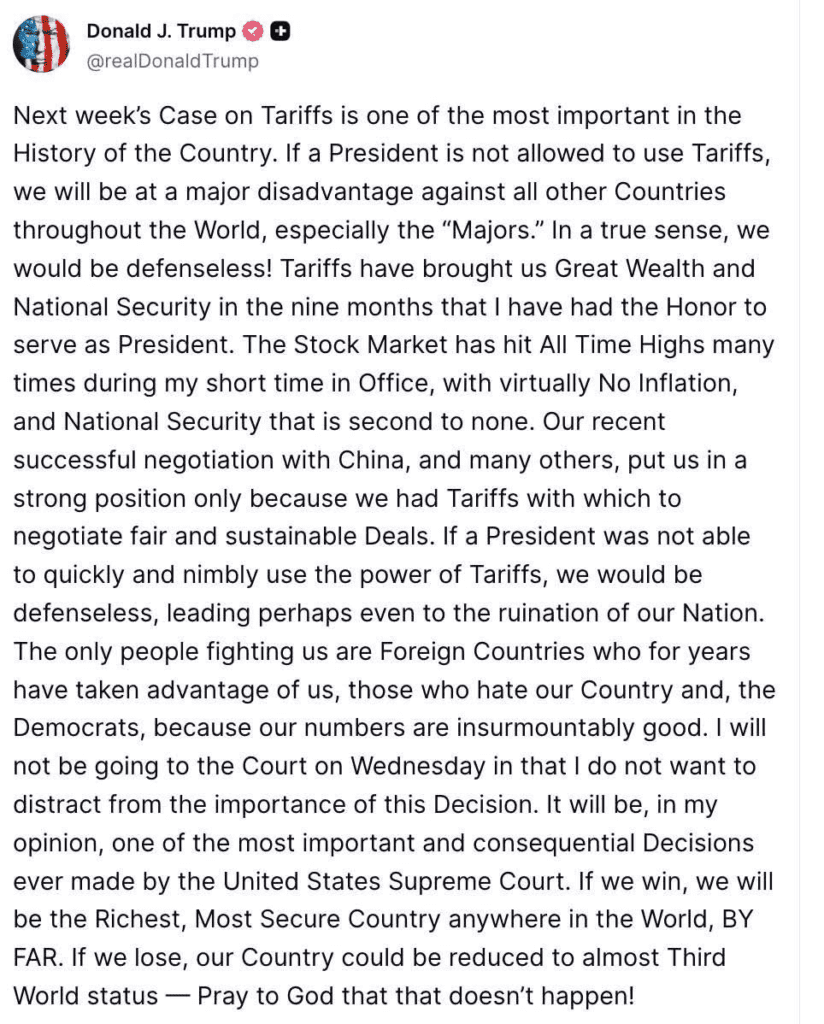

In a lengthy post on Truth Social, Trump defended his use of tariffs as a matter of national security and economic survival, arguing they brought the U.S. “great wealth and national strength.”

He cited his recent China trade truce and record stock market gains as proof that tariff leverage works, saying:

“If a President is not allowed to use tariffs, we will be at a major disadvantage against all other countries… In a true sense, we would be defenseless.”

Trump added that his administration’s success in negotiating with China and other trading partners “was possible only because we had tariffs with which to negotiate fair and sustainable deals.”

The Legal Battle

Roughly 40 business groups, led by the U.S. Chamber of Commerce, have filed briefs urging the Supreme Court to strike down Trump’s IEEPA-based tariffs. They argue that invoking an “economic emergency” over the trade deficit—something the U.S. has had for nearly 50 years—sets a dangerous precedent.

The administration’s Treasury Secretary, Scott Bessent, told reporters he expects the Court to uphold the policy. But he made clear that even if the justices reject the IEEPA rationale, the White House will pivot to other tariff tools such as:

- Section 122 of the Trade Act of 1974 (15% tariffs for 150 days)

- Section 338 of the Tariff Act of 1930 (up to 50% tariffs on discriminatory countries)

- Section 232 of the 1962 Trade Expansion Act (national security tariffs)

“You should assume they’re here to stay,” Bessent said, signaling that the administration views tariffs as a cornerstone of Trump’s economic strategy, regardless of legal hurdles.

Economic Fallout and Market Impact

Economists warn that a ruling against Trump could rattle financial markets, which have largely priced in the continuation of tariff policies.

Over $100 billion in IEEPA tariffs have been collected this year alone, forming a key part of US revenue and deficit reduction efforts. If the Court overturns them, Washington could be forced to refund billions to importers, disrupting Treasury markets and inflating the fiscal deficit.

The S&P 500 and Dow Jones could face short-term volatility around the decision. A ruling that upholds the tariffs might reinforce Trump’s “strong America” narrative and lift industrial and defense stocks, while a rejection could boost global trade-sensitive sectors like tech, autos, and semiconductors, which have been pressured by higher import costs.

Oxford Economics estimates that tariffs have already added 0.4 percentage points to US inflation, pushing consumer prices higher in categories like apparel and electronics. Corporate earnings, meanwhile, have taken a $35 billion hit this year from tariff-related costs, according to industry filings.

Why It Matters for Investors

- If Trump Wins: Expect continued protectionism, more “reciprocal tariff” policies, and likely gains in US industrial, energy, and defense stocks tied to domestic production.

- If Trump Loses: Markets may rally on hopes of easing trade friction and inflation relief, though analysts expect Trump to reimpose duties through other legal means.

- Volatility Ahead: With the government still partly shut down and key economic data delayed, investors will rely on corporate guidance and Fed commentary for cues.

The Supreme Court’s tariff case could reshape US trade law and test the limits of presidential power.

But for markets, one thing is clear: tariffs are not going away anytime soon. Whether Trump wins or loses, his administration has already laid the legal groundwork to keep protectionist policies alive.

As one strategist at JPMorgan put it:

“A Trump loss might shake markets for a day, but the tariff era isn’t ending, it’s just finding new legal language.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: November is historically one of the stock market’s best months. Where to invest?